Question: How do I solve a and b? Thanks! Question 4 (Essential to cover) Suppose the risk-free rate is 4% and that you believe in the

How do I solve a and b? Thanks!

How do I solve a and b? Thanks!

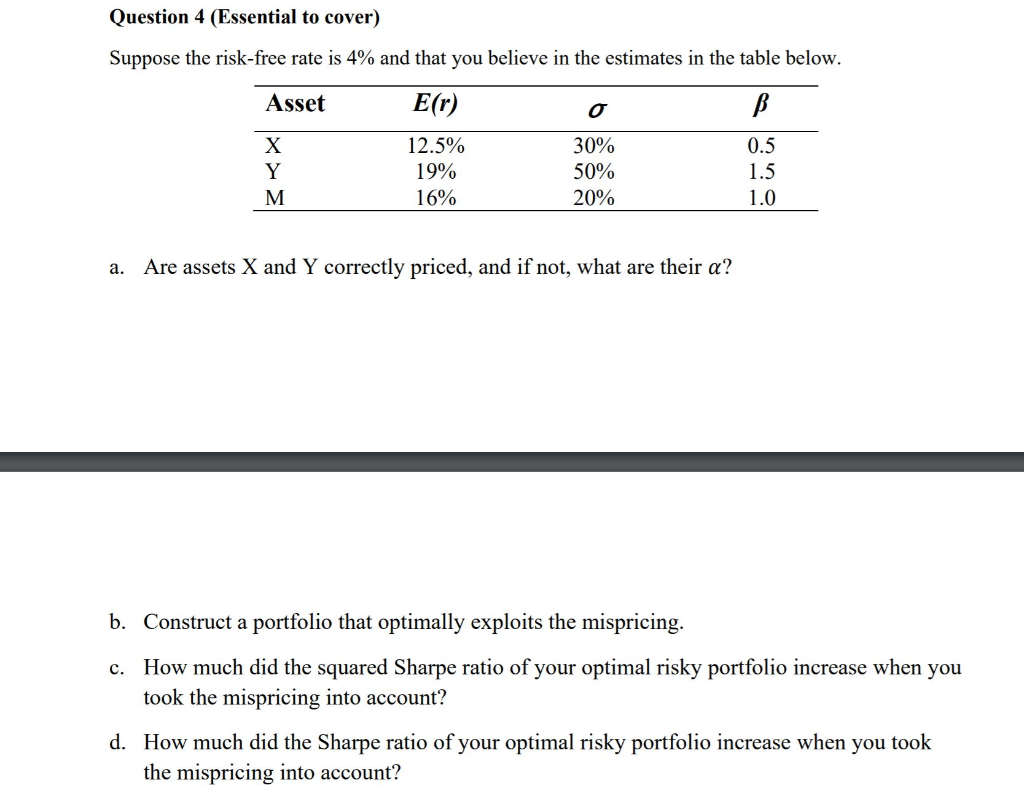

Question 4 (Essential to cover) Suppose the risk-free rate is 4% and that you believe in the estimates in the table below. Asset E(r) 0.5 12.5% 19% 16% 30% 50% 20% 1.0 a. Are assets X and Y correctly priced, and if not, what are their a? b. Construct a portfolio that optimally exploits the mispricing. c. How much did the squared Sharpe ratio of your optimal risky portfolio increase when you took the mispricing into account? d. How much did the Sharpe ratio of your optimal risky portfolio increase when you took the mispricing into account? Question 4 (Essential to cover) Suppose the risk-free rate is 4% and that you believe in the estimates in the table below. Asset E(r) 0.5 12.5% 19% 16% 30% 50% 20% 1.0 a. Are assets X and Y correctly priced, and if not, what are their a? b. Construct a portfolio that optimally exploits the mispricing. c. How much did the squared Sharpe ratio of your optimal risky portfolio increase when you took the mispricing into account? d. How much did the Sharpe ratio of your optimal risky portfolio increase when you took the mispricing into account

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts