Question: How do I solve for the following problems? Problem 11-7 (AICPA Adapted) On January 1, 2018, Brazilia Company purchased for P4,800,000 a machine with a

How do I solve for the following problems?

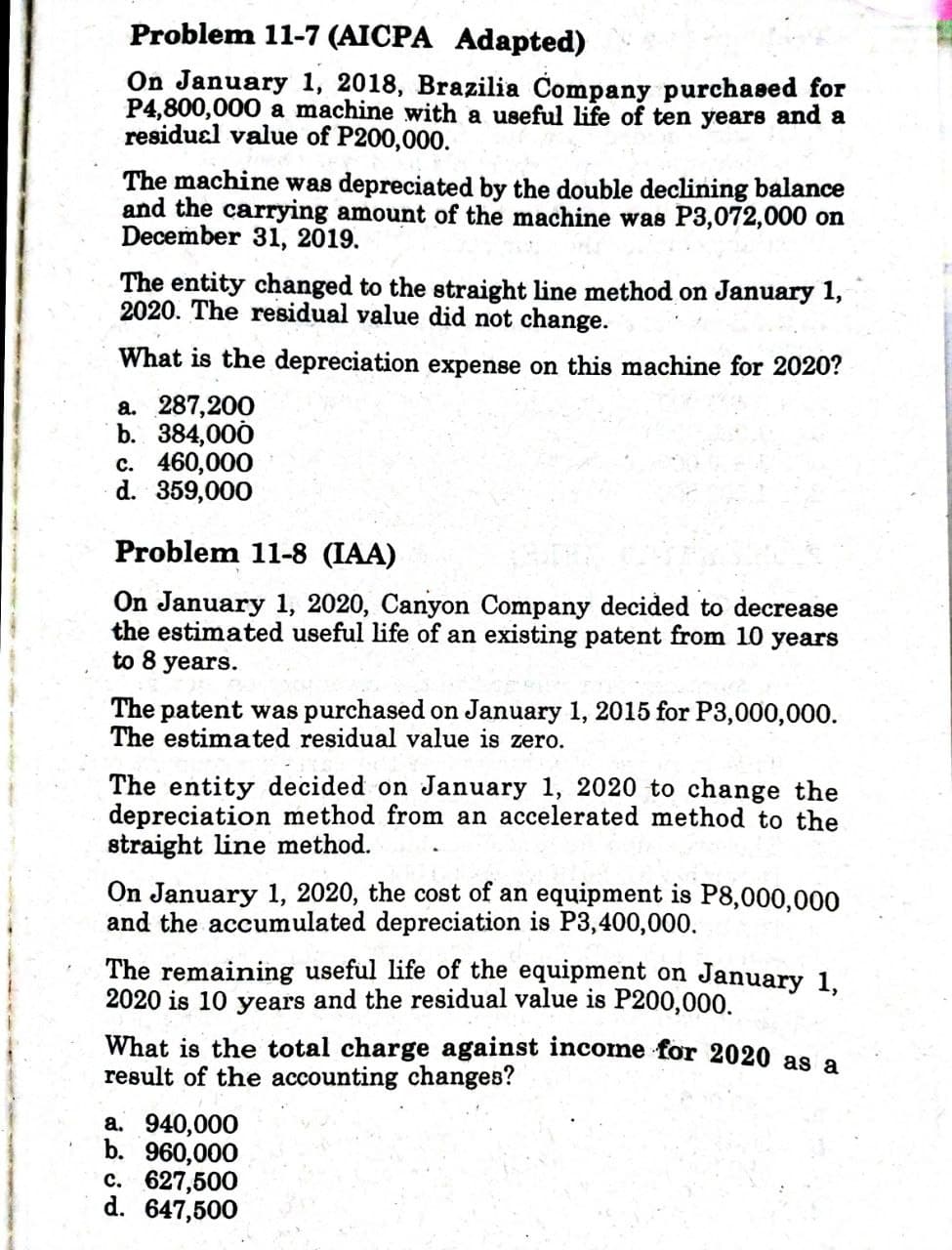

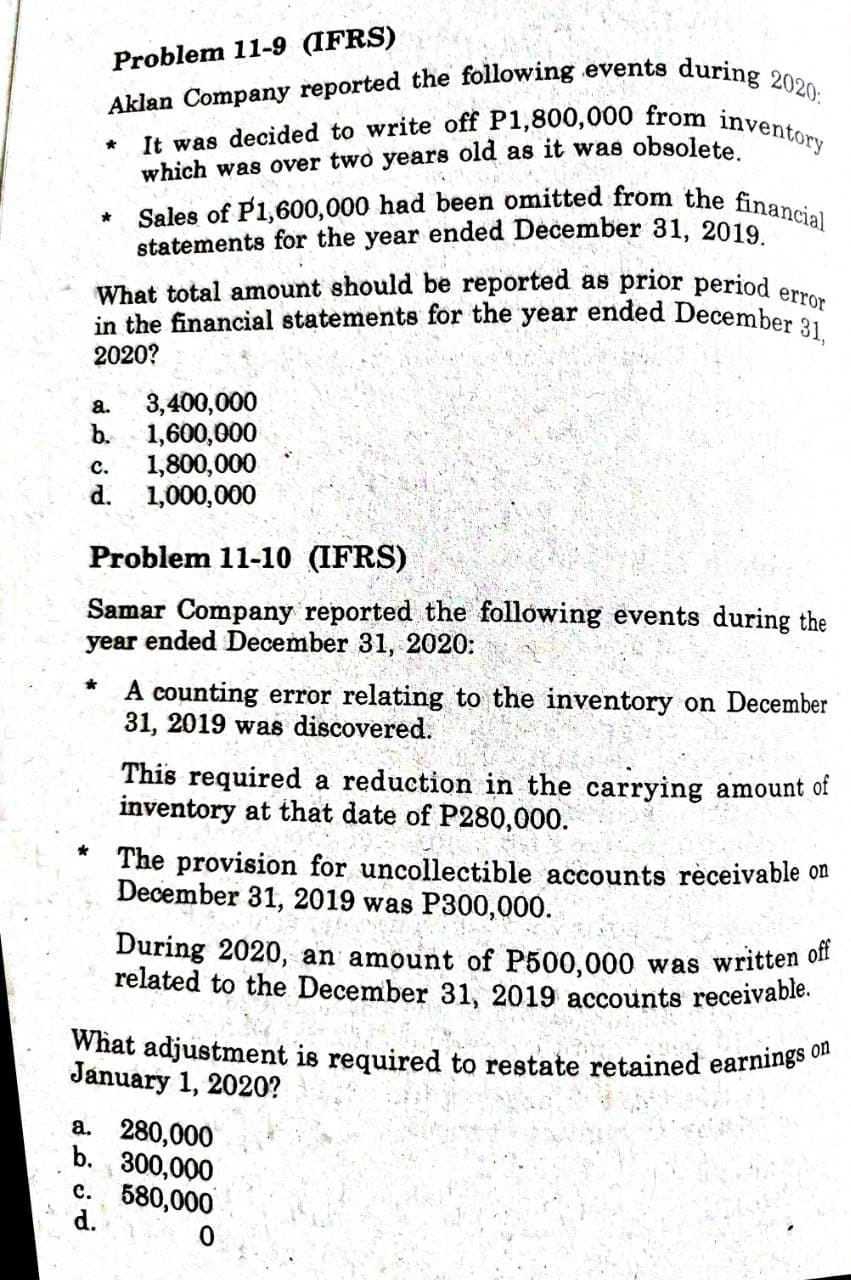

Problem 11-7 (AICPA Adapted) On January 1, 2018, Brazilia Company purchased for P4,800,000 a machine with a useful life of ten years and a residual value of P200,000. The machine was depreciated by the double declining balance and the carrying amount of the machine was P3,072,000 on December 31, 2019. The entity changed to the straight line method on January 1, 2020. The residual value did not change. What is the depreciation expense on this machine for 2020? a. 287,200 b. 384,000 c. 460,000 d. 359,000 Problem 11-8 (LAA) On January 1, 2020, Canyon Company decided to decrease the estimated useful life of an existing patent from 10 years to 8 years. The patent was purchased on January 1, 2015 for P3,000,000. The estimated residual value is zero. The entity decided on January 1, 2020 to change the depreciation method from an accelerated method to the straight line method. On January 1, 2020, the cost of an equipment is P8,000,000 and the accumulated depreciation is P3,400,000. The remaining useful life of the equipment on January 1, 2020 is 10 years and the residual value is P200,000. What is the total charge against income for 2020 as a result of the accounting changes? a. 940,000 b. 960,000 C. 627,500 d. 647,500Problem 11-9 (IFRS) Aklan Company reported the following events during 2020. It was decided to write off P1,800,000 from inventory which was over two years old as it was obsolete. Sales of P1,600,000 had been omitted from the financial statements for the year ended December 31, 2019. What total amount should be reported as prior period error in the financial statements for the year ended December 31, 2020? 3,400,000 b. 1,600,000 C. 1,800,000 d. 1,000,000 Problem 11-10 (IFRS) Samar Company reported the following events during the year ended December 31, 2020: A counting error relating to the inventory on December 31, 2019 was discovered. This required a reduction in the carrying amount of inventory at that date of P280,000. The provision for uncollectible accounts receivable on December 31, 2019 was P300,000. During 2020, an amount of P500,000 was written off related to the December 31, 2019 accounts receivable. What adjustment is required to restate retained earnings on January 1, 2020? a. 280,000 b. 300,000 C. .580,000 d. 0

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts