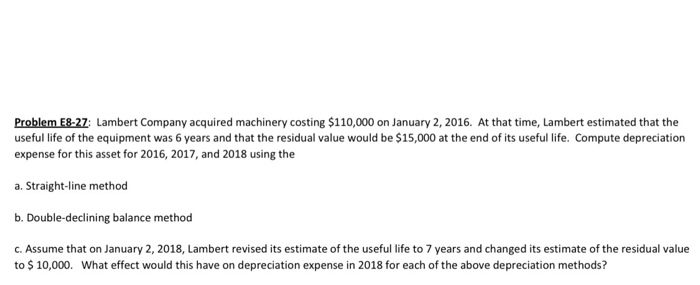

Question: How do I solve part (c) to the question? Please see photo. Thanks. Problem E8-27: Lambert Company acquired machinery costing $110,000 on January 2, 2016.

Problem E8-27: Lambert Company acquired machinery costing $110,000 on January 2, 2016. At that time, Lambert estimated that the useful life of the equipment was 6 years and that the residual value would be $15,000 at the end of its useful life. Compute depreciation expense for this asset for 2016, 2017, and 2018 using the a. Straight-line method b. Double-declining balance method C. Assume that on January 2, 2018, Lambert revised its estimate of the useful life to 7 years and changed its estimate of the residual value to $ 10,000. What effect would this have on depreciation expense in 2018 for each of the above depreciation methods

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts