Question: How do I solve this problem? answer is given A bond that has an annual coupon rate of 11% has three years to maturity. If

How do I solve this problem? answer is given

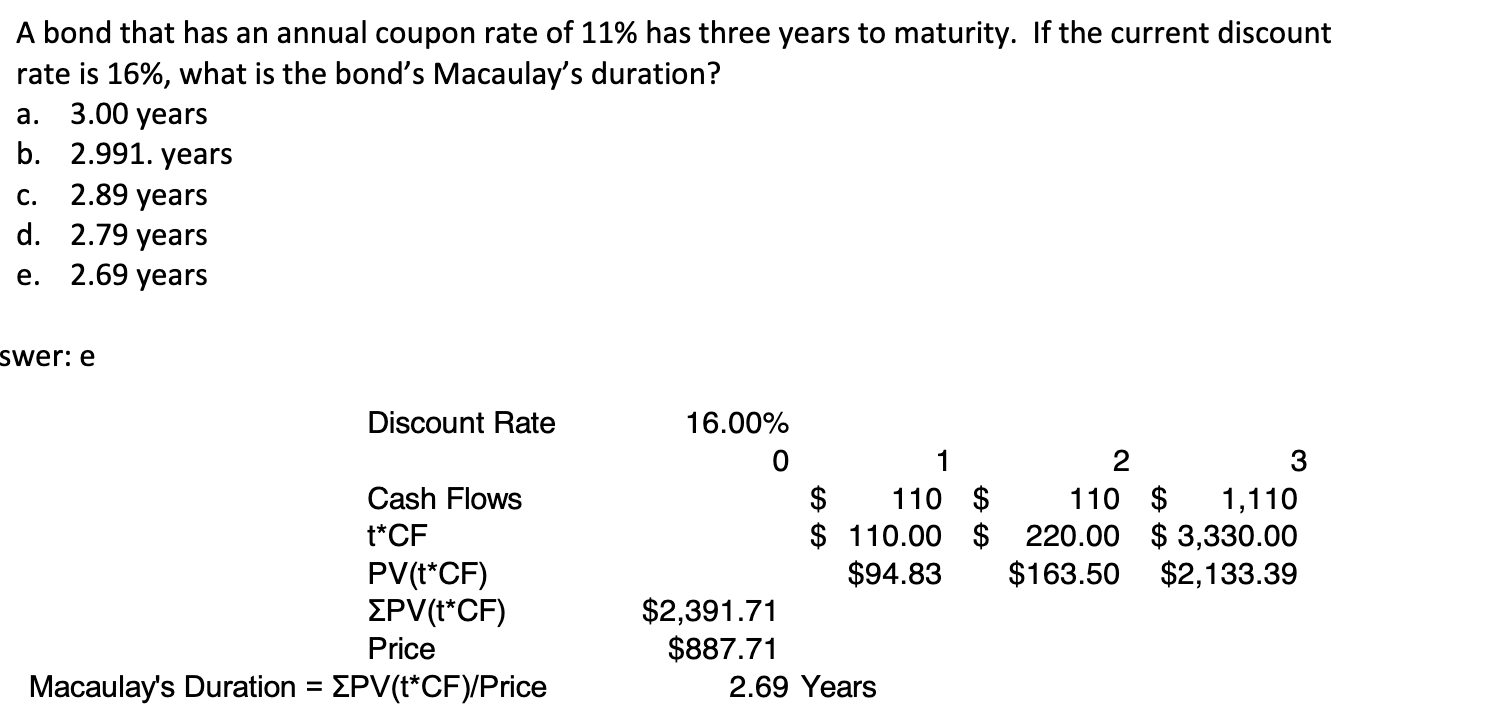

A bond that has an annual coupon rate of 11% has three years to maturity. If the current discount rate is 16%, what is the bond's Macaulay's duration? a. 3.00 years b. 2.991. years C. 2.89 years d. 2.79 years e. 2.69 years swer: e Discount Rate Cash Flows t*CF PV(t*CF) EPV(CF) Price Macaulay's Duration = EPV(t*CF)/Price 16.00% 0 1 2 3 $ 110 $ 110 $ 1,110 $ 110.00 $ 220.00 $3,330.00 $94.83 $163.50 $2,133.39 $2,391.71 $887.71 2.69 Years

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts