Question: Hello. Please answer all questions and round to two decimal places. I will give like if you answer all questions. Thank you so much. Question

Hello. Please answer all questions and round to two decimal places. I will give like if you answer all questions. Thank you so much.

Question 2A

Question 2B

Question 2B

Question 3

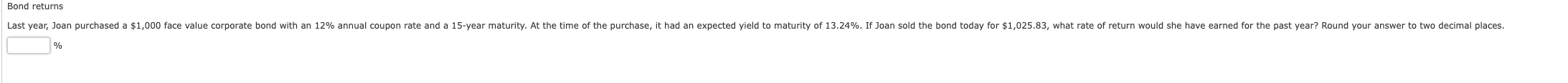

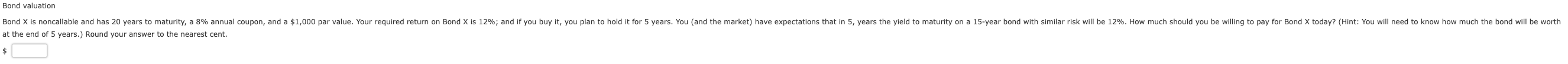

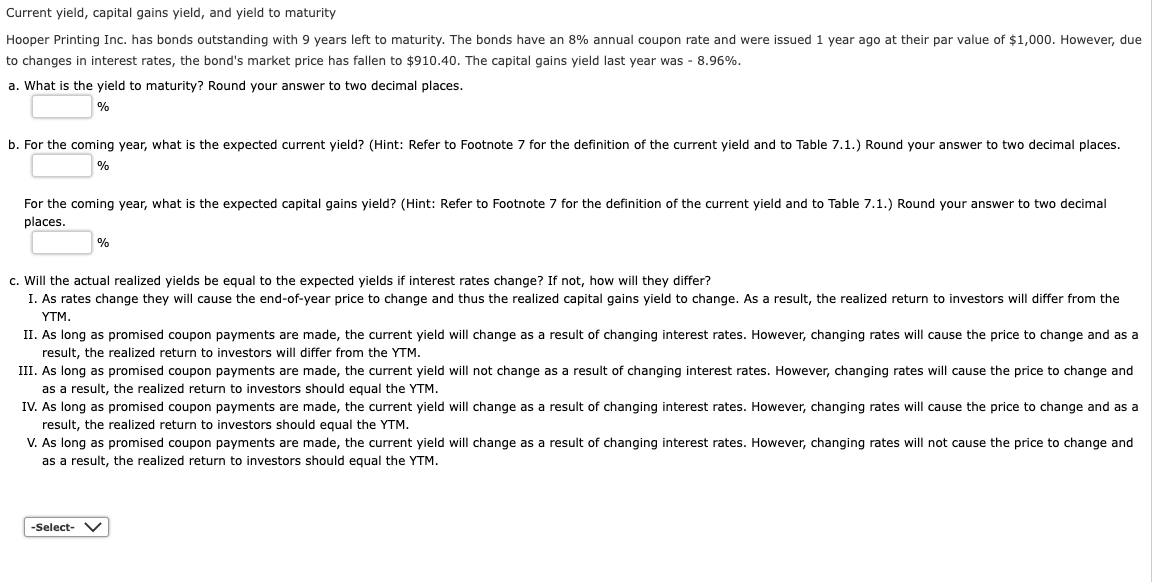

Bond returns Last year, Joan purchased a $1,000 face value corporate bond with an 12% annual coupon rate and a 15-year maturity. At the time of the purchase, it had an expected yield to maturity of 13.24%. If Joan sold the bond today for $1,025.83, what rate of return would she have earned for the past year? Round your answer to two decimal places. % Bond valuation Bond X is noncallable and has 20 years to maturity, a 8% annual coupon, and a $1,000 par value. Your required return on Bond X is 12%; and if you buy it, you plan to hold it for 5 years. You (and the market) have expectations that in 5, years the yield to maturity on a 15-year bond with similar risk will be 12%. How much should you be willing to pay for Bond X today? (Hint: You will need to know how much the bond will be worth at the end of 5 years.) Round your answer to the nearest cent. $ year ago at their par value of $1,000. However, due Current yield, capital gains yield, and yield to maturity Hooper Printing Inc. has bonds outstanding with 9 years left to maturity. The bonds have an 8% annual coupon rate and were issued to changes in interest rates, the bond's market price has fallen to $910.40. The capital gains yield last year was - 8.96%. a. What is the yield to maturity? Round your answer to two decimal places. % b. For the coming year, what is the expected current yield? (Hint: Refer to Footnote 7 for the definition of the current yield and to Table 7.1.) Round your answer to two decimal places. For the coming year, what is the expected capital gains yield? (Hint: Refer to Footnote 7 for the definition of the current yield and to Table 7.1.) Round your answer to two decimal places. % c. Will the actual realized yields be equal to the expected yields if interest rates change? If not, how will they differ? I. As rates change they will cause the end-of-year price to change and thus the realized capital gains yield to change. As a result, the realized return to investors will differ from the YTM. II. As long as promised coupon payments are made, the current yield will change as a result of changing interest rates. However, changing rates will cause the price to change and as a result, the realized return to investors will differ from the YTM. III. As long as promised coupon payments are made, the current yield will not change as a result of changing interest rates. However, changing rates will cause the price to change and as a result, the realized return to investors should equal the YTM. IV. As long as promised coupon payments are made, the current yield will change as a result of changing interest rates. However, changing rates will cause the price to change and as a result, the realized return to investors should equal the YTM. V. As long as promised coupon payments are made, the current yield will change as a result of changing interest rates. However, changing rates will not cause the price to change and as a result, the realized return to investors should equal the YTM. -Select- V -Select- IV V 0= Icon Key

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts