Question: How do small electric vehicle (EV) makers from the base everywhere. In fact, dozens of EV makers have popped of the pyramid of China's automobile

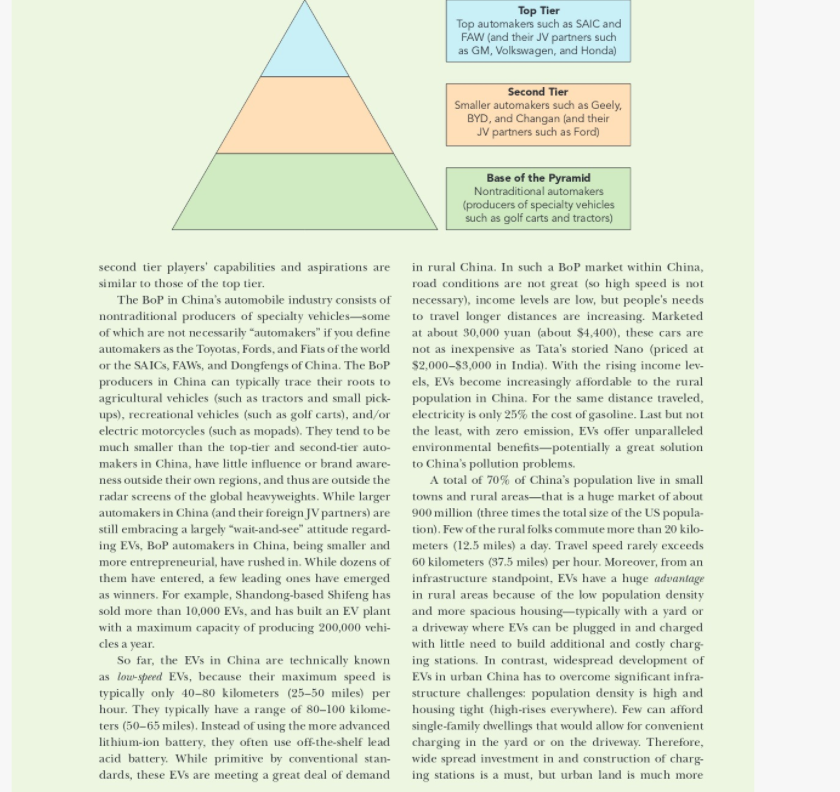

How do small electric vehicle (EV) makers from the base everywhere. In fact, dozens of EV makers have popped of the pyramid of China's automobile industry overcome up in China, and most of them are experimenting institution-based barriers at home? How do they leverage with new products in a great entrepreneurial drive. their strengths overseas? While most of them have a hard time cracking the top tier market in China, a small number of them, Reverse innovation is any innovation that is adopted in a fashion described by Prahalad and Govindara- first in the developing world." Gurus such as C. K. janhave already penetrated the US market. If you Prahalad noted that from the bottom of the pyramid see someone (or you yourself are) driving a Wheego (BOP), reverse innovation is likely to diffuse from or CODA EV in the United States, you are witnessing emerging economies to developed economies. Yet, con- indigenous reverse innovation at work. crete examples of reverse innovation are few. Of the How can the humble EV makers of China accom- list of examples noted in Govindarajan and Trimble's plish so much in a remarkably short span of time? After excellent new book Reverse Innovation, all of them are all, none of the traditional automakers in China has multinational subsidiaries in emerging economies cracked the US market. Other than the Nissan Leaf developing innovative, low cost products (such as GE's (which is a full EV), few traditional automakers active storied portable ultrasound developed in China). in the US market have launched EVs. Other examples in Reverse Innovation include Deere & Company, EMC, Harman, Logitech, PepsiCo, and From the Bottom of the Pyramid-Within China P&G. Are there any examples of reverse innovation Prahalad's BoP model divides the whole world in that are truly indigenous in nature (i.e., developed by three tiers, with low-income emerging economies localon-multinational firms) and that have success- occupying the base. We can extend the BOP model to fully penetrated developed markets? what is unfolding in the automobile industry within The electric vehicle (EV) makers in China can be one emerging economy (Exhibit 1). In the Chinese a great example of such indigenous reverse innova- automobile industry, the top tier is occupied by for- tion. An EV is an electric car that does not burn a eign-branded cars produced by the joint ventures single drop of gasoline. Known as a "plug-in" vehicle, (JV) between global heavyweights and top Chinese an EV is totally based on battery power, has no tail- automakers, such as Shanghai-GM, Shanghai-Volk- pipe, and thus has zero emission. It would be more swagen, and Guangzhou-Honda. As China's auto revolutionary than Toyota's hybrid Prius, which drives market becomes the largest in the world, it has also on battery power before its gasoline engine kicks in become the most competitive-as measured by the and recharges the battery. If you go to Beijing or number of new models unleashed in a given year. The Shanghai, you do not see many EVs. Like everywhere global heavyweights increasingly bring their newest else in the world, the roads and highways in urban designs with the fanciest styles and the most power- China are full of conventional cars. But if you travel ful engines to produce in China. The second tier con- to certain rural areas (such as Liaocheng and Zibo sists of smaller Chinese automakers and their JVs with in Shandong province), locally produced EVs seem smaller global players. All the top-tier and most of the second-tier are state-owned automakers. But the sec- 1) Research on this case was supported by the Jindal Chair at UT Dallas and the Jack Austin Centre for Asia Pacific Business Studies at Simon Fraser Uni- ond tier also includes privately-owned producers such versity. All views and errors are those of the authors. Mike W. Peng, Yanmei as Geely (which recently took over Volvo) and BYD Zhu, and Pek-Hooi Soh. Reprinted with permission. 2) V. Govindarajan & C. Trimble, 2012, Reverse Innovation (p. 4), Boston: Har (which is the most aggressive in developing EVs pow- vard Business Review Press. ered by lithium-ion battery technology). Overall, the Top Tier Top automakers such as SAIC and FAW (and their JV partners such as GM, Volkswagen, and Honda) Second Tier Smaller automakers such as Geely. BYD, and Changan (and their JV partners such as Ford) Base of the Pyramid Nontraditional automakers (producers of specialty vehicles such as golf carts and tractors) second tier players' capabilities and aspirations are in rural China. In such a BoP market within China, similar to those of the top tier. road conditions are not great (so high speed is not The BOP in China's automobile industry consists of necessary), income levels are low, but people's needs nontraditional producers of specialty vehicles-some to travel longer distances are increasing. Marketed of which are not necessarily automakers" if you define at about 30,000 yuan (about $4,400), these cars are automakers as the Toyotas, Fords, and Fiats of the world not as inexpensive as Tata's storied Nano (priced at or the SAICS, FAWs, and Dongfengs of China. The BOP $2,000-$3,000 in India). With the rising income lev- producers in China can typically trace their roots to els, EVs become increasingly affordable to the rural agricultural vehicles (such as tractors and small pick- population in China. For the same distance traveled, ups), recreational vehicles (such as golf carts), and/or electricity is only 25% the cost of gasoline. Last but not electric motorcycles (such as mopads). They tend to be the least, with zero emission, EVs offer unparalleled much smaller than the top-tier and second-tier auto- environmental benefits-potentially a great solution makers in China, have little influence or brand aware- to China's pollution problems. ness outside their own regions, and thus are outside the A total of 70% of China's population live in small radar screens of the global heavyweights. While larger towns and rural areasthat is a huge market of about automakers in China and their foreign JV partners) are 900 million (three times the total size of the US popula- still embracing a largely "wait-and-see" attitude regard- tion). Few of the rural folks commute more than 20 kilo- ing EVs, BoP automakers in China, being smaller and meters (12.5 miles) a day. Travel speed rarely exceeds more entrepreneurial, have rushed in. While dozens of 60 kilometers (37.5 miles) per hour. Moreover, from an them have entered, a few leading ones have emerged infrastructure standpoint, EVs have a huge advantage as winners. For example, Shandong-based Shifeng has in rural areas because of the low population density sold more than 10,000 EVs, and has built an EV plant and more spacious housingtypically with a yard or with a maximum capacity of producing 200,000 vehi- a driveway where EVs can be plugged in and charged cles a year. with little need to build additional and costly charg So far, the EVs in China are technically known ing stations. In contrast, widespread development of as low-speed EVS, because their maximum speed is EVs in urban China has to overcome significant infra- typically only 4080 kilometers (25-50 miles) per structure challenges: population density is high and hour. They typically have a range of 80-100 kilome- housing tight (high-rises everywhere). Few can afford ters (50-65 miles). Instead of using the more advanced single-family dwellings that would allow for convenient lithium-ion battery, they often use off-the-shelf lead charging in the yard or on the driveway. Therefore, acid battery. While primitive by conventional stan- wide spread investment in and construction of charg- dards, these EVs are meeting a great deal of demand ing stations is a must, but urban land is much more expensive than rural areas. Overall, whether EVs can Because low speed EVs are not classified as "cars," in take off in urban China remains a question mark, but most parts of China they do not need to carry a license EVs-especially low-speed EVs made by BoP automak plate, but then their owners cannot purchase insur- ers such as Shifeng-have already taken off in many ance either. Such EVs thus are potentially a safety haz- parts of rural China. ard. As a result, they may not be street legal" in many parts of China. Because of their low speed and lack Institution-Based Barriers to BoP Automakers of insurance, they certainly cannot drive on freeways. One of the recent and controversial) policy initiatives So their mobility is by definition limited. This is not in China is to promote "indigenous innovation." The a huge problem for now, given their short range per Chinese government has announced that in theory, EVs charge. Just like few unlicensed drivers everywhere are are being promoted to be one of the pillars of the auto- afraid of being caught, unlicensed EVs in Bop markets mobile industry, which is one of the "strategic" indus- in China are institutionally vulnerablethey may be tries earmarked for government support. A Development declared illegal and ordered off the streets (for exam- Plan for the "New Energy" Car Industry (2011-2020) has ple, for creating traffic jams) if the political winds blow listed nine specific EV models on its catalog for nation- against them. wide promotion in terms of qualifying for subsidies. To prevent that unfortunate fate from happening, While many foreign firms and governments naturally some local and provincial governments have passed worry that the promotion of "indigenous innovation" city, county, and provincial regulations to legalize and would shut them out and some have complained to the protect the BOP EV producers and owners. This local- Chinese government, not a single foreign automaker ized rule-making has typically taken place in regions has complained. The reason is very simple: instead that house such BoP automakers, such as Liaocheng of being promoted by the government, BoP automak- and Zibo in Shandong province, Dafng in Jiangsu ers are being discriminated against by institution-based province, and Fuyang in Anhui province. To facilitate barriers in China. Foreign automakers simply have no further development of the EV industry, Shandong need to worry about any preferential treatment of the has become the first province to explicitly legalize low- BoP automakers. speed EVs and allow them to hit the roads. Instead, BoP EVs are technically not even defined In the community of Chinese policymakers, execu- as "cars (or passenger vehicles") by existing Chinese tives, and scholars, supporters of low-speed BoP EVS standards. Only high-speed EVs are classified as cars" have urged for tolerance and nurturing given these in China. But of the nine (high-speed) EV models on vehicles' upside potential and environmental attrac- the catalog for the Development Plan for the "New Energy" tiveness. Critics argue that with little regulation, safety Car Industry (2011-2020) that are eligible for subsidies, features, and insurance protection, low-speed EVs are only one high speed EVthe BYD F3DM with a maxi- likely to proliferate to create more traffic jams and mum speed of 150 kilometers (95 miles) per hour and safety hazards, Critics claim that local rules protecting a maximum range of 100 kilometers (62.5 miles)-has locally produced EVs are "unconstitutional" because entered mass market. But the BYD F3DM is a Prius-like they violate the central government's power in making hybrid and not a pure EV. Despite the subsidies, its high and enforcing nationwide traffic and vehicle registra- price and low performance have not attracted many tion laws. While debates continue to rage, one thing customers. On the other hand, none of the dozens of for sure is that such indigenous reverse innovation has BOP EV models appears on the government's catalog a hard time breaking into the top tier, urban market in for subsidies. its own home country. Despite the proclamation to promote "green cars," the omission of BoP EVs on the government promotion Go Global from Bop Markets catalogue is not an oversight. It is intentional. This is Since going from the BOP to the top tier market in because the government promotion catalogue is influ- their own country is so tough, a number of Chinese enced by China's top-tier and second-tier automakers EV makers have gone global. At least two of them have (and their foreign JV partners). Although these incum- cracked the US market. bents themselves are not too enthusiastic to introduce In 2007, Hebei-based Shuanghuan Auto devel- EVs, they do not wish to legitimate BOP EVs. oped its first EV, the two-door, two-passenger Noble. Part One Integrative Cases 129 Unfortunately, the Noble was not allowed to be mar and Virginia allowed EVs such as the Wheego Life to keted as a "car" in China (as noted earlier). In 2009, enjoy the privilege of using high-occupancy vehicle Shuanghuan Auto joined hands with Wheego, an (HOV) lanes. Atlanta-based start-up specializing in all-electric cars. Another example is Hebei-based Great Wall Motors After considerable modification and enhancement In 2011, Great Wall signed an alliance agreement with in terms of control and safety features undertaken in Los Angeles-based CODA Automotive, which would Ontario, California, the Noble was marketed as the export EVs to the United States. With a top speed of Wheego Whip EV in the United States starting in 136 kilometers (85 miles) per hour, the four-door, December 2009. With a top speed of 40-55 kilome five-passenger CODA car was also fully "street legal" ters (25-35 miles) per hour, a range of 65 kilometer in the United States. It had a range of 240 kilometers (40 miles), and 10 hours to fully charge its engine, the (150 miles) and needed six hours to fully charge. It Wheego Whip retailed at $18,995. After adding options retailed at $44,900. After applying a $7,500 federal tax and taxes and then applying a $2,500 federal tax credit, credit, the net price was $97,400. the net price was $17,995. As of this writing, 25 dealers in 18 states as well as After a year, a significantly improved Noble became Japan and the Cayman Islands signed up with Wheego. the Wheego Life. With a top speed of 105 kilometers Five dealers in Southern California signed up with (65 miles) per hour, Wheego Life was fully highway CODA. The diffusion of such indigenous reverse inno- capable (and street legal") in the United States. It had vation is likely to proliferate. a range of 160 kilometers (100 miles) and only needed Case Discussion Questions five hours to fully charge its engine. The Wheego Life retailed at $32,995. After adding options and taxes and 1. From a resource-based view, what are some of then applying a $7,500 federal tax credit, the net price the outstanding capabilities that EV produc- was $26,495. In addition, some US state and local tax ers in China have? Why their larger competi- credit can further bring down the price tag. For exam- tors (incumbents) in China do not have such ple, in California, the Wheego Life appeared on the capabilities? state's list of approved "green cars" for state subsidies- 2. From an institution-based view, what are domes- this is no small accomplishment, considering that the tic incumbents in China-in collaboration with Noble (and all BOP EVs in China) failed to appear on global heavyweightsinterested in leveraging China's Development Plan for the "New Energy" Car Industry their influence on the Chinese government to (2011-2020) that would make them eligible for subsi- heighten entry barriers for EV producers? dies. As a result, Wheego Life owners in California could 3. Given that some EV producers from China's BoP enjoy an additional $2,000 off. In addition, Arizona, can penetrate the US market, what are some of California, Florida, Georgia, Hawaii, Maryland, New the lessons from indigenous reverse innovation Jersey, New York, North Carolina, Tennessee, Utah, in the era of globalization