Question: how do that need to know the steps ACCOUNTING FOR BONDS Company A issues $100,000 of 9 % , five-year bonds that pay interest annually.

how do that need to know the steps

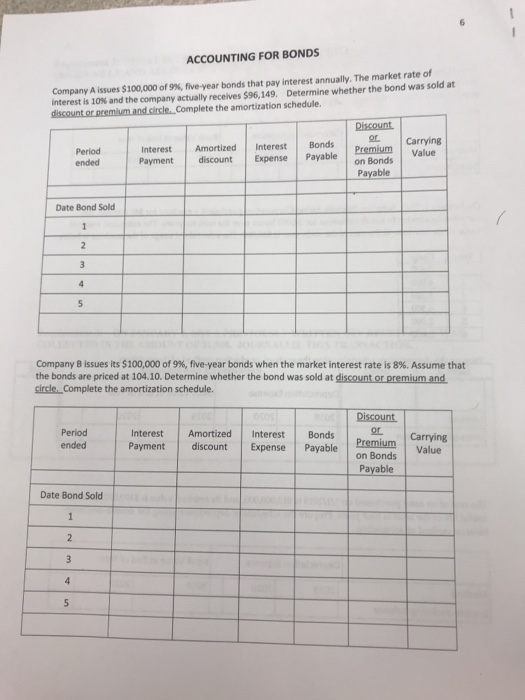

how do that need to know the steps ACCOUNTING FOR BONDS Company A issues $100,000 of 9 % , five-year bonds that pay interest annually. The market rate of interest is 10% and the company actually receives $96,149. Determine whether the bond was sold at discount or premium.and circle. Complete the amortization schedule Discount or Carrying Value Bonds Interest Expense Amortized discount Premium Period ended Interest Payable Payment on Bonds Payable Date Bond Sold 3 4 5 Company B issues its $100,000 of 99 % , five-year bonds when the market interest rate is 8%. Assume that the bonds are priced at 104.10. Determine whether the bond was sold at discount or premium and circle. Complete the amortization schedule. Discount or Period Interest Amortized Interest Bonds Carrying Premium ended Payment discount Expense Payable Value on Bonds Payable Date Bond Sold 3 5

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts