Question: How do we calculate the premium book value and the p/b ratio Please give formaula and explain in very much details E5.3. A Residual Earnings

How do we calculate the premium book value and the p/b ratio

Please give formaula and explain in very much details

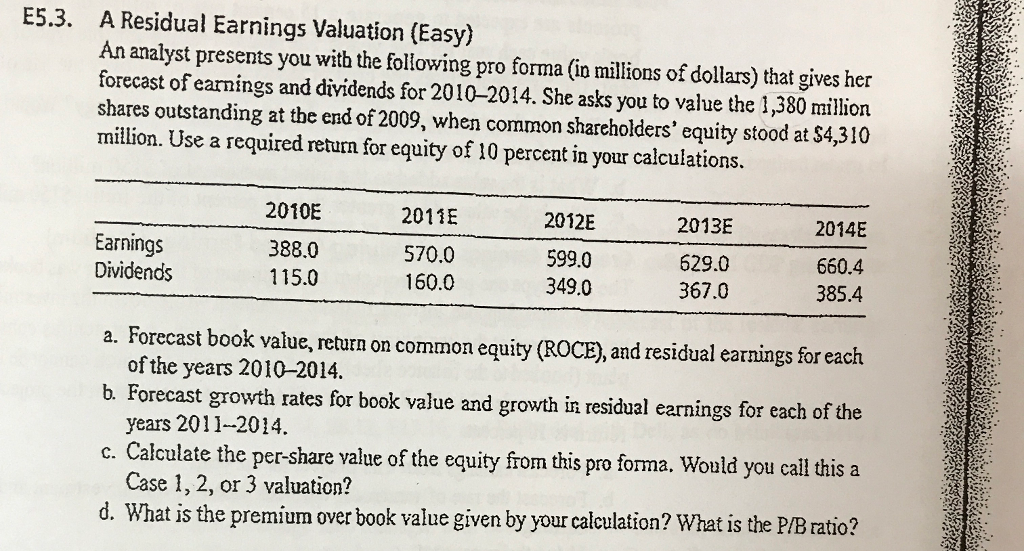

E5.3. A Residual Earnings Valuation (Easy) An analyst presents you with the following pro forma (io millions of dollars) that gives her forecast of earnings and dividends for 2010-2014. She asks you to value the 1,380 million shares outstanding at the end of 2009, when common shareholders' equity stood at $4,310 million. Use a required return for equity of 10 percent in your calculations. 2010E 388.0 115.0 2012E Earnings Dividends 2011E 570.0 160.0 599.0 349.0 2013E 629.0 367.0 2014E 660.4 385.4 a. Forecast book value, return on common equity (ROCE), and residual earnings for each of the years 2010-2014. years 2011-2014 Case 1, 2, or 3 valuation? b. Forecast growth rates for book value and growth in residual earnings for each of the c. Calculate the per-share value of the equity from this pro forma. Would you cal his a r book value given by your calculation? What is the PB ratio

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts