Question: How do we solve this? Thanks You've been considering purchasing a large-screen television for your home. During visits to your local electronics retailer you've identified

How do we solve this? Thanks

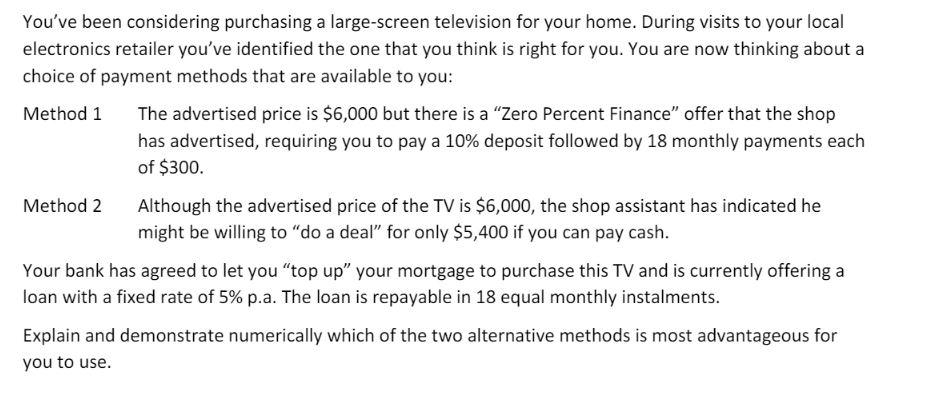

You've been considering purchasing a large-screen television for your home. During visits to your local electronics retailer you've identified the one that you think is right for you. You are now thinking about a choice of payment methods that are available to you: Method 1 The advertised price is $6,000 but there is a Zero Percent Finance offer that the shop has advertised, requiring you to pay a 10% deposit followed by 18 monthly payments each of $300. Method 2 Although the advertised price of the TV is $6,000, the shop assistant has indicated he might be willing to "do a deal" for only $5,400 if you can pay cash. Your bank has agreed to let you "top up" your mortgage to purchase this TV and is currently offering a loan with a fixed rate of 5% p.a. The loan is repayable in 18 equal monthly instalments. Explain and demonstrate numerically which of the two alternative methods is most advantageous for you to use

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts