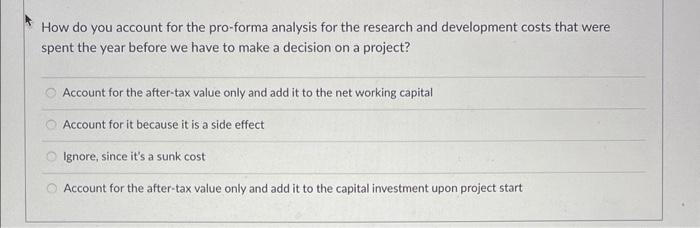

Question: How do you account for the pro-forma analysis for the research and development costs that were spent the year before we have to make a

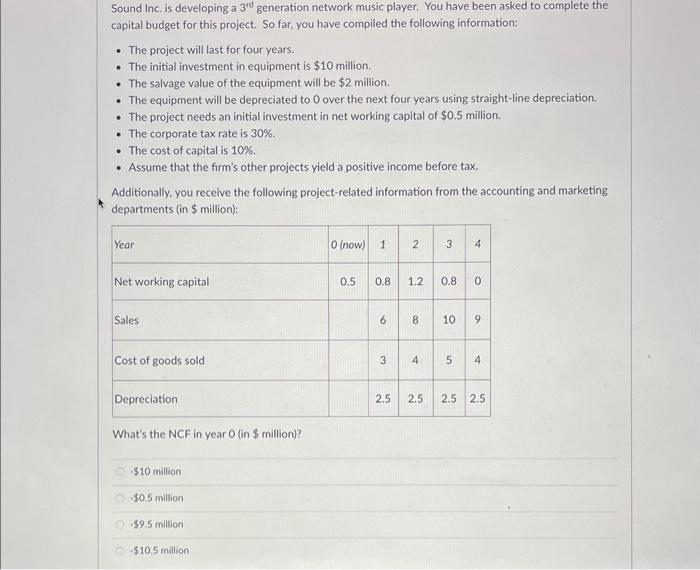

How do you account for the pro-forma analysis for the research and development costs that were spent the year before we have to make a decision on a project? Account for the after-tax value only and add it to the net working capital Account for it because it is a side effect Ignore, since it's a sunk cost Account for the after-tax value only and add it to the capital investment upon project start Sound Inc. is developing a 3td generation network music player. You have been asked to complete the capital budget for this project. So far, you have compiled the following information: - The project will last for four years. - The initial investment in equipment is $10 million. - The salvage value of the equipment will be $2 million. - The equipment will be depreciated to 0 over the next four years using straight-line depreciation. - The project needs an initial investment in net working capital of $0.5 million. - The corporate tax rate is 30%. - The cost of capital is 10%. - Assume that the firm's other projects yield a positive income before tax. Additionally, you receive the following project-related information from the accounting and marketing departments (in $ million): What's the NCF in year 0 (in $ million)? $10 million .50.5 million $9.5 million $10.5 million

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts