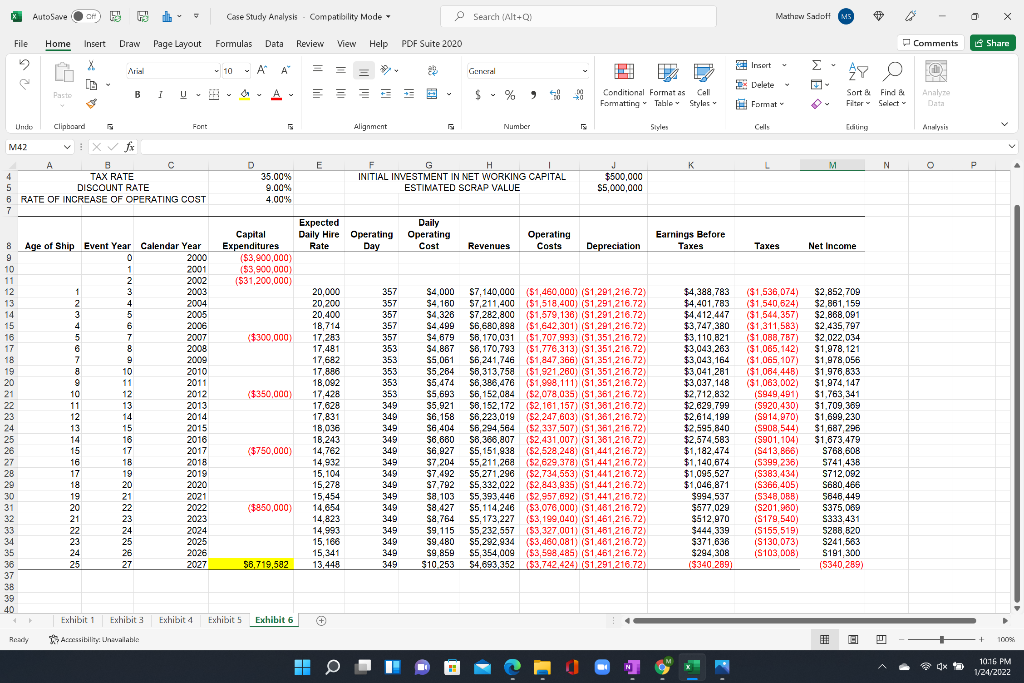

Question: How do you calculate $6,719,582 and where does 4% for the rate of increase of operating cost come from? AutoSave of F Case Study Analysis.

How do you calculate $6,719,582 and where does 4% for the rate of increase of operating cost come from?

AutoSave of F Case Study Analysis. Compatibility Mode Search (Alt+Q) Mathew Sadott MS File Home Insert Draw Page Layout Formulas Data Review View Help PDF Suite 2020 Comments Share 2 10 A Arial ! Insert 29 A Gencral X IS Ayo HD IX Delete Pasto B 1 U U A, == $ % 988 Conditional Format as Call Formatting Table Styles Sort Find Filter Select Analyze Data Format Unti Clipboard Font Alignment Number F Styles Cels Eating Analysis D E K L M N P M42 VIX fi A B C 4 TAX RATE 5 DISCOUNT RATE 6 RATE OF INCREASE OF OPERATING COST 7 35.00% 9.00% 4.00% F G H INITIAL INVESTMENT IN NET WORKING CAPITAL ESTIMATED SCRAP VALUE J $500,000 $5,000,000 Earnings Before Taxes Taxes Net Income 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 29 30 31 32 Age of Ship Event Year Calendar Year 0 2000 1 2001 2 2002 1 3 3 2003 2 4 2004 3 5 2005 4 6 2008 5 7 2007 6 8 2008 7 2009 8 10 2010 9 11 2011 10 12 2012 11 13 2013 12 14 2014 13 15 2015 14 16 2016 15 17 2017 16 18 2018 17 19 2019 18 20 2020 19 21 2021 20 22 2022 21 23 2023 22 24 2024 23 25 2025 24 26 2026 25 27 2027 gapm23dBbCB9%a8888 Expected Daily Capital Daily Hire Operating Operating Operating Expenditures Rate Day Cost Revenues Costs Depreciation ($3,900,000) ($3,900,000 (531,200,000) 20,000 357 $4.000 S7,140,000 ($1,460,000) (S1.291,216.72) 20,200 357 $4,160 $7,211,400 ($1,518,400) (51 291,216.72) 20,400 357 $4.326 $7,282,800 ($1,579,136) (S1.291,216.72) 18,714 357 $4,499 $6.680,898 ($1,642,301) ($1.291,216.72) ($300,000) 17,283 357 $4.679 $6,170,031 ($1,707,993) ($1.351,216.72) 17,481 353 $4,867 S6, 170,793 ($1,776,313) ($1.351,216.72) 17,682 353 S5 061 S6,241,746 ($1,847,366) (S1,351,216.72) 17,856 353 $5 264 $6,313,758 ($1,921,260) ($1.351,216.72) 18.092 353 $5,474 S6,386,476 ($1.998,111) (S1,351,216.72) ($350,000) 17,428 353 $5,693 S6, 152,084 $2,078,035) (81 361,216.72) 17,628 349 $5.921 58,152,172 ($2,161,157) (S1,361,216.72) 17.831 349 S6, 158 S6.223,019 ($2,247,603) (S1,361,216.72) 18,036 349 $6,404 $6,294,564 ($2,337,507) ($1,361,216.72) 18,243 349 $6.880 $8,388,807 ($2,431,007) (S1,381,216.72) ($750,000) 14,762 349 $6.927 S5, 151,938 ($2,528,248) (81,441,216.72) () 14,932 349 $7 204 $5,211,268 ($2,629,378) ($1.441,216.72) 15,104 349 $7.492 $5,271,296 ($2,734,553) ($1.441,216.72) 15,278 $7,792 S5,332,022 ($2,843,935) (S1,441,216.72) 15,454 349 $a 103 $5,393,446 ($2,957,692) (S1 441,216.72) ($950,000) 14,654 349 $8,427 $5,114,246 ($3,076,000) ($1.481,216.72) 14,823 349 S8.764 S5, 173,227 ($3,199,040) (S1.461,216.72) 14,993 349 $9.115 $5,232,557 ($3,327,001) (51.461,216.72) 15,186 349 $9.480 S5,292,934 ($3,460,081) (81,461,216.72) 15,341 349 $9.859 $5,354,009 ($3,598,485) (S1,461,216.72) ( $6,719,582 13,448 349 $10.253 $4,693,352 ($3,742,424) ($1.291,216.72) $4,388,783 $4,401,783 $4,412,447 $3,747,380 $3,110.821 $3,043.263 $3,043,164 $3,041.281 $3,037.148 $2,712,832 $2.629.799 $2,614,199 $2,595,840 $2,574,583 $1,182,474 $1,140,674 $1,095,527 $1,046,871 $994 537 $577,029 $512,970 $444,339 $371.636 $294,308 ($340 289) ($1,536,074) ($1.540,624) ($1,544,357) ($1,311,583) ($1.088,787) ($1,065, 142) ($1,065, 107) ($1,064 4438 ($1,063,002) (5949,491) (S920,430) (S914.970) (8908, 544) (5901, 104) (S413.866) (S399 238) (S383,434) (S366,405) (5348 DBB) (S201.980) (S179.540) (S155,519) (S130,073) (S103, DDB) $2,852.709 $2,861, 159 $2,868,091 $2.435.797 $2,022,034 $1,978, 121 $1,978,056 $1,976,533 $1,974,147 $1.763,341 $1.709,369 $1,699.230 $1,687,296 $1.673,479 S768.608 5741,438 S712,092 S680.466 5646,449 S375,089 S333,431 5268,620 S241,563 $191,300 (5340,289) 349 34 35 36 37 38 39 40 Exhibit 1 Exhibit 3 Exhibit 4 Exhibit 5 Exhibit 6 # R Ready Accessibility Unavailable HII El + 100% H 0x 10:16 PM 1/24/2022

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts