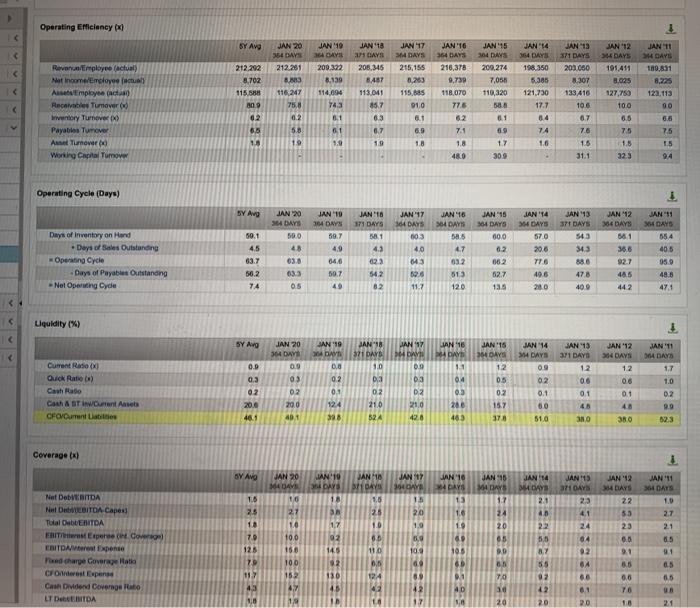

Question: How do you calculate interval measure? Operating Efficiency (x) SY Avg JAN '17 DAYS 212.292 8.702 115.88 809 JAN 20 354 DAYS 212.261 B. 116.247

Operating Efficiency (x) SY Avg JAN '17 DAYS 212.292 8.702 115.88 809 JAN 20 354 DAYS 212.261 B. 116.247 75,8 12 5.8 19 JAN 10 3 DAYS 209.372 8.139 114,096 JAN 18 DAYS 208,345 8,457 113.041 857 63 0.7 215,155 8.263 115.88 010 JAN '16 364 DAYS 210,378 9,739 118.070 77.6 62 7.1 1.8 JAN '15 304 DAYS 209.274 7,056 110,320 58.8 Rev. Employee actual Net Income Employee actual Amployect Recambe Tumover) Inventory Turnover Payables Tumor Al Turower Woning Capital Tumor JAN '14 364 DAYS 198.350 5.385 121,730 17.7 8.4 74 1.6 JAN 13 371 DAYS 203.060 8.307 133 410 10.6 JAN 12 34 DAYS 191.411 3.025 127.750 100 0.5 JANI DAYS 180.871 8.225 123.113 00 3 21 11 67 02 6.5 61 6.9 7.6 75 61 9.9 6.6 7.5 1.5 69 17 300 18 15 31.1 480 24 Operating Cycle (Days) SY Avg JAN 20 A DAYS 500 48 JAN 19 104 DAYS 59.7 4.9 JAN 18 171 DAYS 581 4.3 023 542 8.2 JAN '17 564 DAYS 003 40 643 JAN '16 4 DAYS 000 02 JAN 14 34 DAYS 57.0 20.6 50.1 JAN '16 34 DAYS 585 47 032 513 120 JAN 13 371 DAYS 543 343 JAN 12 304 DAYS 661 36.6 Days of inventory on Hand Days of Outstanding Operating Cycle Days of Payables Outstanding -Net Operating Cyde JAN '11 04 DAYS 554 405 45 63.7 56.2 74 082 696 04.0 507 49 196 033 05 77.6 49.6 200 473 48.5 62.7 13.5 485 442 11.7 400 471 Liquidity (%) SY Avg SL. NVE SAVO VE JAN 20 364 DAYS 0.9 03 SAN 19 DAVE 0,0 02 0.0 JAN '12 304 DAYS 1.2 LAN '16 DAYE 11 04 JAN 18 321 DAYS 1.0 01 02 21.0 32A Current Ratio Quick Rate :) t = 4 CA STIWDA CFO Latin JAN 17 4 DAVI 0.9 03 D2 21.0 42.8 CD JAN 13 371 DAYD 12 06 0.1 JAN 14 4 DAYS 09 02 0.1 6.0 JAN '11 164 DAYS 1.7 1.0 0.2 0.1 12 0.5 02 157 378 02 20.6 461 01 02 20.0 401 0.3 288 463 124 38 06 DIS ONE 629 Coverage SV AVG JAN 20 DAVE 01.VT JAN 18 SAVE JAN 11 304 DAYS 1.5 JAN 18 MAAYO 1.7 24 1,0 JAN 17 394 AV 15 20 1.9 to 27 10 100 JAN 14 WAY 28 40 22 25 1.0 LAN 10 4 DAYS 13 10 19 60 105 25 10 70 125 Net DebTDA Nel DEBITDA Capes Total ObETDA ERIT Expert Cover EBITDAW response Predcharge Coverage Hati CF Odnost Expense Casa de Coverage LT DIDA JAN '13 7 DAYS 23 4.1 24 04 92 17 92 20 65 20 JAN 12 4 DAYS 22 33 23 0.0 2.1 8.5 0.0 2.7 2.1 05 196 145 110 10.9 02 0, 90 100 152 AM 55 92 60 11 43 05 45 40 10 VA BE 20 20 10 Operating Efficiency (x) SY Avg JAN '17 DAYS 212.292 8.702 115.88 809 JAN 20 354 DAYS 212.261 B. 116.247 75,8 12 5.8 19 JAN 10 3 DAYS 209.372 8.139 114,096 JAN 18 DAYS 208,345 8,457 113.041 857 63 0.7 215,155 8.263 115.88 010 JAN '16 364 DAYS 210,378 9,739 118.070 77.6 62 7.1 1.8 JAN '15 304 DAYS 209.274 7,056 110,320 58.8 Rev. Employee actual Net Income Employee actual Amployect Recambe Tumover) Inventory Turnover Payables Tumor Al Turower Woning Capital Tumor JAN '14 364 DAYS 198.350 5.385 121,730 17.7 8.4 74 1.6 JAN 13 371 DAYS 203.060 8.307 133 410 10.6 JAN 12 34 DAYS 191.411 3.025 127.750 100 0.5 JANI DAYS 180.871 8.225 123.113 00 3 21 11 67 02 6.5 61 6.9 7.6 75 61 9.9 6.6 7.5 1.5 69 17 300 18 15 31.1 480 24 Operating Cycle (Days) SY Avg JAN 20 A DAYS 500 48 JAN 19 104 DAYS 59.7 4.9 JAN 18 171 DAYS 581 4.3 023 542 8.2 JAN '17 564 DAYS 003 40 643 JAN '16 4 DAYS 000 02 JAN 14 34 DAYS 57.0 20.6 50.1 JAN '16 34 DAYS 585 47 032 513 120 JAN 13 371 DAYS 543 343 JAN 12 304 DAYS 661 36.6 Days of inventory on Hand Days of Outstanding Operating Cycle Days of Payables Outstanding -Net Operating Cyde JAN '11 04 DAYS 554 405 45 63.7 56.2 74 082 696 04.0 507 49 196 033 05 77.6 49.6 200 473 48.5 62.7 13.5 485 442 11.7 400 471 Liquidity (%) SY Avg SL. NVE SAVO VE JAN 20 364 DAYS 0.9 03 SAN 19 DAVE 0,0 02 0.0 JAN '12 304 DAYS 1.2 LAN '16 DAYE 11 04 JAN 18 321 DAYS 1.0 01 02 21.0 32A Current Ratio Quick Rate :) t = 4 CA STIWDA CFO Latin JAN 17 4 DAVI 0.9 03 D2 21.0 42.8 CD JAN 13 371 DAYD 12 06 0.1 JAN 14 4 DAYS 09 02 0.1 6.0 JAN '11 164 DAYS 1.7 1.0 0.2 0.1 12 0.5 02 157 378 02 20.6 461 01 02 20.0 401 0.3 288 463 124 38 06 DIS ONE 629 Coverage SV AVG JAN 20 DAVE 01.VT JAN 18 SAVE JAN 11 304 DAYS 1.5 JAN 18 MAAYO 1.7 24 1,0 JAN 17 394 AV 15 20 1.9 to 27 10 100 JAN 14 WAY 28 40 22 25 1.0 LAN 10 4 DAYS 13 10 19 60 105 25 10 70 125 Net DebTDA Nel DEBITDA Capes Total ObETDA ERIT Expert Cover EBITDAW response Predcharge Coverage Hati CF Odnost Expense Casa de Coverage LT DIDA JAN '13 7 DAYS 23 4.1 24 04 92 17 92 20 65 20 JAN 12 4 DAYS 22 33 23 0.0 2.1 8.5 0.0 2.7 2.1 05 196 145 110 10.9 02 0, 90 100 152 AM 55 92 60 11 43 05 45 40 10 VA BE 20 20 10

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts