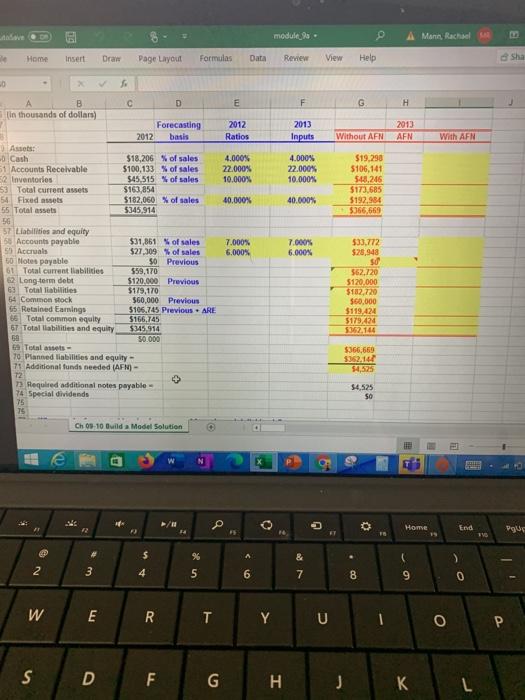

Question: how do you caluclate with the AFN module Mann, Rachel Home Insert Draw Page Layout Formulas Data Review View Help E F G 2012 Ratios

how do you caluclate with the AFN

how do you caluclate with the AFNmodule Mann, Rachel Home Insert Draw Page Layout Formulas Data Review View Help E F G 2012 Ratios 2013 Inputs 2013 AFN Without AFN With AFN 4.0005 22.000% 10.000% 4.000% 22.000% 10.000% $19,290 5106,141 548,246 $17.685 $192,984 $366,669 40.000% 40.000% B D in thousands of dollars) Forecasting 2012 basis Assets: - Cash $18,206 % of sales 1 Accounts Receivable $100,133 % of sales 2. Inventarios $45,515 of sales 53 Total current assets $163,854 54 Fixed assets 5182,060 % of sales 55 Total assets 5345.914 56 ities and equity 50 Accounts payable $31,861 of sales 55 Accruals $27,309 of sales 50 Notes payable $0 Previous 61 Total current liabilities $59,170 62 Long-term debt $120.000 Previous 63 Total abilities $179,170 54 Common stock $60,000 Previous 65 Retained Earnings 5106.745 Previous ARE 6 Total common equity 5166, 745 67 Total liabilities and equity $445 914 50.000 Total assets 70 Planned liabilities and equity - 71. Additional funds needed (AFN) - 7.000% 6.000% 7.000 6.000% 533.772 $28,948 $ 562,720 5120,000 $182.720 $60.000 $119.424 5179/24 5.362,146 S366,659 $352,161 $4,525 54.525 SO Required additional notes payable 74 Special dividends 75 15 Ch 05-10 Build Model Solution Home 12 , FR TV & $ 4 % 5 2 3 6 7 8 9 0 - 2 E R Y U O S D F G H L

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts