Question: How do you compute the effective annual yield (EAY) on a semi-annual coupon paying bond? A. You find the semi-annual IRR using six-month periods to

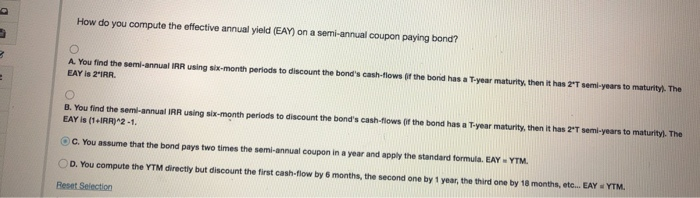

How do you compute the effective annual yield (EAY) on a semi-annual coupon paying bond? A. You find the semi-annual IRR using six-month periods to discount the bond's cash-flows of the bord has a T-year maturity, then it has 2'T semi-years to maturity). The LAY IS 2 IRR 8. You find the semi-annual IRR using six-month periods to discount the bond's cash-flows of the bond has a T-year maturity, then it has 2'T semi-years to maturity. The EAY is (1-IRR) 2-1 C. You assume that the bond pays two times the semi-annual coupon in a year and apply the standard formula EAY YTM D. You compute the YTM directly but discount the first cash-flow by 6 months, the second one by 1 year, the third one by 18 months, etc... CAY - YTM. Roca Colation

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts