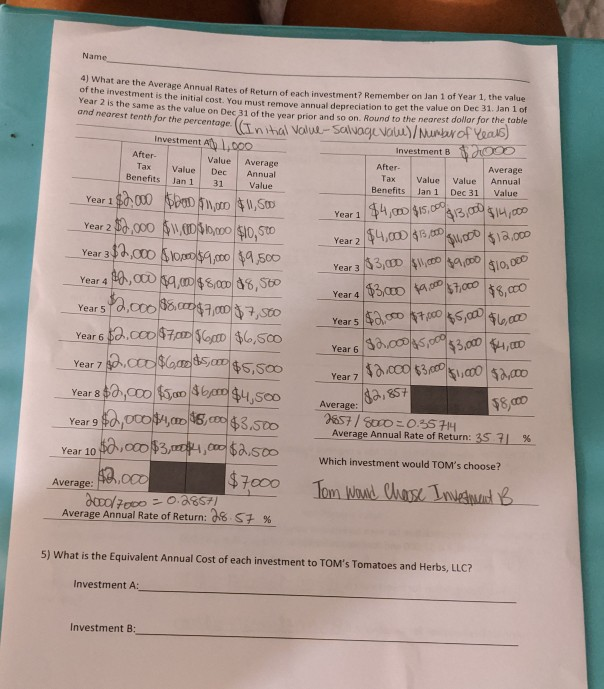

Question: How do you determine question number five for this assignment? Name 4) What are the Average Annual Rates of Return of each investment? Remember on

How do you determine question number five for this assignment?

Name 4) What are the Average Annual Rates of Return of each investment? Remember on Jan 1 of Year 1, the value of the investment is the initial cost. You must remove annual depreciation to get the value on Dec 31. Jan 1 of Year 2 is the same as the value on Dec 31 of the year prior and so on. Round to the nearest dollor for the table and nearest tenth for the percentage. (Initial value-salvage vaw) / Member of years) Investment B $2000 Investment Apo 1.000 After Tax Value Benefits Jan 1 Value Dec 31 Average Annual Value After Tax Benefits Value Jan 1 Value Dec 31 Average Annual Value Year 1 $13,000 $4,000 Year 2 $12,000 $10,000 $4,000 $15.000 $14,000 $4,000 $13.000 Year 3 $3,00 $0 $9,000 Year 4 $3,000 $9.000 187,000 $8,000 Years $2.000 $7.000 5,00 $6,000 $2.00045,000 $3,000 $4,000 $2.000 63.000 Year 5 Year 1 $2,000 $oo 000 $1,500 Year 2 $2,000 $1,000 $10,000 $10,500 Year 3 $2,000 lop $9.00 $9.500 Year 4 20,000 $9,000 $8,000 $8,560 $2,000 $8.000$7,000 $7,500 Year 6 12.000 $7,000 $600 $6,500 Year 7 $2.00086 5,00 $5,500 Year 8 $2,000 $5,00 $6,000 $4,500 Year 9 $2,000$4,00 48,00 $3.500 $2,000 $3,000,000 $2.500 $2.000 $7000 200/7000 - 0.28571 Average Annual Rate of Return: 28.57% Year 6 Year 7 $1,000 $2,000 8a,857 $8,000 Average: 3657) Sub=0.3571 Average Annual Rate of Return: 35 71% Year 10 Which investment would TOM's choose? Average: Tom would choose Investment B 5) What is the Equivalent Annual Cost of each investment to TOM's Tomatoes and Herbs, LLC? Investment A: Investment B

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts