Question: please answer the following questions regarding the data above. 1) What is the payback period of each pitential investment? Round to the nearest tenth Investment

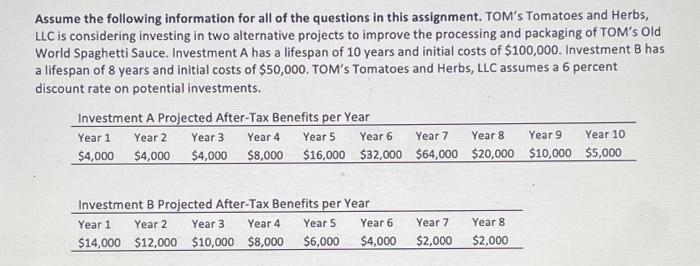

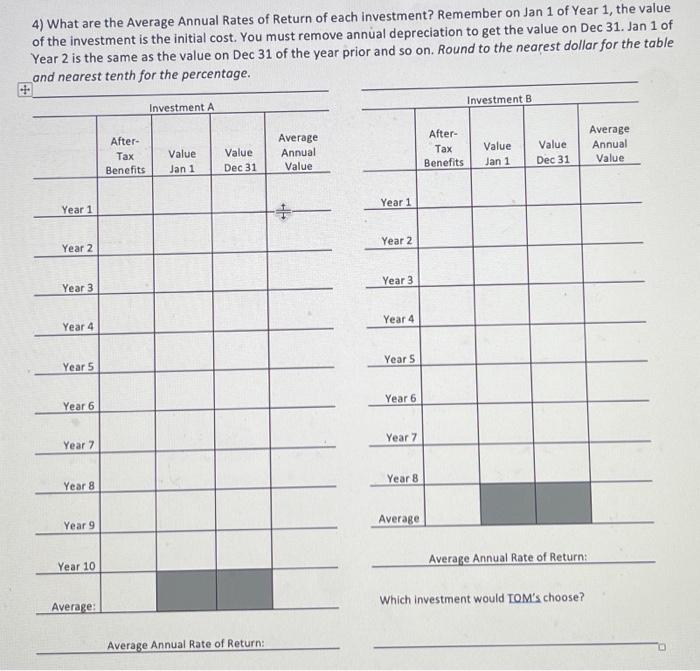

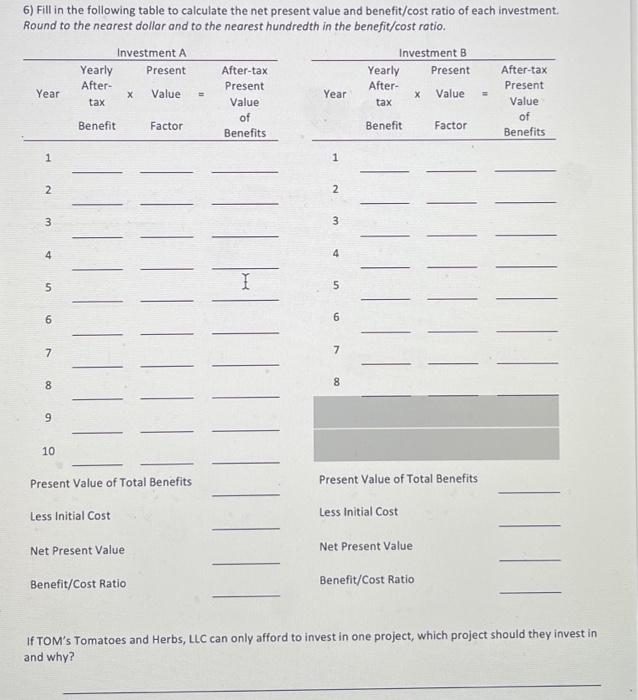

Assume the following information for all of the questions in this assignment. TOM's Tomatoes and Herbs, LLC is considering investing in two alternative projects to improve the processing and packaging of TOM's Old World Spaghetti Sauce. Investment A has a lifespan of 10 years and initial costs of $100,000. Investment B has a lifespan of 8 years and initial costs of $50,000. TOM's Tomatoes and Herbs, LLC assumes a 6 percent discount rate on potential investments. 4) What are the Average Annual Rates of Return of each investment? Remember on Jan 1 of Year 1 , the value of the investment is the initial cost. You must remove annual depreciation to get the value on Dec 31 . Jan 1 of Year 2 is the same as the value on Dec 31 of the year prior and so on. Round to the nearest dollar for the table 6) Fill in the following table to calculate the net present value and benefit/cost ratio of each investment. Round to the nearest dollar and to the nearest hundredth in the benefit/cost ratio. If TOM's Tomatoes and Herbs, LLC can only afford to invest in one project, which project should they invest in and why? Assume the following information for all of the questions in this assignment. TOM's Tomatoes and Herbs, LLC is considering investing in two alternative projects to improve the processing and packaging of TOM's Old World Spaghetti Sauce. Investment A has a lifespan of 10 years and initial costs of $100,000. Investment B has a lifespan of 8 years and initial costs of $50,000. TOM's Tomatoes and Herbs, LLC assumes a 6 percent discount rate on potential investments. 4) What are the Average Annual Rates of Return of each investment? Remember on Jan 1 of Year 1 , the value of the investment is the initial cost. You must remove annual depreciation to get the value on Dec 31 . Jan 1 of Year 2 is the same as the value on Dec 31 of the year prior and so on. Round to the nearest dollar for the table 6) Fill in the following table to calculate the net present value and benefit/cost ratio of each investment. Round to the nearest dollar and to the nearest hundredth in the benefit/cost ratio. If TOM's Tomatoes and Herbs, LLC can only afford to invest in one project, which project should they invest in and why

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts