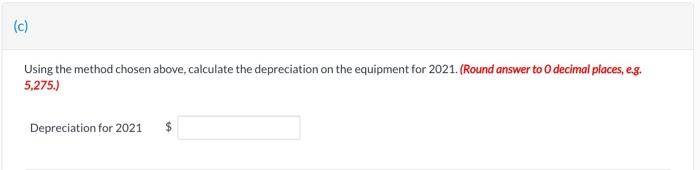

Question: how do you do part c? (c) c) Using the method chosen above, calculate the depreciation on the equipment for 2021. (Round answer to decimal

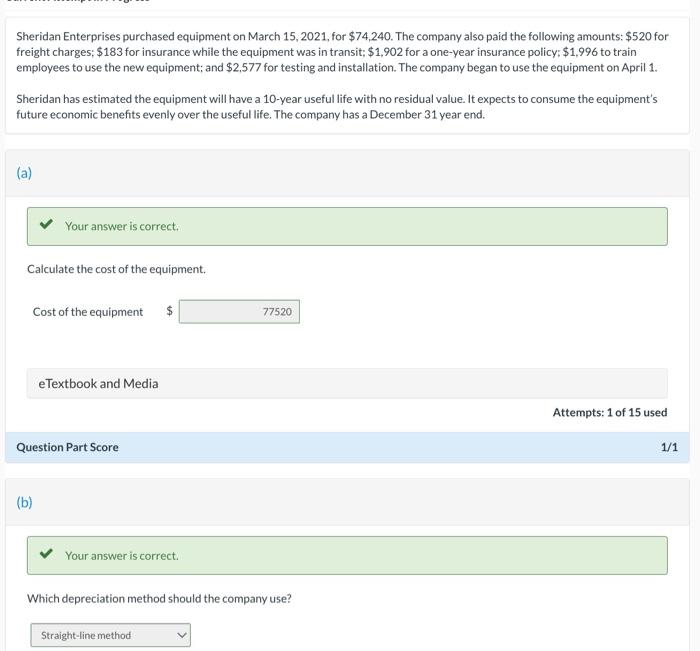

(c) c) Using the method chosen above, calculate the depreciation on the equipment for 2021. (Round answer to decimal places, eg. 5,275.) Depreciation for 2021 $ Sheridan Enterprises purchased equipment on March 15, 2021, for $74,240. The company also paid the following amounts: $520 for freight charges: $183 for insurance while the equipment was in transit: $1,902 for a one-year insurance policy: $1.996 to train employees to use the new equipment; and $2,577 for testing and installation. The company began to use the equipment on April 1. Sheridan has estimated the equipment will have a 10-year useful life with no residual value. It expects to consume the equipment's future economic benefits evenly over the useful life. The company has a December 31 year end. (a) Your answer is correct. Calculate the cost of the equipment. Cost of the equipment $ 77520 e Textbook and Media Attempts: 1 of 15 used Question Part Score 1/1 (b) Your answer is correct. Which depreciation method should the company use? Straight-line method

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts