Question: How do you do supporting value analysis with exhibit 1?Please help Your team of experienced investment bankers has been advising Bega and its executive management

How do you do supporting value analysis with exhibit 1?Please help

How do you do supporting value analysis with exhibit 1?Please help

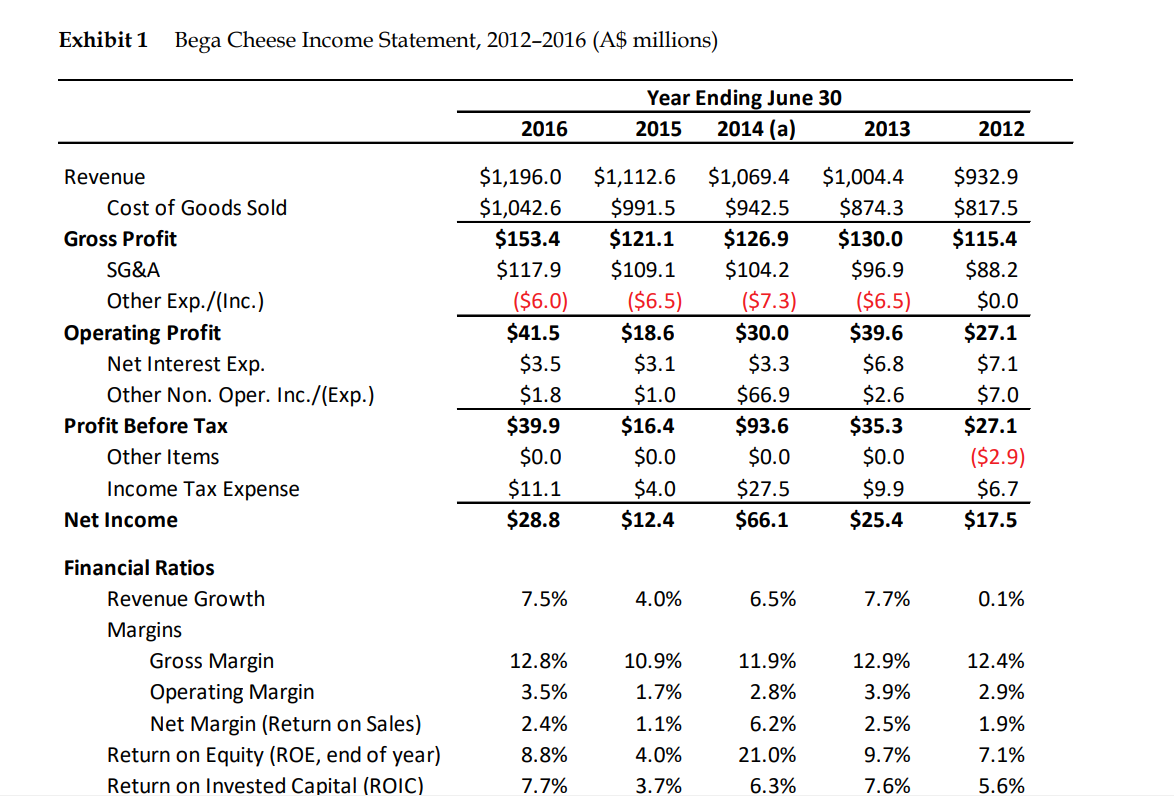

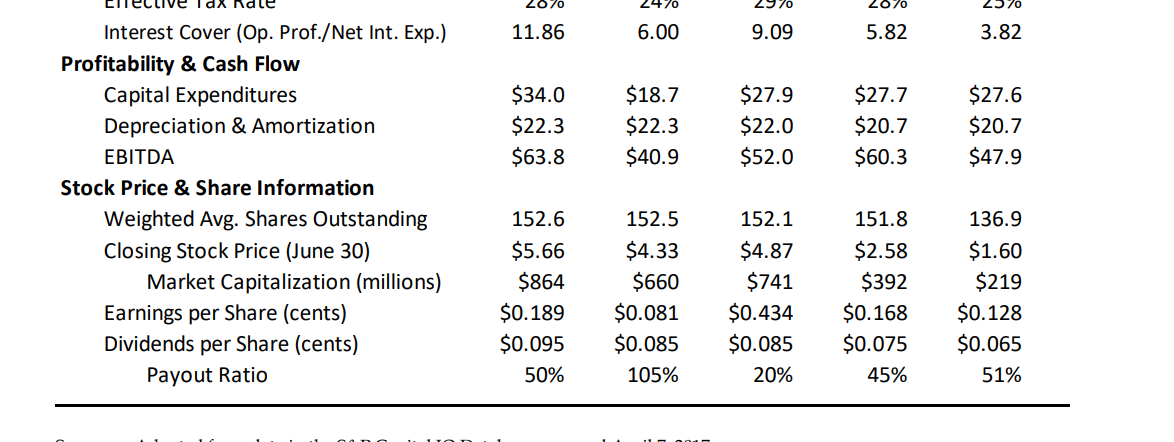

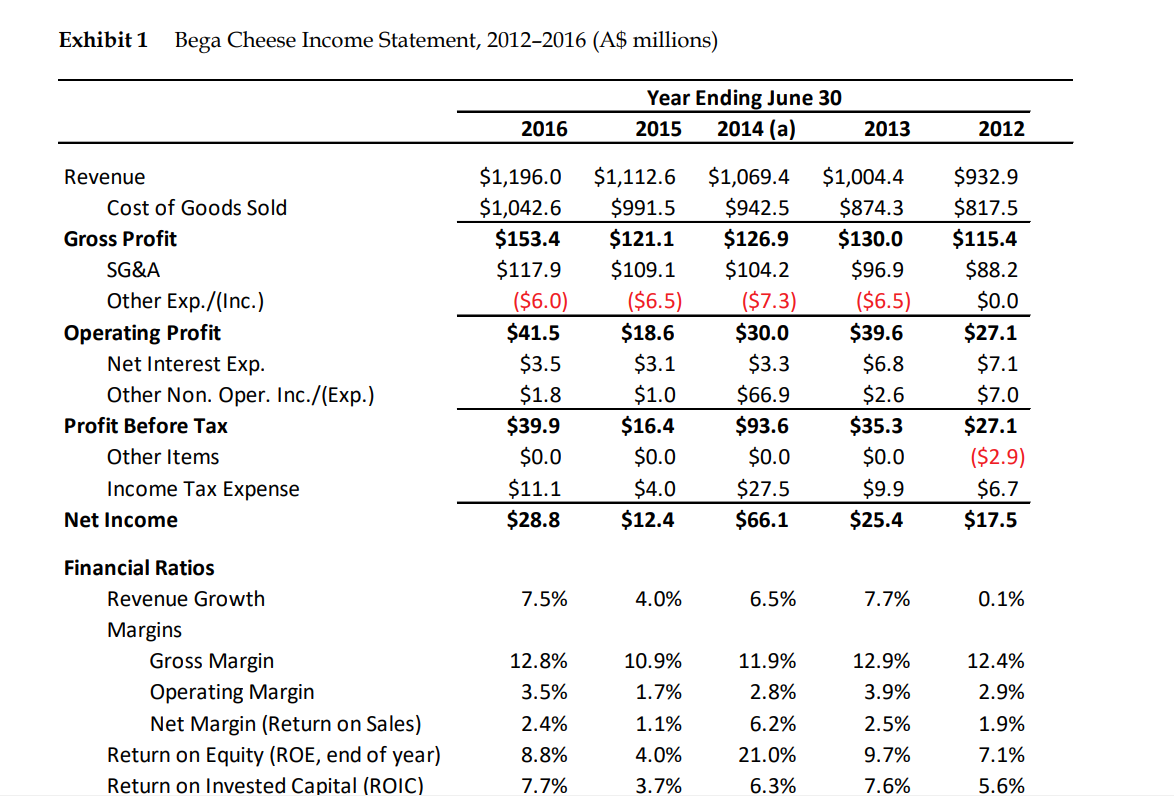

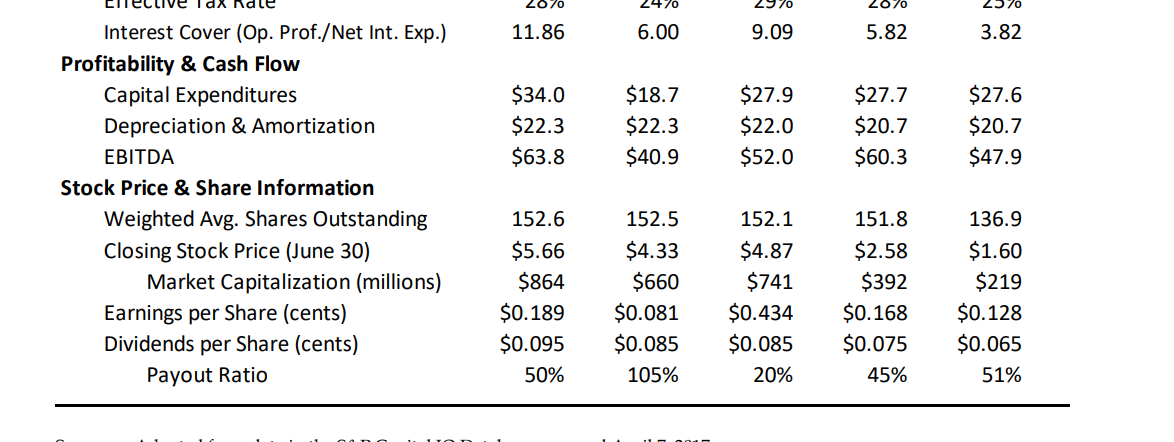

Your team of experienced investment bankers has been advising Bega and its executive management team on evaluating the potential acquisition of Mondelez International's Australian and New Zealand grocery business (ANZ"). Your role is to help the management team consider the strategic merits and risks of a proposed transaction, determine what value should be assigned to the business, and decide how to structure the transaction. In support of this analysis, please answer the following questions. Note: The information presented in the case represents a simplification of historical facts. Teams are reminded not to undertake additional research or use external reference materials. Undertaking additional research into the historical facts of the situation may add complexity to the analysis. Your analysis should be based on the information presented in the case and related exhibits. Please use the native currency provided in the case package. 1. Transaction Rationale a. What are the strategic merits of acquiring ANZ? b. What are the opportunities and risks? Consider both internal and external factors. 2. Supporting Value Analysis a. Using the information in the case, perform a DCF analysis to determine the value of ANZ. For this analysis, please use the historical ROIC of Bega from Exhibit 1 as a oxy for WACC. b. Please discuss any assumptions you made on the value attributed to the manufacturing facility in Port Melbourne. 3. Recommendation to the Board a. If proceeding with a bid, what is your suggested form of consideration and financing plan? Assuming the target is acquired on a cash-free debt-free basis, how accretive or dilutive to Bega's key metrics would the transaction be based on your acquisition financing assumptions? b. Based on your analysis, what is your recommendation to Bega? C. If you advised against the transaction, what additional information would have given you more comfort to change your recommendation? Exhibit 1 Bega Cheese Income Statement, 2012-2016 (A$ millions) Year Ending June 30 2015 2014 (a) 2016 2013 2012 Revenue Cost of Goods Sold Gross Profit SG&A Other Exp./(Inc.) Operating Profit Net Interest Exp. Other Non. Oper. Inc./(Exp.) Profit Before Tax Other Items Income Tax Expense Net Income $1,196.0 $1,042.6 $153.4 $117.9 ($6.0) $41.5 $3.5 $1.8 $39.9 $0.0 $11.1 $28.8 $1,112.6 $991.5 $121.1 $109.1 ($6.5) $18.6 $3.1 $1.0 $16.4 $0.0 $4.0 $12.4 $1,069.4 $942.5 $126.9 $104.2 ($7.3) $30.0 $3.3 $66.9 $93.6 $0.0 $27.5 $66.1 $1,004.4 $874.3 $130.0 $96.9 ($6.5) $39.6 $6.8 $2.6 $35.3 $0.0 $9.9 $25.4 $932.9 $817.5 $115.4 $88.2 $0.0 $27.1 $7.1 $7.0 $27.1 ($2.9) $6.7 $17.5 7.5% 4.0% 6.5% 7.7% 0.1% Financial Ratios Revenue Growth Margins Gross Margin Operating Margin Net Margin (Return on Sales) Return on Equity (ROE, end of year) Return on Invested Capital (ROIC) 12.8% 3.5% 2.4% 8.8% 7.7% 10.9% 1.7% 1.1% 4.0% 3.7% 11.9% 2.8% 6.2% 21.0% 6.3% 12.9% 3.9% 2.5% 9.7% 7.6% 12.4% 2.9% 1.9% 7.1% 5.6% 2070 2470 297 2070 11.86 6.00 9.09 5.82 3.82 $34.0 $22.3 $63.8 $18.7 $22.3 $40.9 $27.9 $22.0 $52.0 $27.7 $20.7 $60.3 $27.6 $20.7 $47.9 Interest Cover (Op. Prof./Net Int. Exp.) Profitability & Cash Flow Capital Expenditures Depreciation & Amortization EBITDA Stock Price & Share Information Weighted Avg. Shares Outstanding Closing Stock Price (June 30) Market Capitalization (millions) Earnings per Share (cents) Dividends per Share (cents) Payout Ratio 152.5 136.9 152.6 $5.66 $864 $0.189 $0.095 50% $4.33 $660 $0.081 $0.085 105% 152.1 $4.87 $741 $0.434 $0.085 20% 151.8 $2.58 $392 $0.168 $0.075 45% $1.60 $219 $0.128 $0.065 51%

How do you do supporting value analysis with exhibit 1?Please help

How do you do supporting value analysis with exhibit 1?Please help