Question: how do you get #14 13) Since your first birthday, your grandparents have been depositing $1,000 into a savings account on every one of your

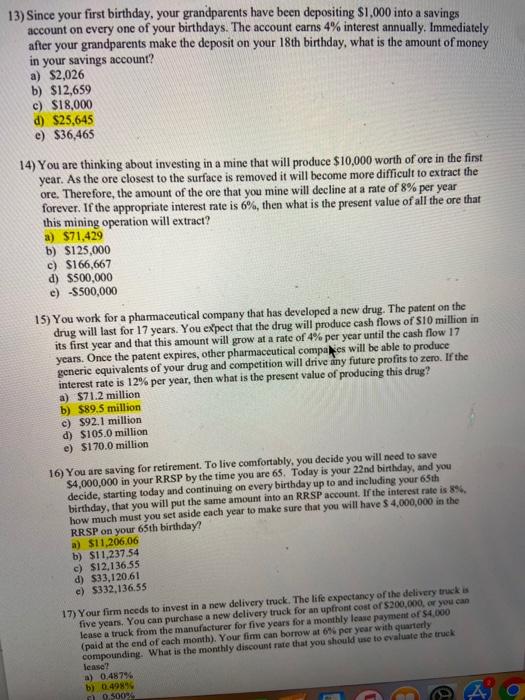

13) Since your first birthday, your grandparents have been depositing $1,000 into a savings account on every one of your birthdays. The account carns 4% interest annually. Immediately after your grandparents make the deposit on your 18th birthday, what is the amount of money in your savings account? a) $2,026 b) $12,659 c) $18,000 d) $25,645 e) $36,465 14) You are thinking about investing in a mine that will produce $10,000 worth of ore in the first year. As the ore closest to the surface is removed it will become more difficult to extract the ore. Therefore, the amount of the ore that you mine will decline at a rate of 8% per year forever. If the appropriate interest rate is 6%, then what is the present value of all the ore that this mining operation will extract? a) $71,429 b) $125,000 c) $166,667 d) $500,000 e) -$500,000 15) You work for a pharmaceutical company that has developed a new drug. The patent on the drug will last for 17 years. You expect that the drug will produce cash flows of $10 million in its first year and that this amount will grow at a rate of 4% per year until the cash flow 17 years. Once the patent expires, other pharmaceutical companies will be able to produce generic equivalents of your drug and competition will drive any future profits to zero. If the interest rate is 12% per year, then what is the present value of producing this drug? a) $71.2 million b) $89.5 million c) 892.1 million d) S105.0 million e) $170.0 million 16) You are saving for retirement. To live comfortably, you decide you will need to save $4,000,000 in your RRSP by the time you are 65. Today is your 22nd birthday, and you decide, starting today and continuing on every birthday up to and including your 65th birthday, that you will put the same amount into an RRSP account. If the interest rate is 89 how much must you set aside each year to make sure that you will have $ 4,000,000 in the RRSP on your 65th birthday? a) $11,206.06 b) $11,237.54 c) $12.136.55 d) $33,120.61 c) $332,136,55 17) Your firm needs to invest in a new delivery truck. The life expectancy of the delivery truck is five years. You can purchase a new delivery truck for an upfront cost of $200,000, or you can lease a truck from the manufacturer for five years for a monthly loose payment of $4.000 (paid at the end of each month). Your fimm can borrow at 6% per year with quarterly compounding. What is the monthly discount rate that you should use to evaluate the truck lease? a) 0.487% b) 0.4989 50.500

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts