Question: How do you plug this into the FV function for the dividends calculation? I have this same exact problem for my class, however my teacher

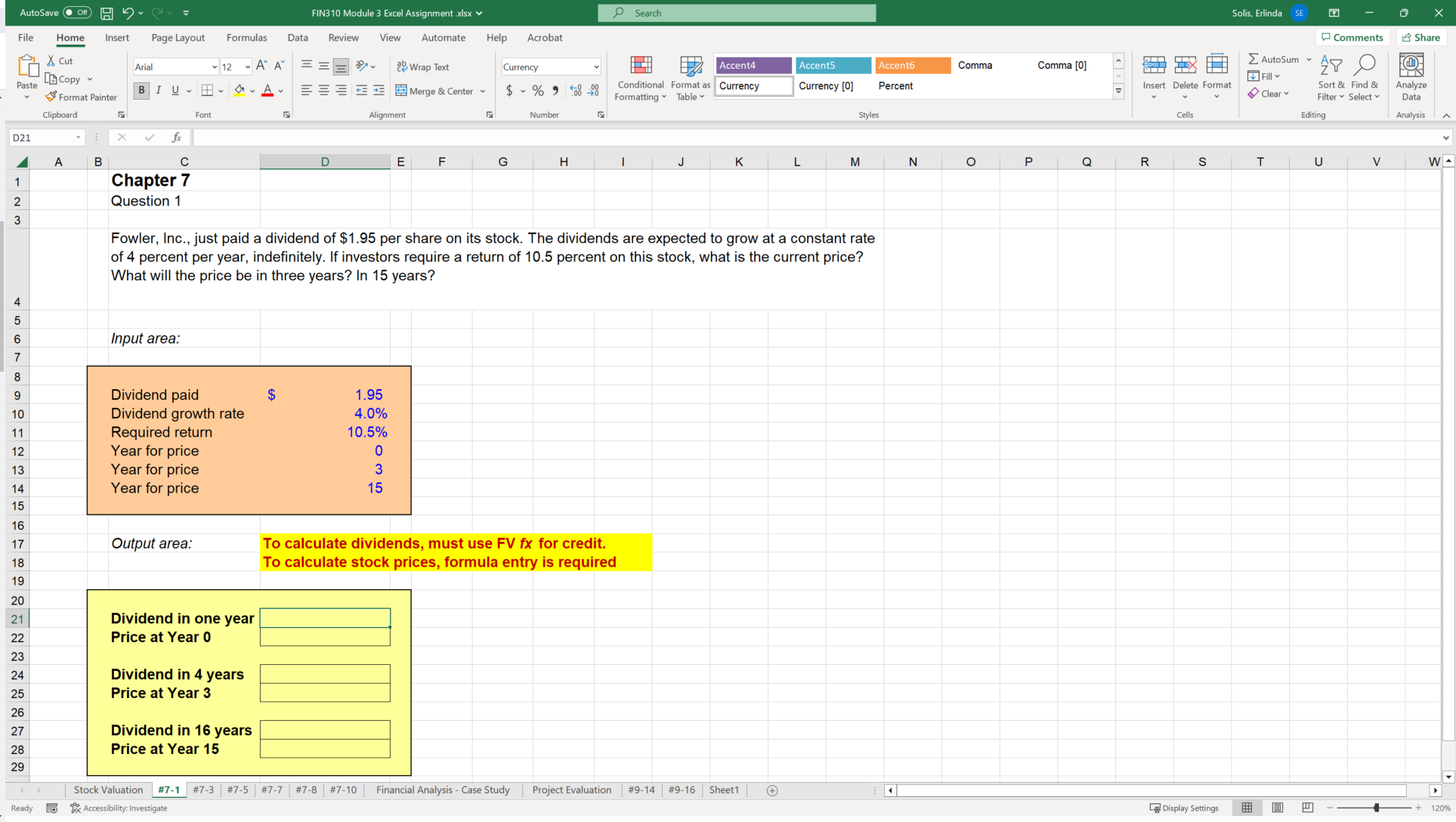

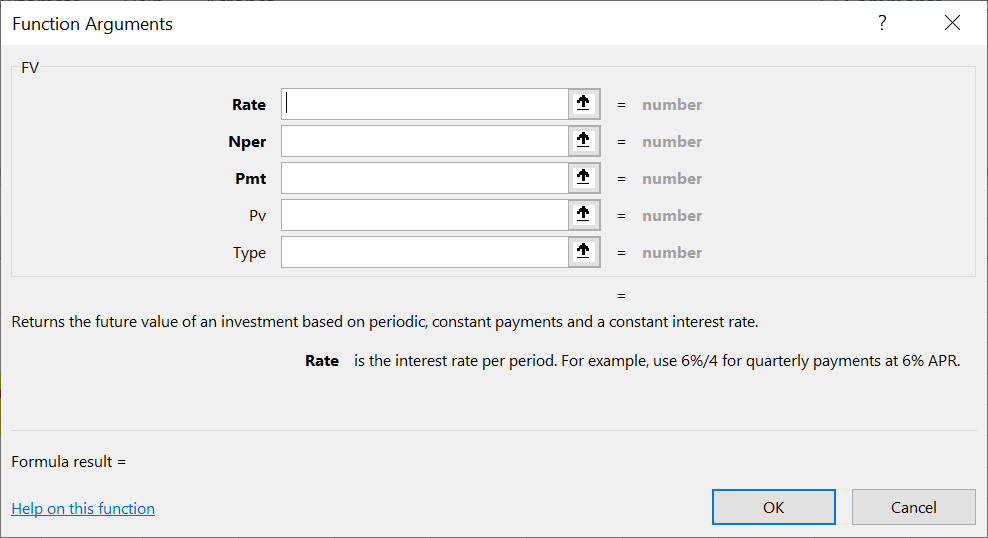

How do you plug this into the FV function for the dividends calculation? I have this same exact problem for my class, however my teacher is asking us to plug it into the FV fx for credit:

Output area:To calculate dividends, must use FV fx for credit. To calculate stock prices, formula entry is required

Please help! :(

Fowler, Inc., just paid a dividend of \\( \\$ 1.95 \\) per share on its stock. The dividends are expected to grow at a constant rate of 4 percent per year, indefinitely. If investors require a return of 10.5 percent on this stock, what is the current price? What will the price be in three years? In 15 years? \\begin{tabular}{|l|l|} \\hline Input area: \\\\ \\hline & \\\\ \\hline Output area: & \\( \\begin{array}{l}\\text { To calculate dividends, must use FV fx for credit. } \\\\ \\text { To calculate stock prices, formula entry is required }\\end{array} \\) \\\\ \\hline \\end{tabular} FV \\begin{tabular}{r|r} Rate & \\( = \\) number \\\\ Nper & \\( = \\) number \\\\ Pmt & \\( = \\) number \\\\ Pv & \\( = \\) number \\\\ Type & \\( = \\) number \\\\ & \\( = \\) \\end{tabular} Returns the future value of an investment based on periodic, constant payments and a constant interest rate. Rate is the interest rate per period. For example, use \6 for quarterly payments at \6 APR. Formula result \\( = \\)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts