Question: How do you solve for net income in this problem? Required information The following information applies to the questions displayed below] Alison and Chuck Reniny

![information The following information applies to the questions displayed below] Alison and](https://dsd5zvtm8ll6.cloudfront.net/si.experts.images/questions/2024/10/66fbbe019120e_20966fbbe013d0ec.jpg)

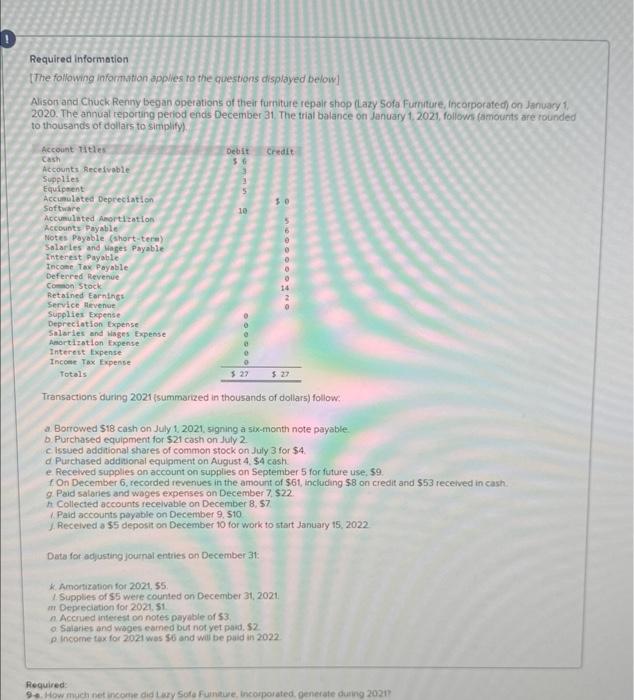

Required information The following information applies to the questions displayed below] Alison and Chuck Reniny began operations of their furniture repair shop (Lazy 5ofa Furnture, incarporafed) on Januacy 1 , 2020. The annual reporting period ends December 31 . The trial balance on January 1, 2021, followi famounts are rounded to thousands of dollars to simplify) Transactions during 2021 (summarized in thousands of dollars) follow: a. Borrowed $18 cash on July 1, 2021, signing a six-month note payable: b. Purchased equipment for $21 cash on July 2. c lseued additional shares of common stock on July 3 for $4. d. Purchased addisional equipment on August 4, $4 cash. e Received supplies on account on supplies on September 5 for future use, 59 f On December 6 , recorded revenues in the amount of $61, including $8 on credit and $53 recelved in cash. 9 Paid salaries and woges expenses on December 7,$22 A. Collected accounts recelvable on December 8,57 1. Paid accounts payable on December 9,510 4. Recelved a $5 deposit on December to for work to start January 15,2022 Data for adjusting journal entries on December 31 : k. Amortazation for 2021,55 . 1. Supplies of $5 were counted on December 31, 2021. if Deprecition tor 20021 st a Accrued interest on notes payable of 53 . o Salartes and wages earned but not yet paid, $2. o incorne tax for 2.021 wos $6 and wal be paid in 2022 Required: How much net income did Lazy Sofa furniture, Incorporated, generate during 2021 ? (Enter your answer in thou dollars.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts