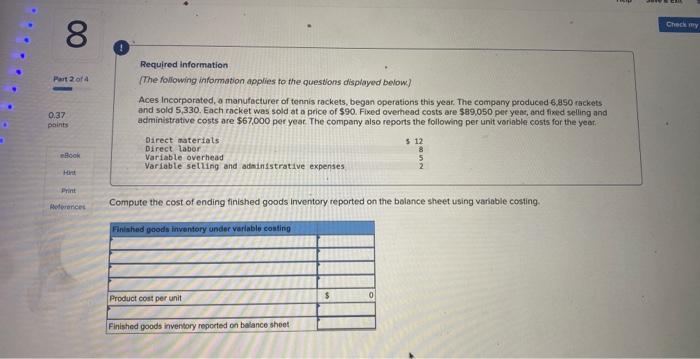

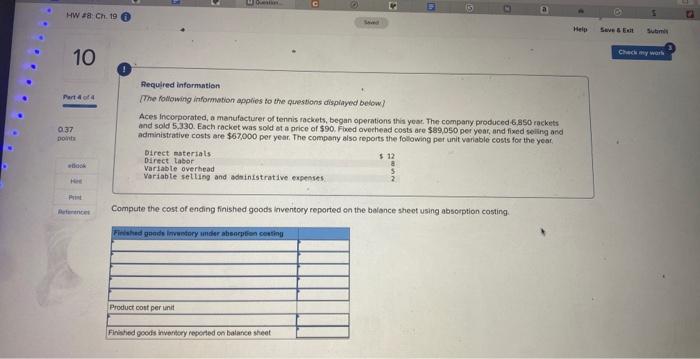

Question: pls help w this 3 part problem!! Required information [The following information applies to the questions displayed below] Aces incorporated, a manufacturer of tennis rackets,

![information applies to the questions displayed below] Aces incorporated, a manufacturer of](https://dsd5zvtm8ll6.cloudfront.net/si.experts.images/questions/2024/09/66e72f1d02726_90866e72f1c97ff5.jpg)

Required information [The following information applies to the questions displayed below] Aces incorporated, a manufacturer of tennis rackets, began operations this year. The company produced 6.850 rackets and sold 5,330 . Each racket was sold at a price of $90. Fixed overhead costs are 589,050 per yeat, and fixed selling and aciministrative costs are $67,000 per yeat. The company also reports the following per unit variable costs for the yeat. Compute the cost of ending finished goods inventory reported on the bolance sheet using variable costing. Required information TThe following informetion applies to the questions displayed below] Aces Incorporated, a manufacturer of tennis rackets, began operations this year. The company produced 6.850 rackets and sold 5.330. Each racket was sold at a price of $90. Fixed overhead costs are $89,050 per year, and foxed seiling and administrative costs are $67,000 per year. The company aiso reports the following per unit variable costs for the yeat. Prepare an income statement under absorption costing. Required informstion [The following informution applies to the questions displayed betow) Aces Incorporated, a manufacturer of tennis rackets, began operations this yoat. The company produced 6.850 rackets and sold 5,330 . Each racket was sold et a price of $90. Fwed aveehead costs are $89,050 per year, and fixed seiling and administrative costs are $67,000 per year, The company also reports the following per unit variable costs for the yeat, Compute the cost of ending finished goods inventory reported on the balance sheot using absorption costing

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts