Question: How do you solve part D, E and F. I provided the answers and process for A-D, just need how to solve D, E and

How do you solve part D, E and F. I provided the answers and process for A-D, just need how to solve D, E and F. Please include any equations

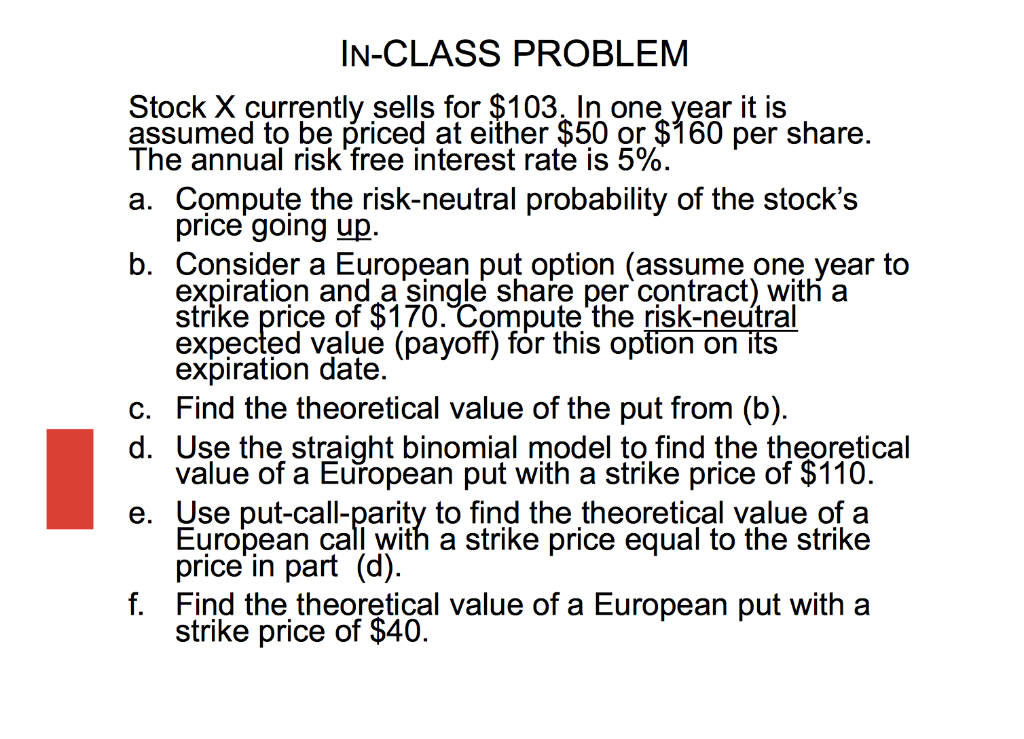

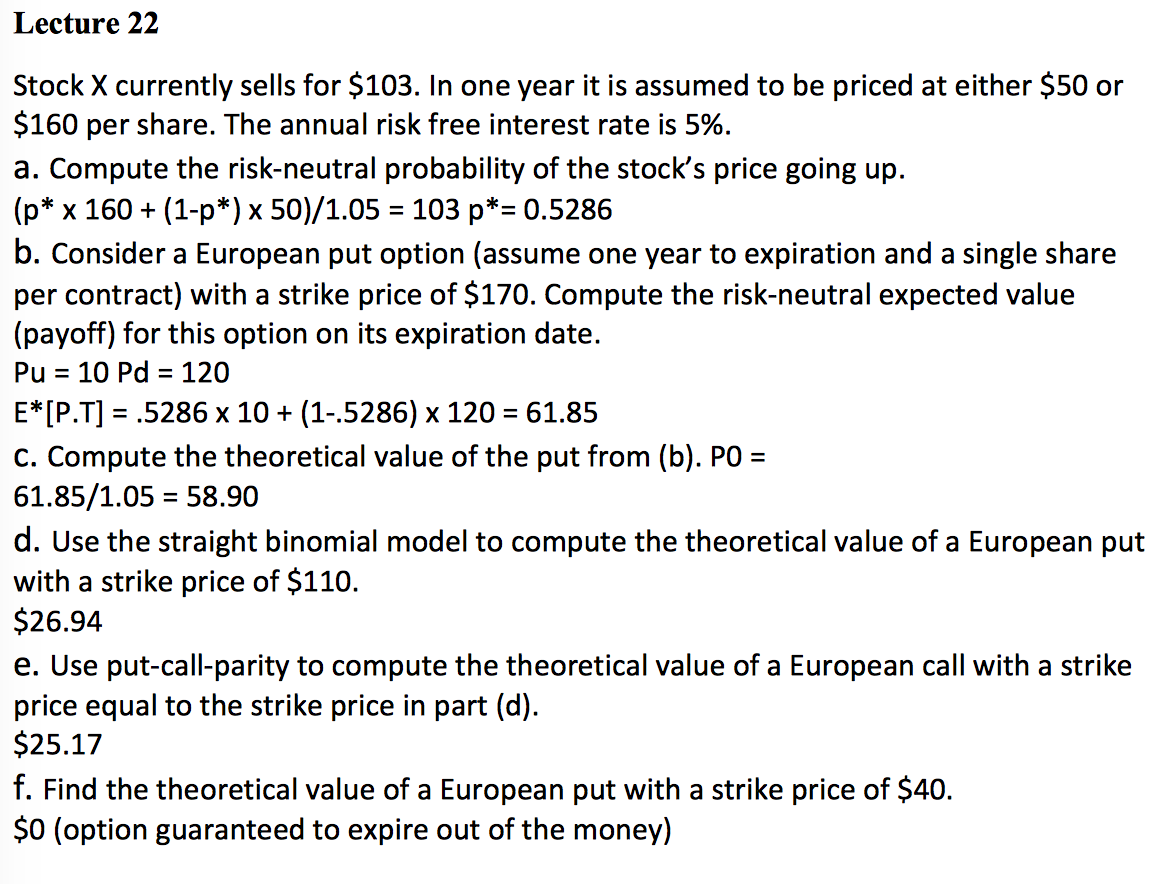

IN-CLASS PROBLEM Stock X currently sells for $103. In one year it is assumed to be priced at either $50 or $160 per share. The annual risk free interest rate is 5%. a. Compute the risk-neutral probability of the stock's price going up. b. Consider a European put option (assume one year to expiration and a 'single share per contract) with a strike price of $170. Compute the risk-neutral expected value (payoff) for this option on its expiration date. C. Find the theoretical value of the put from (b). d. Use the straight binomial model to find the theoretical value of a European put with a strike price of $110. e. Use put-call-parity to find the theoretical value of a European call with a strike price equal to the strike price in part (d). f. Find the theoretical value of a European put with a strike price of $40. Lecture 22 Stock X currently sells for $103. In one year it is assumed to be priced at either $50 or $160 per share. The annual risk free interest rate is 5%. a. Compute the risk-neutral probability of the stock's price going up. (p* x 160 + (1-p*) x 50)/1.05 = 103 p*= 0.5286 b. Consider a European put option (assume one year to expiration and a single share per contract) with a strike price of $170. Compute the risk-neutral expected value (payoff) for this option on its expiration date. Pu = 10 Pd = 120 E*[P.T] = .5286 x 10 + (1-.5286) x 120 = 61.85 C. Compute the theoretical value of the put from (b). PO = 61.85/1.05 = 58.90 d. Use the straight binomial model to compute the theoretical value of a European put with a strike price of $110. $26.94 e. Use put-call-parity to compute the theoretical value of a European call with a strike price equal to the strike price in part (d). $25.17 f. Find the theoretical value of a European put with a strike price of $40. $0 (option guaranteed to expire out of the money)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts