Question: how do you solve these in excel? 17 Problem 5 Eat-It-Grandma Pretzels is ready to open for business, but the corporate lawyers have bad news

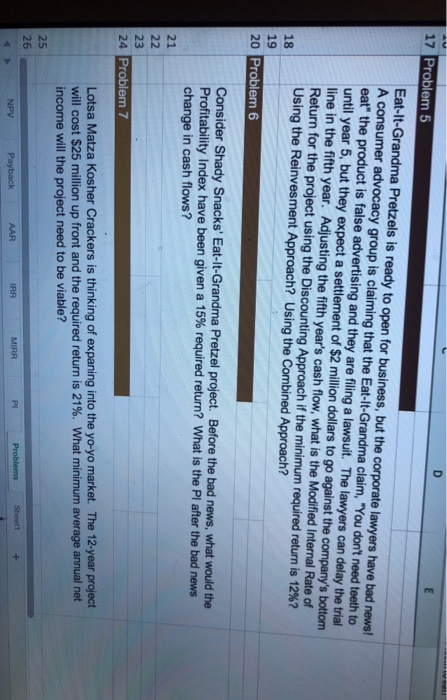

17 Problem 5 Eat-It-Grandma Pretzels is ready to open for business, but the corporate lawyers have bad news A consumer advocacy group is claiming that the Eat-It-Grandma claim, "You don't need teeth to eat the product is false advertising and they are filing a lawsuit. The lawyers can delay the trial until year 5, but they expect a settlement of $2 million dollars to go against the company's bottom line in the fifth year. Adjusting the fifth year's cash flow, what is the Modified Internal Rate of Return for the project using the Discounting Approach if the minimum required return is 12%? Using the Reinvesment Approach? Using the Combined Approach? 19 20 Problem 6 Consider Shady Snacks' Eat-It-Grandma Pretzel project. Before the bad news, what would the Profitability Index have been given a 15% required return? What is the Pl after the bad news change in cash flows? 24 Problem 7 Lotsa Matza Kosher Crackers is thinking of expaning into the yo-yo market. The 12-year project will cost $25 million up front and the required return is 21%. What minimum average annua income will the project need to be viable? Payback AAR NPV IRR MIRR PL Problems Sheet + 17 Problem 5 Eat-It-Grandma Pretzels is ready to open for business, but the corporate lawyers have bad news A consumer advocacy group is claiming that the Eat-It-Grandma claim, "You don't need teeth to eat the product is false advertising and they are filing a lawsuit. The lawyers can delay the trial until year 5, but they expect a settlement of $2 million dollars to go against the company's bottom line in the fifth year. Adjusting the fifth year's cash flow, what is the Modified Internal Rate of Return for the project using the Discounting Approach if the minimum required return is 12%? Using the Reinvesment Approach? Using the Combined Approach? 19 20 Problem 6 Consider Shady Snacks' Eat-It-Grandma Pretzel project. Before the bad news, what would the Profitability Index have been given a 15% required return? What is the Pl after the bad news change in cash flows? 24 Problem 7 Lotsa Matza Kosher Crackers is thinking of expaning into the yo-yo market. The 12-year project will cost $25 million up front and the required return is 21%. What minimum average annua income will the project need to be viable? Payback AAR NPV IRR MIRR PL Problems Sheet +

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts