Question: How do you solve this question by hand? X FOR NEXT TIME Part 1: Practice with Portfolios Let's say you have 2 stocks: Nike and

How do you solve this question by hand?

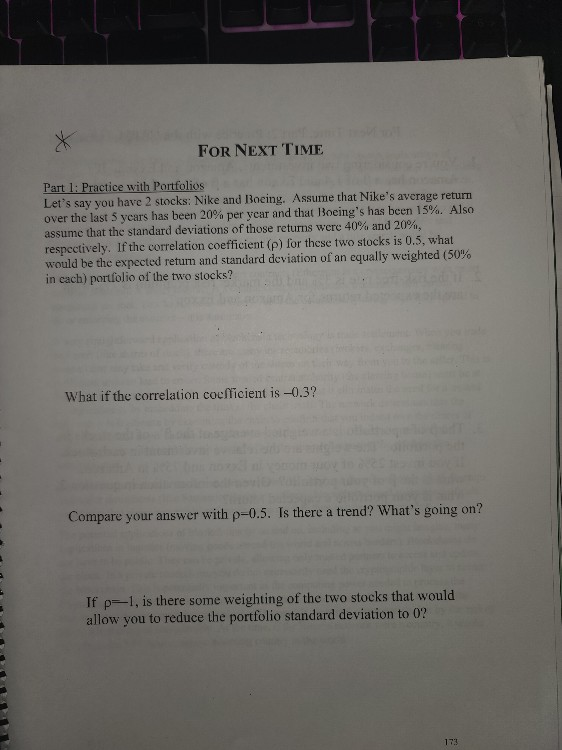

X FOR NEXT TIME Part 1: Practice with Portfolios Let's say you have 2 stocks: Nike and Boeing. Assume that Nike's average return over the last 5 years has been 20% per year and that Boeing's has been 15%. Also assume that the standard deviations of those returns were 40% and 20%, respectively. If the correlation coefficient (p) for these two stocks is 0.5, what would be the expected return and standard deviation of an equally weighted (50% in cach) portfolio of the two stocks? What if the correlation coefficient is -0.3? Compare your answer with p=0.5. Is there a trend? What's going on? If p=1, is there some weighting of the two stocks that would allow you to reduce the portfolio standard deviation to 0? 173

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts