Question: how do you work out the wrong ones and the blank ones? what information do you need? take Assignment/takeAssignmentMain.do?invoker=assignments&takeAssignmentSessionLocator=assignment-take&inprogress=false Hourly rate $421.62/40 = $10.540 rounded

how do you work out the wrong ones and the blank ones?

what information do you need?

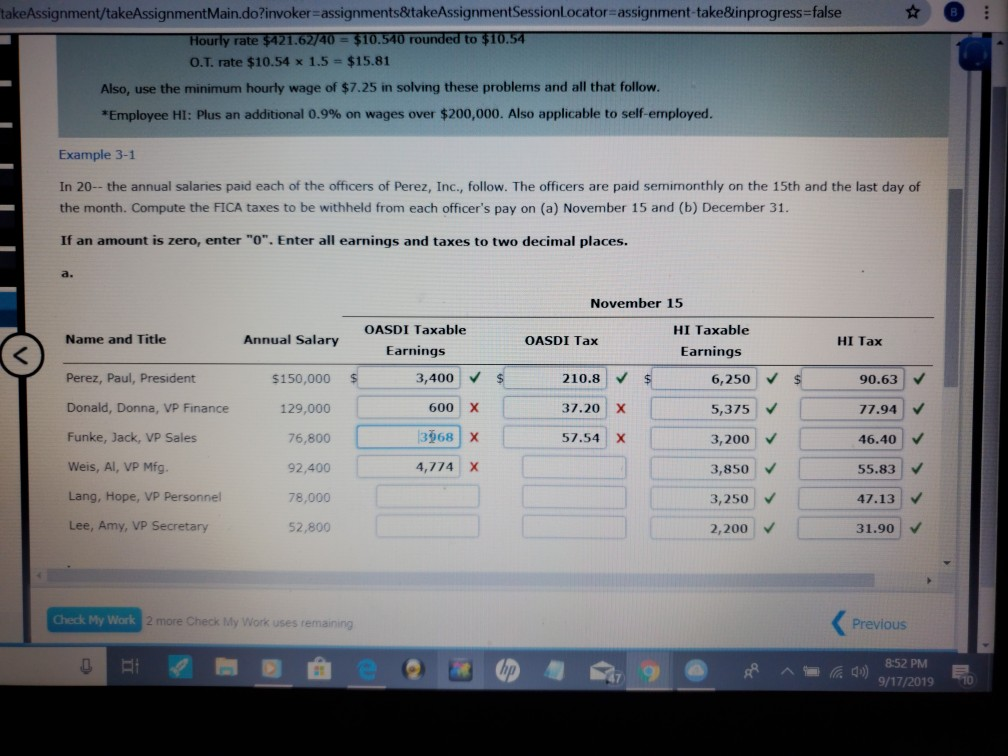

take Assignment/takeAssignmentMain.do?invoker=assignments&takeAssignmentSessionLocator=assignment-take&inprogress=false Hourly rate $421.62/40 = $10.540 rounded to $10.54 O.T. rate $10.54 x 1.5 - $15.81 Also, use the minimum hourly wage of $7.25 in solving these problems and all that follow. *Employee HI: Plus an additional 0.9% on wages over $200,000. Also applicable to self-employed. Example 3-1 In 20-- the annual salaries paid each of the officers of Perez, Inc., follow. The officers are paid semimonthly on the 15th and the last day of the month. Compute the FICA taxes to be withheld from each officer's pay on (a) November 15 and (b) December 31. If an amount is zero, enter "0". Enter all earnings and taxes to two decimal places. November 15 Name and Title Annual Salary OASDI Tax HI Tax OASDI Taxable Earnings $ 3,400 HI Taxable Earnings 6,250 5,375 Perez, Paul, President $150,000 210.8 $ 90.63 77.94 Donald, Donna, VP Finance 129,000 600 37.20 x 76,800 3968 x 57.54 x 3,200 46.40 Funke, Jack, VP Sales Weis, AI, VP Mfg. 92,400 4,774 x 3,850 55.83 Lang, Hope, VP Personnel 78,000 3,250 47.13 Lee, Amy, VP Secretary 52,800 2,200 31.90 Check My Work 2 more Check My Work uses remaining Previous 9/17/2019 10 take Assignment/takeAssignmentMain.do?invoker=assignments&takeAssignmentSessionLocator=assignment-take&inprogress=false Hourly rate $421.62/40 = $10.540 rounded to $10.54 O.T. rate $10.54 x 1.5 - $15.81 Also, use the minimum hourly wage of $7.25 in solving these problems and all that follow. *Employee HI: Plus an additional 0.9% on wages over $200,000. Also applicable to self-employed. Example 3-1 In 20-- the annual salaries paid each of the officers of Perez, Inc., follow. The officers are paid semimonthly on the 15th and the last day of the month. Compute the FICA taxes to be withheld from each officer's pay on (a) November 15 and (b) December 31. If an amount is zero, enter "0". Enter all earnings and taxes to two decimal places. November 15 Name and Title Annual Salary OASDI Tax HI Tax OASDI Taxable Earnings $ 3,400 HI Taxable Earnings 6,250 5,375 Perez, Paul, President $150,000 210.8 $ 90.63 77.94 Donald, Donna, VP Finance 129,000 600 37.20 x 76,800 3968 x 57.54 x 3,200 46.40 Funke, Jack, VP Sales Weis, AI, VP Mfg. 92,400 4,774 x 3,850 55.83 Lang, Hope, VP Personnel 78,000 3,250 47.13 Lee, Amy, VP Secretary 52,800 2,200 31.90 Check My Work 2 more Check My Work uses remaining Previous 9/17/2019 10

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts