Question: how do you work these out? 32) (CH3) If a company has a debt ratio of 50%, and an equity multiplier of 2. What is

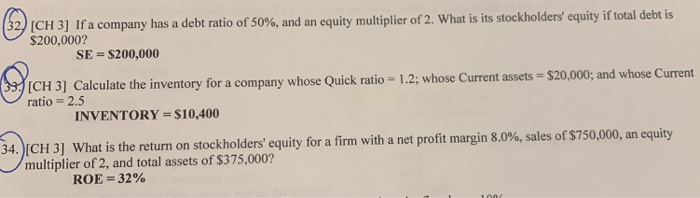

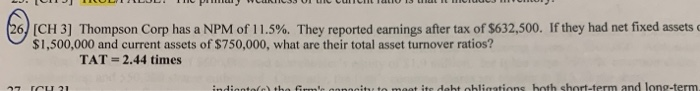

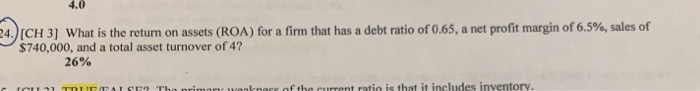

32) (CH3) If a company has a debt ratio of 50%, and an equity multiplier of 2. What is its stockholders' equity if total debt is $200,000? SE = $200,000 39.7 (CH 3] Calculate the inventory for a company whose Quick ratio = 1.2; whose Current assets = $20,000; and whose Current ratio = 2.5 INVENTORY = $10,400 34.)CH 3] What is the return on stockholders' equity for a firm with a net profit margin 8.0%, sales of $750,000, an equity multiplier of 2, and total assets of $375,000? ROE = 32% DE TO OULULE P ERICULULILI (26) (CH 3) Thompson Corp has a NPM of 11.5%. They reported earnings after tax of $632,500. If they had net fixed assets $1,500,000 and current assets of $750,000, what are their total asset turnover ratios? TAT -2.44 times dal C i ty to meet ite debt obligations both short term and long-term 14.) [CH 3] What is the return on assets (ROA) for a firm that has a debt ratio of 0.65, a net profit margin of 6.5%, sales of $740,000, and a total asset turnover of 4? 26% OD Tk w ane fo n t ratio is that it includes inventory

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts