Question: How does a one-time unexpected revaluation ultimately affect the central bank's balance sheet under a fixed exchange rate? O A. The central bank's foreign assets

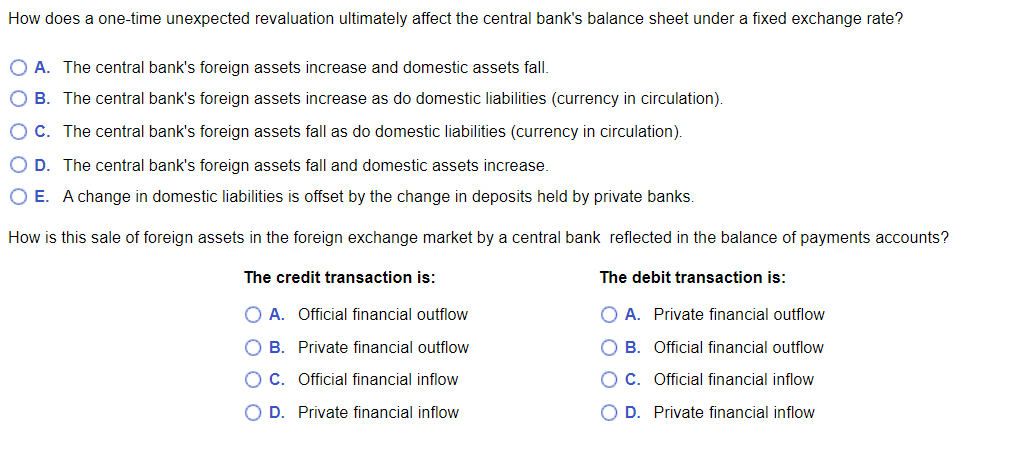

How does a one-time unexpected revaluation ultimately affect the central bank's balance sheet under a fixed exchange rate? O A. The central bank's foreign assets increase and domestic assets fall. OB. The central bank's foreign assets increase as do domestic liabilities (currency in circulation). OC. The central bank's foreign assets fall as do domestic liabilities (currency in circulation). OD. The central bank's foreign assets fall and domestic assets increase O E. A change in domestic liabilities is offset by the change in deposits held by private banks. How is this sale of foreign assets in the foreign exchange market by a central bank reflected in the balance of payments accounts? The credit transaction is: The debit transaction is: O A. Official financial outflow O A. Private financial outflow O B. Private financial outflow OB. Official financial outflow OC. Official financial inflow OC. Official financial inflow OD. Private financial inflow OD. Private financial inflow

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts