Question: How does a taxpayer's tax accounting method affect the amount of tax paid? A . The accounting methods used by a taxpayer affect the amount

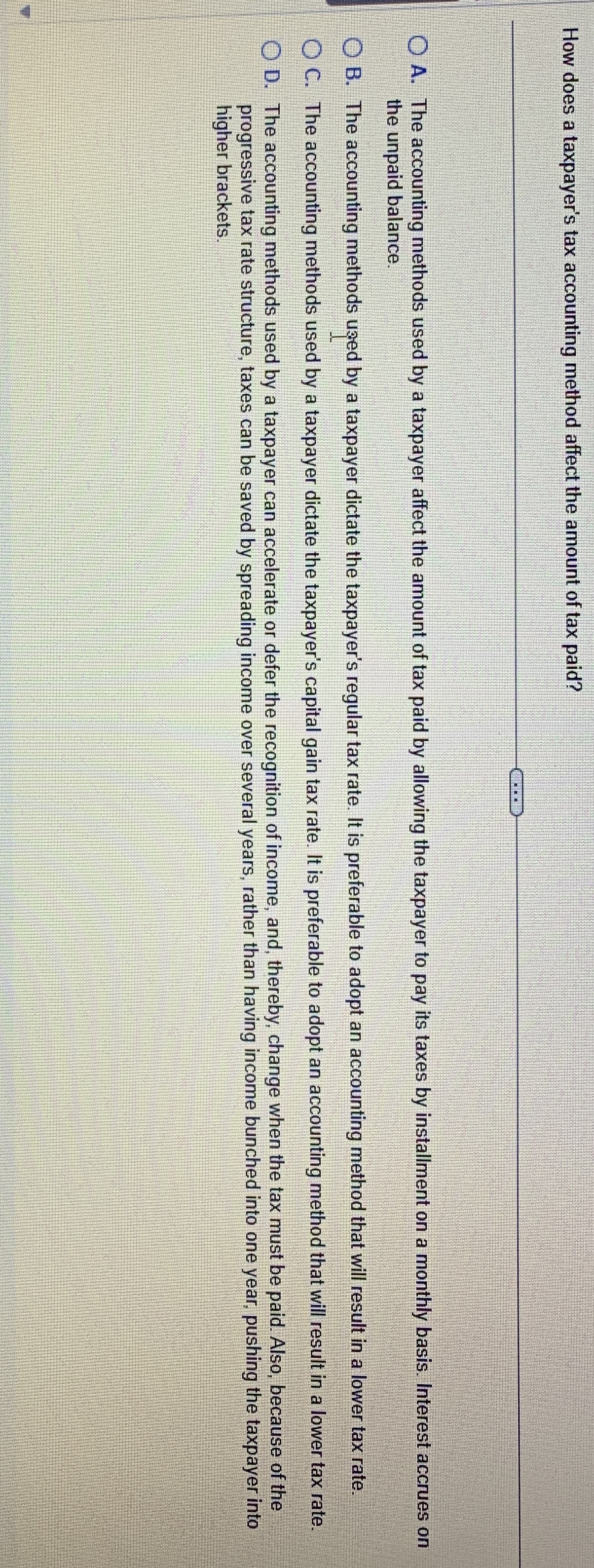

How does a taxpayer's tax accounting method affect the amount of tax paid?

A The accounting methods used by a taxpayer affect the amount of tax paid by allowing the taxpayer to pay its taxes by installment on a monthly basis. Interest accrues on the unpaid balance.

B The accounting methods used by a taxpayer dictate the taxpayer's regular tax rate. It is preferable to adopt an accounting method that will result in a lower tax rate.

C The accounting methods used by a taxpayer dictate the taxpayer's capital gain tax rate. It is preferable to adopt an accounting method that will result in a lower tax rate.

D The accounting methods used by a taxpayer can accelerate or defer the recognition of income, and, thereby, change when the tax must be paid. Also, because of the progressive tax rate structure, taxes can be saved by spreading income over several years, rather than having income bunched into one year, pushing the taxpayer into higher brackets.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock