Question: How does one calculate risk neutral probability measures when N = 2 as described in 16.2 B 68 Exercise 16.2. Consider the market model below.

How does one calculate risk neutral probability measures when N = 2 as described in 16.2 B

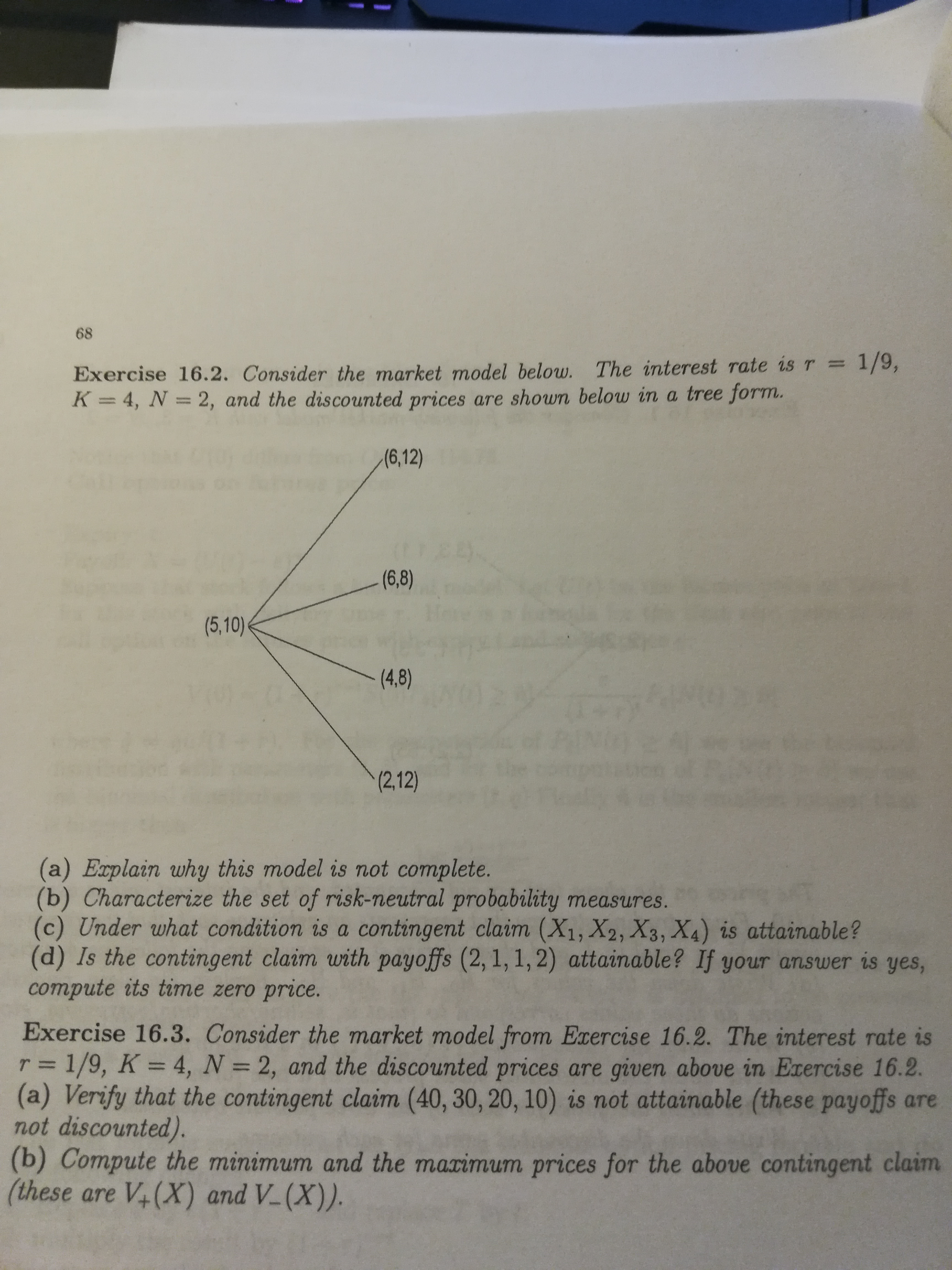

68 Exercise 16.2. Consider the market model below. The interest rate is r = 1/9, K = 4, N = 2, and the discounted prices are shown below in a tree form. (6,12) (6,8) (5, 10) (4,8) (2, 12) (a) Explain why this model is not complete. (b) Characterize the set of risk-neutral probability measures. (c) Under what condition is a contingent claim (X1, X2, X3, X4) is attainable? (d) Is the contingent claim with payoffs (2, 1, 1, 2) attainable? If your answer is yes, compute its time zero price. Exercise 16.3. Consider the market model from Exercise 16.2. The interest rate is r = 1/9, K = 4, N = 2, and the discounted prices are given above in Exercise 16.2. (a) Verify that the contingent claim (40, 30, 20, 10) is not attainable (these payoffs are not discounted) (b) Compute the minimum and the maximum prices for the above contingent claim (these are V+ (X) and V-(X))

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts