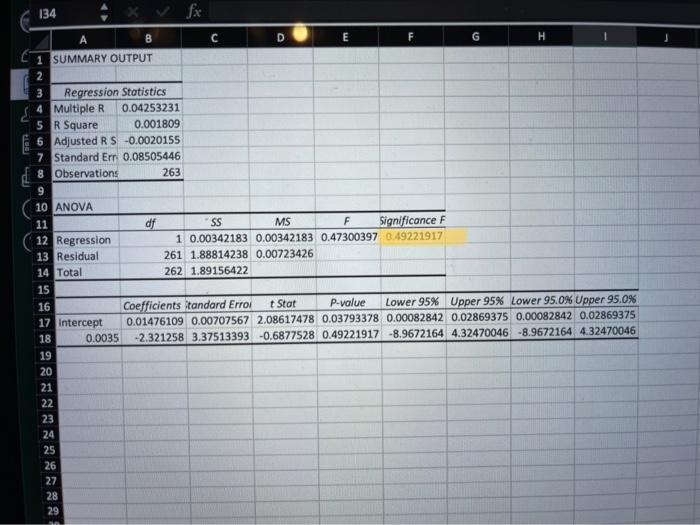

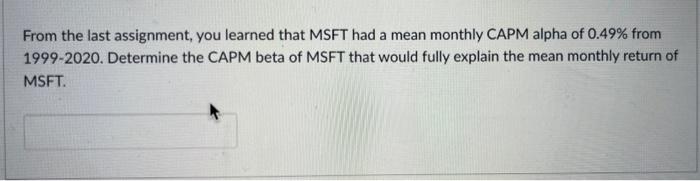

Question: how does one go about this question when you already have run your regression and have your alpha? can any finance tutors please explain? thank

134 fx C D E F G H 1 SUMMARY OUTPUT 2 3 Regression Statistics 4 Multiple R 0.04253231 5 R Square 0.001809 6 Adjusted RS -0.0020155 7 Standard Err 0.08505446 8 Observations 263 9 10 ANOVA 11 df SS MS F Significance F 12 Regression 1 0.00342183 0.00342183 0.47300397 0.49221917 13 Residual 261 1.88814238 0.00723426 14 Total 262 1.89156422 15 16 Coefficients tandard Erroi t Stat P-value Lower 95% Upper 95% Lower 95.0% Upper 95.0% 17 Intercept 0.01476109 0.00707567 2.08617478 0.03793378 0.00082842 0.02869375 0.00082842 0.02869375 18 0.0035 -2.321258 3.37513393 -0.6877528 0.49221917 -8.9672164 4.32470046 -8.9672164 4.32470046 19 20 21 22 23 24 25 26 27 28 29 From the last assignment, you learned that MSFT had a mean monthly CAPM alpha of 0.49% from 1999-2020. Determine the CAPM beta of MSFT that would fully explain the mean monthly return of MSFT. 134 fx C D E F G H 1 SUMMARY OUTPUT 2 3 Regression Statistics 4 Multiple R 0.04253231 5 R Square 0.001809 6 Adjusted RS -0.0020155 7 Standard Err 0.08505446 8 Observations 263 9 10 ANOVA 11 df SS MS F Significance F 12 Regression 1 0.00342183 0.00342183 0.47300397 0.49221917 13 Residual 261 1.88814238 0.00723426 14 Total 262 1.89156422 15 16 Coefficients tandard Erroi t Stat P-value Lower 95% Upper 95% Lower 95.0% Upper 95.0% 17 Intercept 0.01476109 0.00707567 2.08617478 0.03793378 0.00082842 0.02869375 0.00082842 0.02869375 18 0.0035 -2.321258 3.37513393 -0.6877528 0.49221917 -8.9672164 4.32470046 -8.9672164 4.32470046 19 20 21 22 23 24 25 26 27 28 29 From the last assignment, you learned that MSFT had a mean monthly CAPM alpha of 0.49% from 1999-2020. Determine the CAPM beta of MSFT that would fully explain the mean monthly return of MSFT

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts