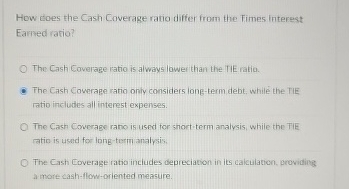

Question: How does the Cash Coverage ratio differ from the Fimes interest Earned ratio? The Cash Coverage ratio is always lower than the TIE ratio. The

How does the Cash Coverage ratio differ from the Fimes interest

Earned ratio?

The Cash Coverage ratio is always lower than the TIE ratio.

The Cash Cowerape ratio only considers longterm debt, while the TIE

ratio includes ail interest expenses.

The Gash Coverage rano is used for short term analysis, while the TiE

ratio is used for longterminalysis:

The Cash Coverage ratio includes depreciation in its calculation, providings

a more cashfloworiented measure.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock