Question: How does the shared value framework departs from (or is different to) the shareholder capitalism approach to businesses advocated by Friedman? and Mail - Yen

How does the shared value framework departs from (or is different to) the shareholder capitalism approach to businesses advocated by Friedman?

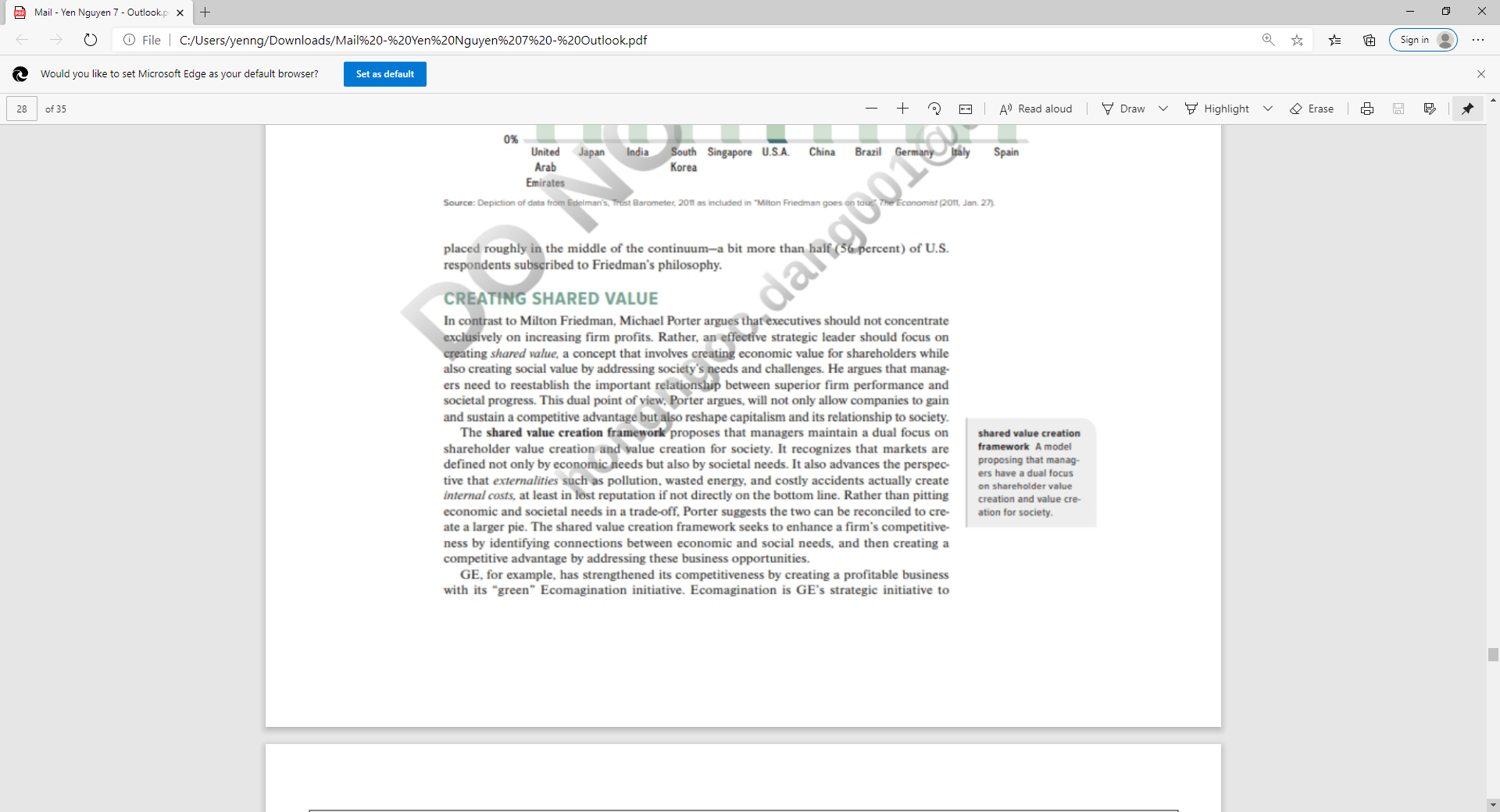

and Mail - Yen Nguyen 7 - Outlook.p x + X O File | C:/Users/yenng/Downloads/Mail%20-%20Yen%20Nguyen%207%20-%20Outlook.pdf Sign in . . . Would you like to set Microsoft Edge as your default browser? Set as default X 28 of 35 + |A' Read aloud | Draw V Highlight V 2 Erase | 0% United Japan India South Singapore U.S.A. China Brazil Germany lesly Spain Arab Korea Emirates Source: Depiction of data from Alton Friedman goes a Economist (2011, Jan. 27) placed roughly in the middle of the continuum-a bit more than half (56 percent) of U.S. respondents subscribed to Friedman's philosophy. CREATING SHARED VALUE dar In contrast to Milton Friedman, Michael Porter argues that executives should not concentrate exclusively on increasing firm profits. Rather, an effective strategic leader should focus on creating shared value, a concept that involves creating economic value for shareholders while also creating social value by addressing society's needs and challenges. He argues that manag- ers need to reestablish the important relationship between superior firm performance and societal progress. This dual point of view, Porter argues, will not only allow companies to gain and sustain a competitive advantage but also reshape capitalism and its relationship to society. The shared value creation framework proposes that managers maintain a dual focus on shared value creation shareholder value creation and value creation for society. It recognizes that markets are framework A model defined not only by economic needs but also by societal needs. It also advances the perspec- proposing that manag- tive that externalities such as pollution, wasted energy, and costly accidents actually create ers have a dual focus internal costs, at least in lost reputation if not directly on the bottom line. Rather than pitting on shareholder value creation and value cre- economic and societal needs in a trade-off, Porter suggests the two can be reconciled to cre- ation for society. ate a larger pie. The shared value creation framework seeks to enhance a firm's competitive- ness by identifying connections between economic and social needs, and then creating a competitive advantage by addressing these business opportunities. GE, for example, has strengthened its competitiveness by creating a profitable business with its "green" Ecomagination initiative. Ecomagination is GE's strategic initiative toand Mail - Yen Nguyen 7 - Outlook.p x + X O File | C:/Users/yenng/Downloads/Mail%20-%20Yen%20Nguyen%207%20-%20Outlook.pdf Sign in . . . Would you like to set Microsoft Edge as your default browser? Set as default X 27 of 35 + A' Read aloud | Draw Highlight & Erase | sional managers (the agents). The public stock company has been a major contributor to value creation since its incep- edu BOARD OF tion as a new organizational form more than a hundred years ago. Michael Porter and oth- DIRECTORS ers, however, argue that many public companies have defined value creation too narrowly in terms of financial performance." This in turn has contributed to some of the black swan events discussed in Chapter 2, such as large-scale accounting scandals and the global finan- cial crisis. Executives' pursuit of strategies that define value creation too narrowly may have MANAGEMENT negative consequences for society at large, as evidenced during the global financial crisis. This narrow focus has contributed to the loss of trust in the corporation as a vehicle for value creation, not only for shareholders but also other stakeholders and society. Nobel laureate Milton Friedman circumscribed a firm's social obligations as follows: EMPLOYEES "There is one and only one social responsibility of business-to use its resources and engage in activities designed to increase its profits so long as it stays within the rules of the game, which is to say, engages in open and free competition without deception or fraud." This notion is often captured by the term shareholder capitalism. According to this perspective, shareholders-the providers of the necessary risk capital and the legal own- shareholder capitalism Shareholders-the pro- ers of public companies-have the most legitimate claim on profits. When introducing the viders of the necessary notion of corporate social responsibility (CSR) in Chapter 1, though, we noted that a firm's risk capital and the le obligations frequently go beyond the economic responsibility to increase profits, extending to gal owners of public ethical and philanthropic expectations that society has of the business enterprise. 10 companies-have the A survey that measured attitudes toward business responsibility in various countries pro- most legitimate claim on profits. vides more insights into this debate and how opinions may vary across the globe. The survey asked the top 25 percent of income earners holding a university degree in each country surveyed whether they agree with Milton Friedman's philosophy that "the social responsibil ity of business is to increase its profits."" The results, displayed in Exhibit 12.2, revealed intriguing national differences. The United Arab Emirates (UAE), a small and business- friendly federation of seven emirates, had the highest level of agreement, at 84 percent. Roughly two-thirds agreed in the Asian countries of Japan, India, South Korea, and Singa- pore, which completed the top five in the survey. The countries where the fewest people agreed with Friedman's philosophy were China, Brazil, Germany, Italy, and Spain; fewer than 40 percent of respondents in those countries supported an exclusive focus on shareholder capitalism. Although they have achieved a high standard of living, European countries such as Germany have tempered the free market system with a strong social element, leading to so-called social market economies. The respondents from these countries seemed to be more supportive of a stakeholder strategy approach to business. Some critics, however, would argue that too strong a focus on the social dimension contributed to the European debt crisis because sovereign governments such as Greece, Italy, and Spain took on nonsustainable debt levels to fund social programs such as early retirement plans, government-funded health care, and so on. The United States