Question: How does unrelated diversification differ from related diversification? Unrelated diversification involves businesses with a common feature, while related diversification does not. Unrelated diversification aims to

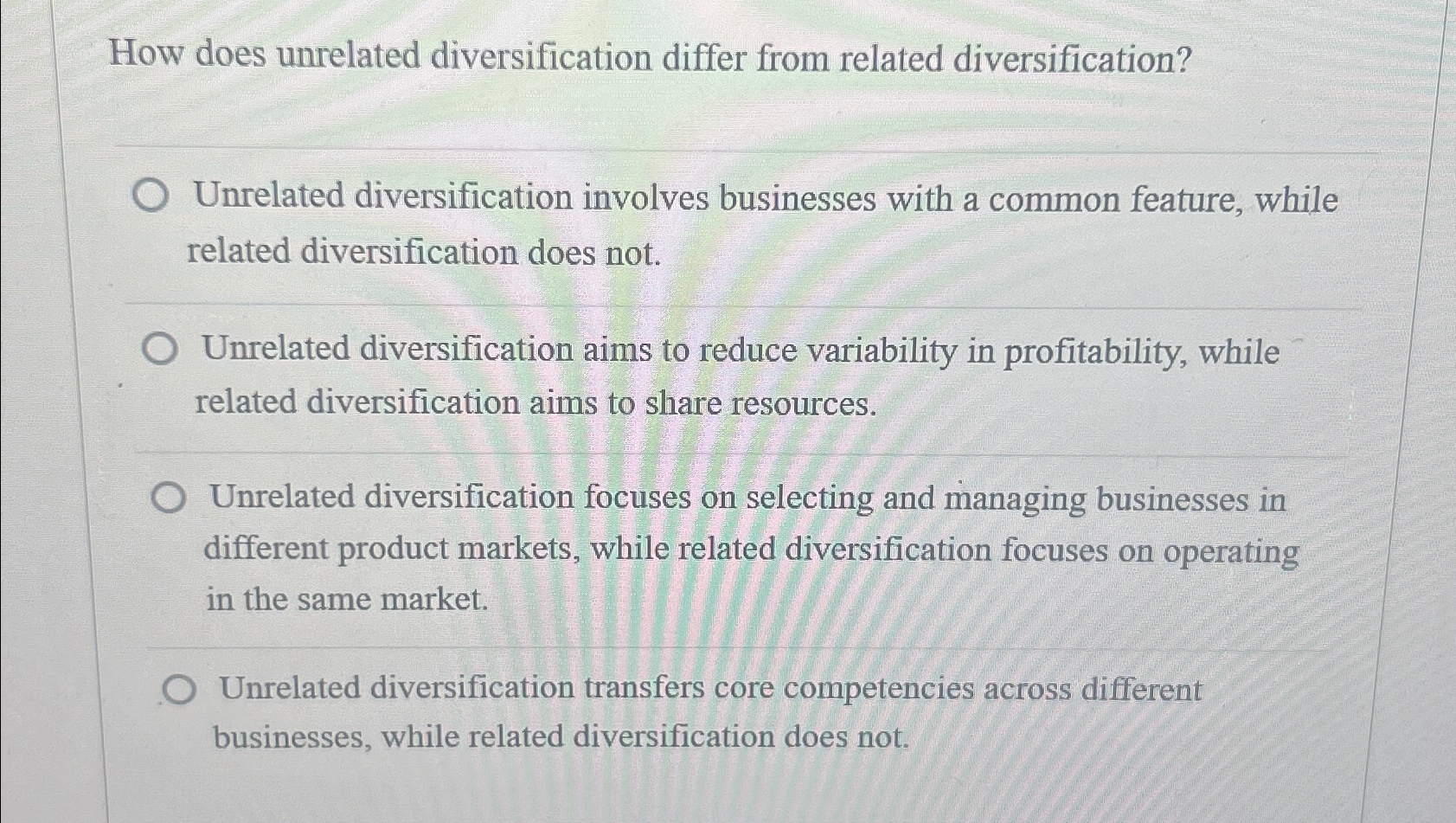

How does unrelated diversification differ from related diversification?

Unrelated diversification involves businesses with a common feature, while related diversification does not.

Unrelated diversification aims to reduce variability in profitability, while related diversification aims to share resources.

Unrelated diversification focuses on selecting and managing businesses in different product markets, while related diversification focuses on operating in the same market.

Unrelated diversification transfers core competencies across different businesses, while related diversification does not.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock