Question: How is the COGS Inventory calculated? Invoice No. Date 12/03/18 Sales Journal - Credit Sales Accounts Debited 1201 Beverly's Building Products 12/03/18 1202 Bilder Construction

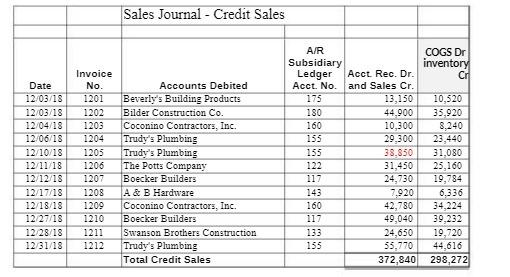

How is the COGS Inventory calculated?

Invoice No. Date 12/03/18 Sales Journal - Credit Sales Accounts Debited 1201 Beverly's Building Products 12/03/18 1202 Bilder Construction Co. 12/04/18 1203 Coconino Contractors, Inc. 12/06/18 1204 12/10/18 1205 12/11/18 1206 12/12/18 1207 12/17/18 1208 Trudy's Plumbing Trudy's Plumbing The Potts Company Boecker Builders A & B Hardware 12/18/18 1209 Coconino Contractors, Inc. 12/27/18 1210 Boecker Builders 12/28/18 1211 Swanson Brothers Construction 12/31/18 1212 Trudy's Plumbing Total Credit Sales A/R Subsidiary Ledger Acct. No. 175 180 160 155 155 122 117 143 160 117 133 155 Acct. Rec. Dr. and Sales Cr. 13,150 44,900 10,300 29,300 38,850 31,450 24,730 7,920 42,780 49,040 24,650 55,770 372,840 COGS Dr inventory 10,520 35,920 8,240 23,440 31,080 25,160 19,784 6.336 34,224 39,232 19,720 44,616 298,272

Step by Step Solution

3.42 Rating (149 Votes )

There are 3 Steps involved in it

COGS Cost of Goods Sold is the sum of costs directly associated with producing the goods sold It is considered an expense for accounting purposes and ... View full answer

Get step-by-step solutions from verified subject matter experts