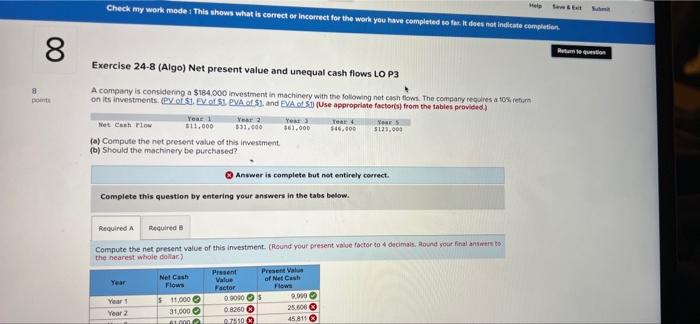

Question: how is this wrong Check my work mode : This shows what is correct or Incorrect for the work you have completed to far. K

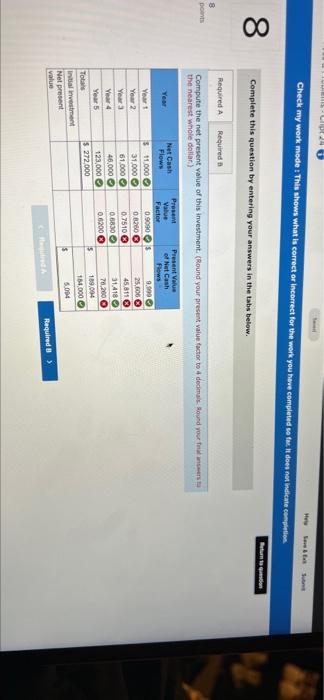

Check my work mode : This shows what is correct or Incorrect for the work you have completed to far. K does not indicate completion 8. 8 Exercise 24-8 (Algo) Net present value and unequal cash flows LO P3 A company is considering a $184.000 investment in machinery with the following net cash flows. The company rere a 10% reum on its investments (py of $1. EVO 51 PVA of 3), and EVA 50 (Use appropriate factor(s) from the tables provided) Year 1 Year 2 Year Tear Years Wet Cash Flow $11,000 $31.000 361.000 $16.000 5133.001 (a) Compute the net present value of this investment () should the machinery be purchased? Answer is complete but not entirely correct. Complete this question by entering your answers in the tabs below. Required Required Compute the net present value of this investment (Round your presentative factor to decimals. Round your final answers to the nearest whole dollar) Net Cash Present Present Value Year Flows Value of Net Cash Factor Flows Year 11.000 0.0000 5 9.000 Year 2 31.000 20 25.606 1000 07510 45.811 oo OOG 00 2431 Check my work mode: This shows what is correct or incorrect for the work you have completed so far. I does not indicate completion Return to go 00 8 Complete this question by entering your answers in the tabs below. 8 po Required A Required Compute the net present value of this investment. (Round your present value tractor to decimal Sound your fait the nearest whole dollar) Year Net Cash Flows Years Year 2 Year Yea Years Tota Initial investment Net present value 3 11000 31000 61.000 46.000 129.000 $ 272.000 Present Present Value Valve of Net Cash Factor Fiews 0.9090 $ 9,000 0.6.2000 25,000 0.7510 45.811 0.6830 31.418 0.6200 70.200 1890 160.000 50 ooooo Required 83

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts