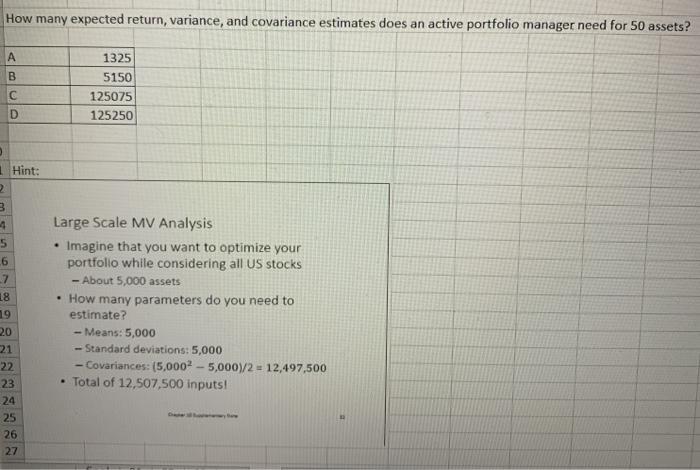

Question: How many expected return, variance, and covariance estimates does an active portfolio manager need for 50 assets? A B 1325 5150 125075 125250 D Hint:

How many expected return, variance, and covariance estimates does an active portfolio manager need for 50 assets? A B 1325 5150 125075 125250 D Hint: 2 3 4 5 . 6 7 18 19 20 21 22 23 24 25 26 27 Large Scale MV Analysis Imagine that you want to optimize your portfolio while considering all US stocks - About 5,000 assets How many parameters do you need to estimate? -Means: 5,000 - Standard deviations: 5,000 - Covariances: (5,0002 - 5,000)/2 = 12,497,500 Total of 12,507,500 inputs

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts