Question: How might management use this information? choose answer from the given options in bold within brackets The actual results varied significantly from the expected results,

How might management use this information?

choose answer from the given options in bold within brackets

The actual results varied significantly from the expected results, (both in total contribution margin and contribution margin ratio / only in contribution margin ratio / only in total contribution margin) management should investigate the cause(s) for the difference in the (actual contribution margin ratio and the actual contribution margin / expected contribution margin ratio and the expected contribution margin / expected variable production costs and the actual variable production costs) the company may decide to (continue the product if it is able to decrease / discontinue the product if it is unable to decrease / discontinue the product if it is unable to increase) the contribution margin. also because the prediction was significantly different from the actual results, management may also want to evaluate the methods the company uses to ( account for product profitability / predict product profitability)

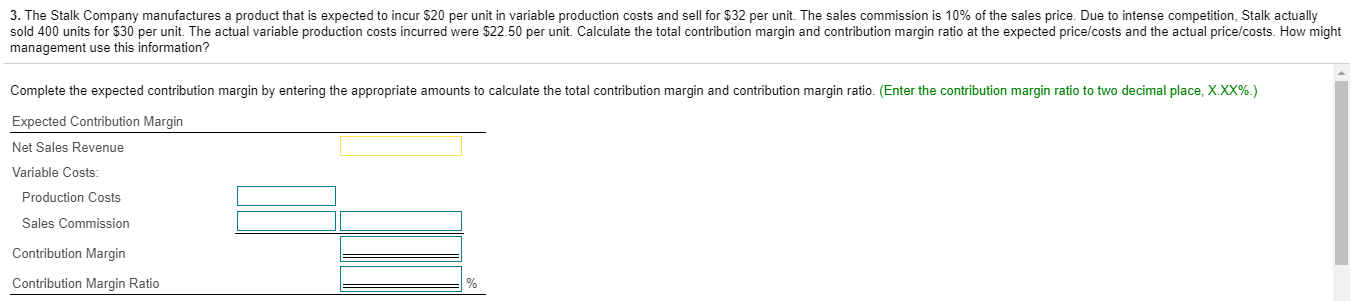

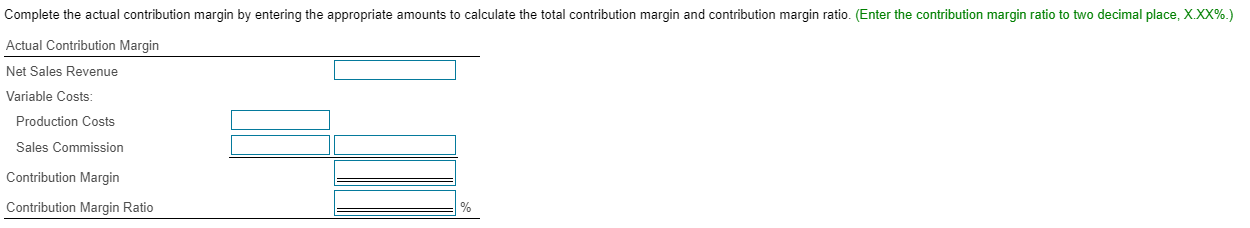

3. The Stalk Company manufactures a product that is expected to incur $20 per unit in variable production costs and sell for $32 per unit. The sales commission is 10% of the sales price. Due to intense competition, Stalk actually sold 400 units for $30 per unit. The actual variable production costs incurred were $22.50 per unit. Calculate the total contribution margin and contribution margin ratio at the expected price/costs and the actual price/costs. How might management use this information? Complete the expected contribution margin by entering the appropriate amounts to calculate the total contribution margin and contribution margin ratio. (Enter the contribution margin ratio to two decimal place, X.XX%.) Expected Contribution Margin Net Sales Revenue Variable Costs Production Costs Sales Commission Contribution Margin Contribution Margin Ratio Complete the actual contribution margin by entering the appropriate amounts to calculate the total contribution margin and contribution margin ratio. (Enter the contribution margin ratio to two decimal place, XXX%.) Actual Contribution Margin Net Sales Revenue Variable Costs: Production Costs Sales Commission Contribution Margin Contribution Margin Ratio

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts