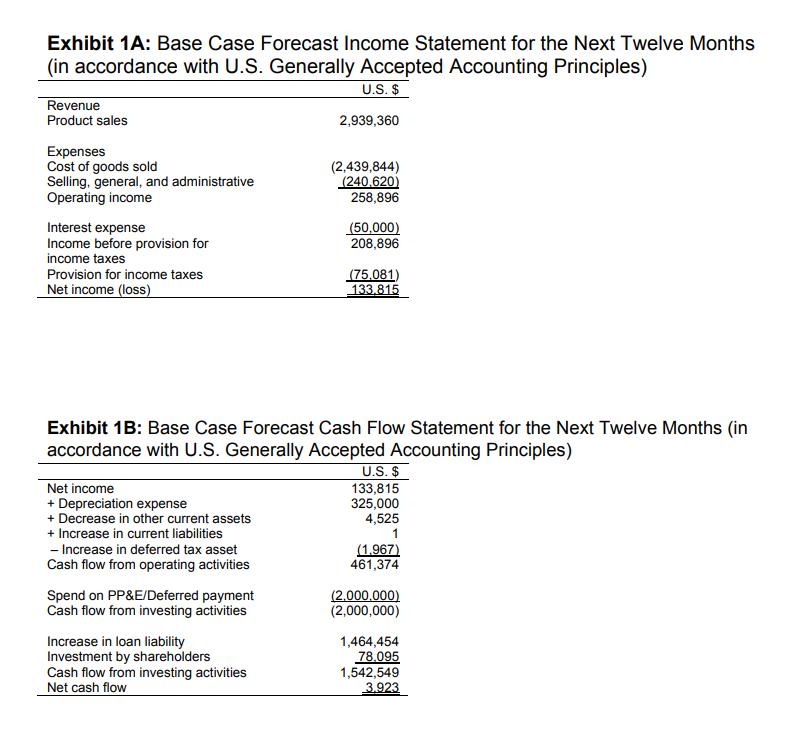

Question: How much do you think a potential buyer will offer based upon a valuation earnings multiple of ten times sustainable earnings, plus the value of

How much do you think a potential buyer will offer based upon a valuation earnings multiple of ten times sustainable earnings, plus the value of cash and marketable investments on the balance sheet.

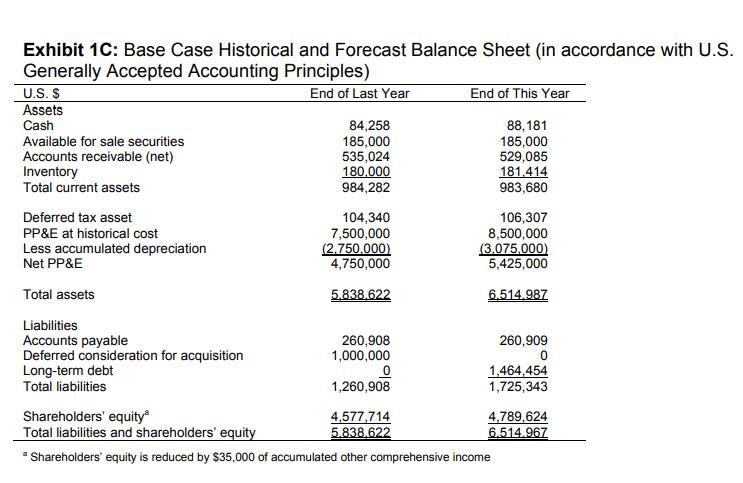

Exhibit 1C: Base Case Historical and Forecast Balance Sheet (in accordance with U.S. Generally Accepted Accounting Principles) U.S. $ Assets End of Last Year End of This Year Cash Available for sale securities Accounts receivable (net) Inventory Total current assets 84,258 185,000 535,024 180,000 984,282 88,181 185,000 529,085 181.414 983,680 Deferred tax asset 104,340 7,500,000 (2.750.000) 4,750,000 106,307 8,500,000 (3.075.000) 5,425,000 PP&E at historical cost Less accumulated depreciation Net PP&E Total assets 5,838,622 6,514,987 Liabilities Accounts payable Deferred consideration for acquisition Long-term debt Total liabilities 260,908 1,000,000 260,909 1,260,908 1,464,454 1,725,343 Shareholders' equity Total liabilities and shareholders' equity 4,577,714 5.838,622 4,789,624 6.514.967 Shareholders' equity is reduced by $35,000 of accumulated other comprehensive income

Step by Step Solution

3.49 Rating (162 Votes )

There are 3 Steps involved in it

1 II III Berkeley Automobile Company Balance Sheet 1231 Description 12312018 123120... View full answer

Get step-by-step solutions from verified subject matter experts