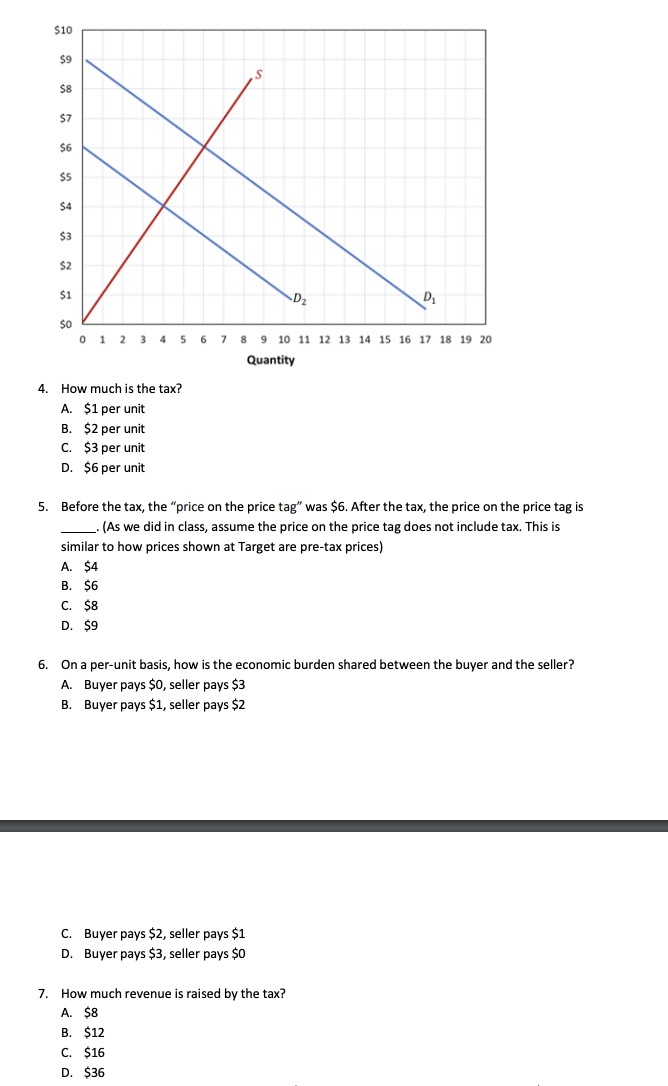

Question: How much is the tax? A . $ 1 per unit B . $ 2 per unit C . $ 3 per unit D .

How much is the tax?

A $ per unit

B $ per unit

C $ per unit

D $ per unit

Before the tax, the "price on the price tag" was $ After the tax, the price on the price tag is

As we did in class, assume the price on the price tag does not include tax. This is

similar to how prices shown at Target are pretax prices

A $

B $

C $

D $

On a perunit basis, how is the economic burden shared between the buyer and the seller?

A Buyer pays $ seller pays $

B Buyer pays $ seller pays $

C Buyer pays $ seller pays $

D Buyer pays $ seller pays $

How much revenue is raised by the tax?

A $

B $

C $

D $

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock