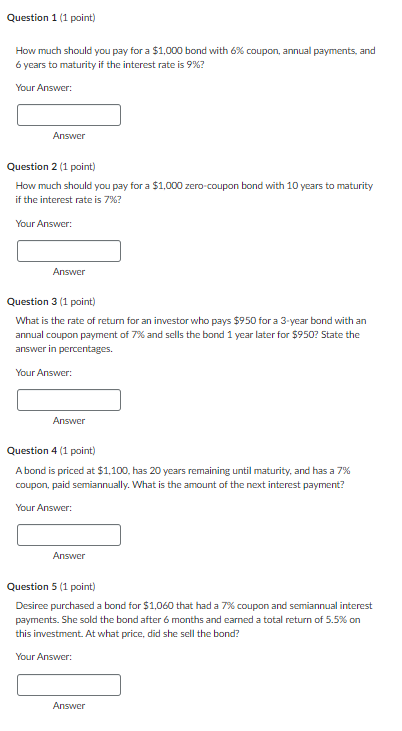

Question: How much should you pay for a $1,000 bond with 6% coupon, annual payments, and 6 years to maturity if the interest rate is 9%

How much should you pay for a $1,000 bond with 6% coupon, annual payments, and 6 years to maturity if the interest rate is 9% ? Your Answer: Answer Question 2 (1 point) How much should you pay for a $1,000 zero-coupon bond with 10 years to maturity if the interest rate is 7% ? Your Answer: Answer Question 3 (1 point) What is the rate of return for an investor who pays $950 for a 3-year bond with an annual coupon payment of 7% and sells the bond 1 year later for $950 ? State the answer in percentages. Your Answer: Answer Question 4 (1 point) A bond is priced at $1,100, has 20 years remaining until maturity, and has a 7% coupon, paid semiannually. What is the amount of the next interest payment? Your Answer: Answer Question 5 (1 point) Desiree purchased a bond for $1,060 that had a 7% coupon and semiannual interest. payments. She sold the bond after 6 months and earned a total return of 5.5% on this imvestment. At what price, did she sell the bond? Your

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts