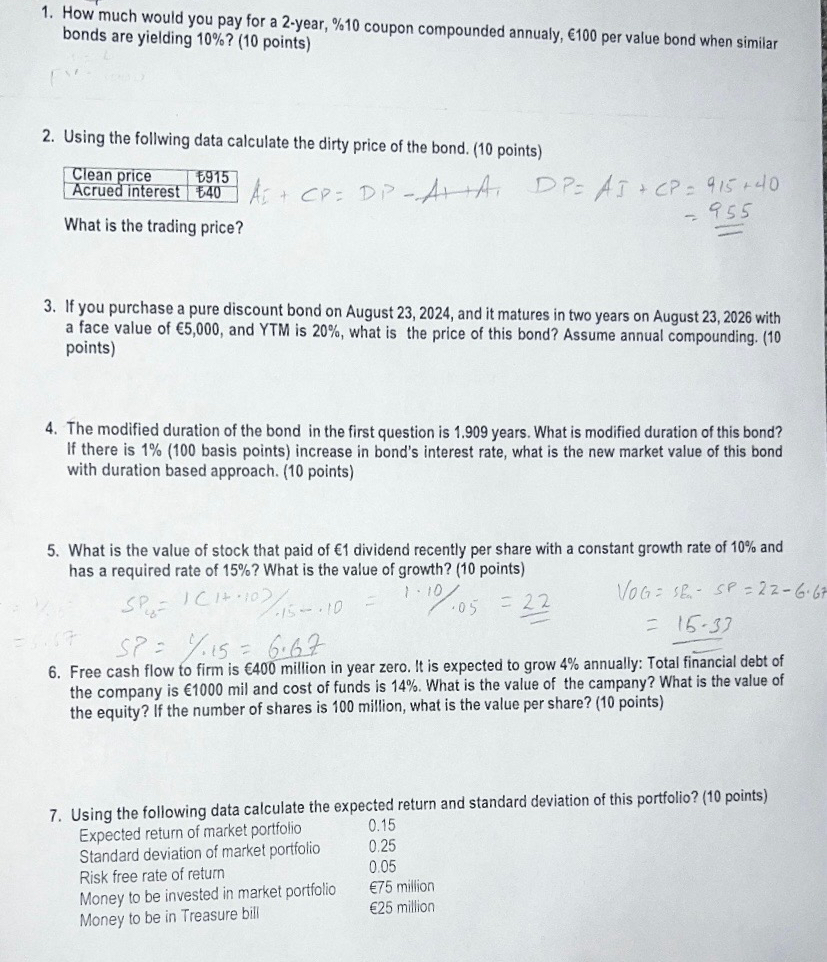

Question: How much would you pay for a 2 - year, % 1 0 coupon compounded annualy, 1 0 0 per value bond when similar bonds

How much would you pay for a year, coupon compounded annualy, per value bond when similar bonds are yielding points

Using the follwing data calculate the dirty price of the bond. points

tableClean price,Acrued interest,

What is the trading price?

If you purchase a pure discount bond on August and it matures in two years on August with a face value of and is what is the price of this bond? Assume annual compounding. points

The modified duration of the bond in the first question is years. What is modified duration of this bond? If there is basis points increase in bond's interest rate, what is the new market value of this bond with duration based approach. points

What is the value of stock that paid of dividend recently per share with a constant growth rate of and has a required rate of What is the value of growth? points

Free cash flow to firm is million in year zero. It is expected to grow annually: Total financial debt of the company is mil and cost of funds is What is the value of the campany? What is the value of the equity? If the number of shares is million, what is the value per share? points

Using the following data calculate the expected return and standard deviation of this portfolio? points

Expected return of market portfolio

Expected return market potrortfolio

Standard deviation market porf

Risk free rate of return

Money to be invested in market portfolio

Money to be in Treasure bill

million

million

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock