Question: How should I adjust this in Income statement and Statement of Financial Position? The directors have estimated the provision for income tax for the year

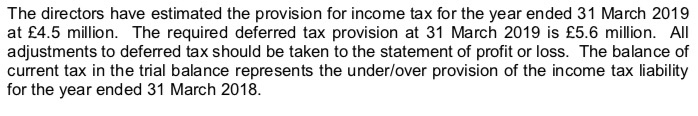

The directors have estimated the provision for income tax for the year ended 31 March 2019 at 4.5 million. The required deferred tax provision at 31 March 2019 is 5.6 million. All adjustments to deferred tax should be taken to the statement of profit or loss. The balance of current tax in the trial balance represents the under/over provision of the income tax liability for the year ended 31 March 2018

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts