Question: How should we evaluate Goldman Sachs using the EQRV screen on a 2 year historical basis? Goldman Sachs seems like it is trading at a

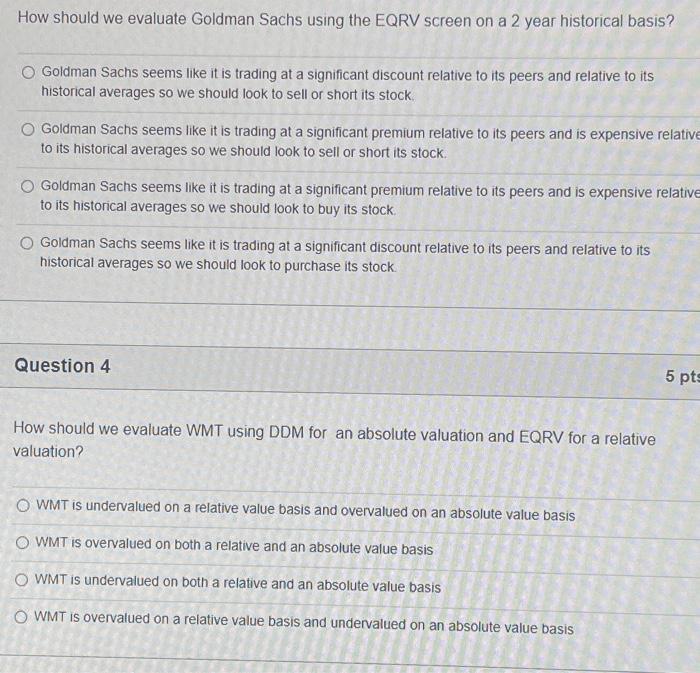

How should we evaluate Goldman Sachs using the EQRV screen on a 2 year historical basis? Goldman Sachs seems like it is trading at a significant discount relative to its peers and relative to its historical averages so we should look to sell or short its stock. Goldman Sachs seems like it is trading at a significant premium relative to its peers and is expensive relativ to its historical averages so we should look to sell or short its stock. Goldman Sachs seems like it is trading at a significant premium relative to its peers and is expensive relativ to its historical averages so we should look to buy its stock. Goldman Sachs seems like it is trading at a significant discount relative to its peers and relative to its historical averages so we should look to purchase its stock. Question 4 How should we evaluate WMT using DDM for an absolute valuation and EQRV for a relative valuation? WMT is undervalued on a relative value basis and overvalued on an absolute value basis WMT is overvalued on both a relative and an absolute value basis WMT is undervalued on both a relative and an absolute value basis WMT is overvalued on a relative value basis and undervalued on an absolute value basis

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts