Question: Read this article above, then read the Article below which is the UBER case study and answer the question CMS ENERGY CASE MATERIALS PART 1

Read this article above, then read the Article below which is the UBER case study and answer the question

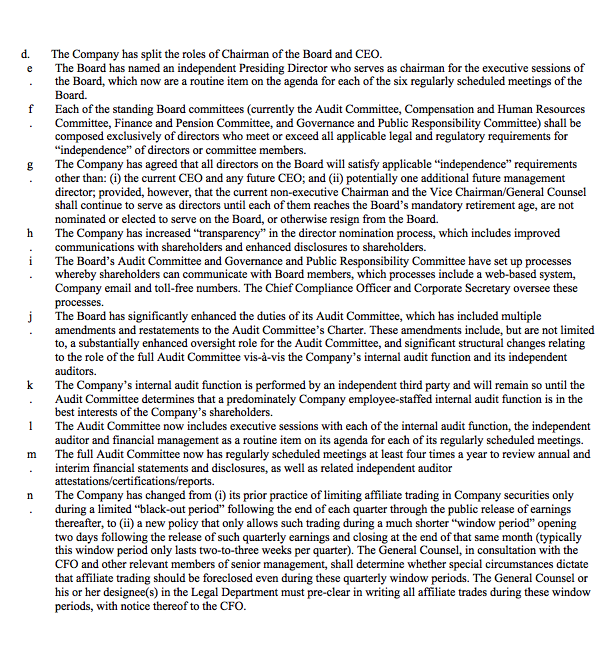

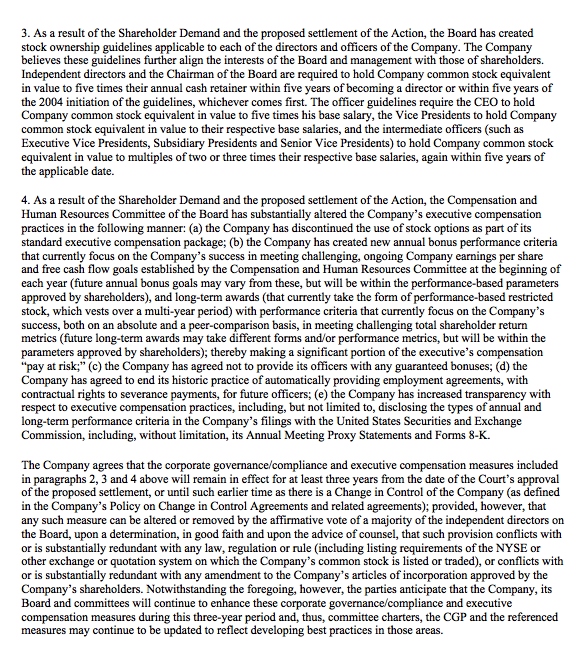

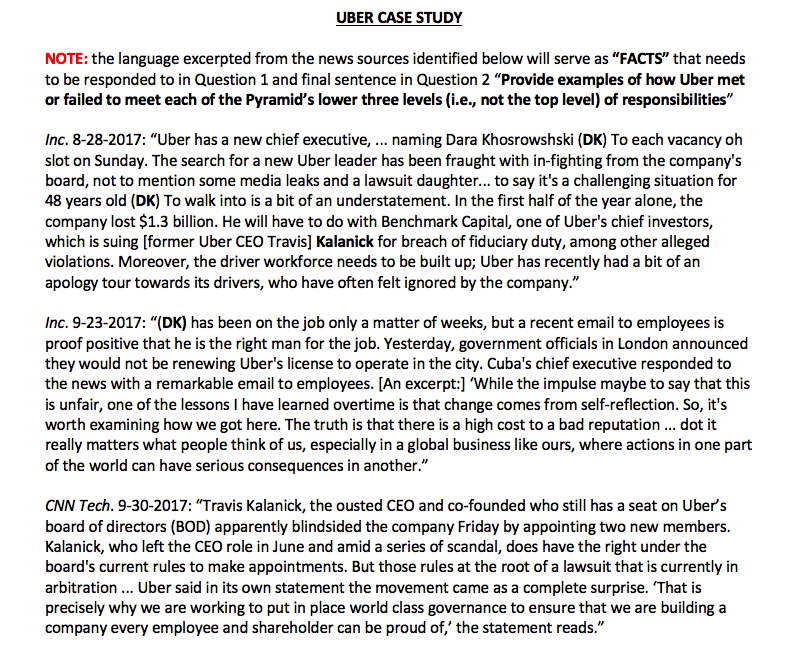

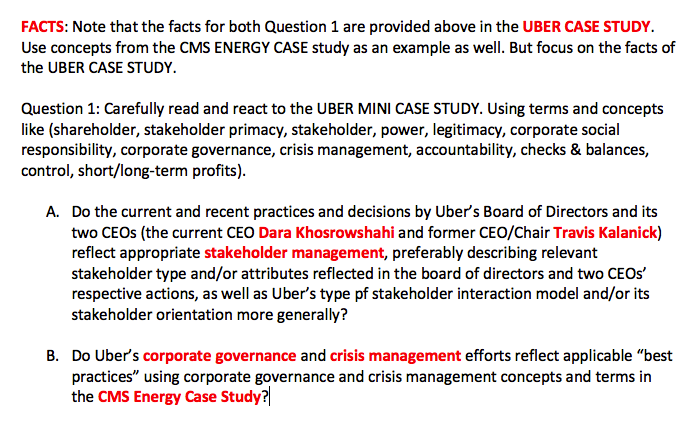

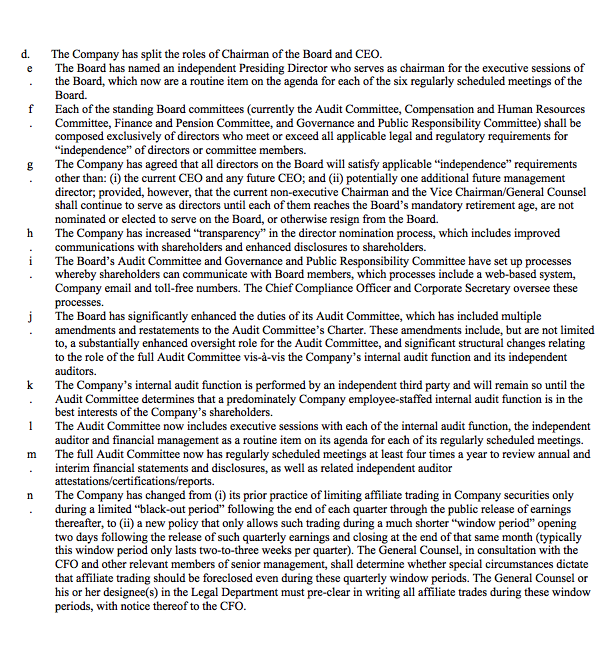

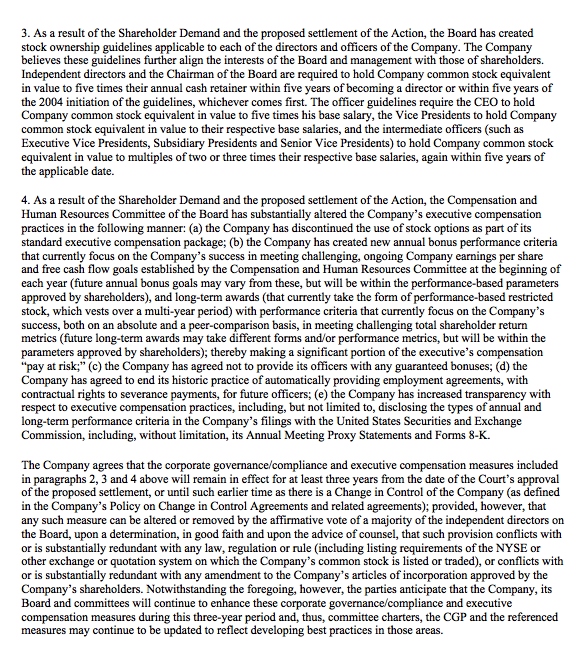

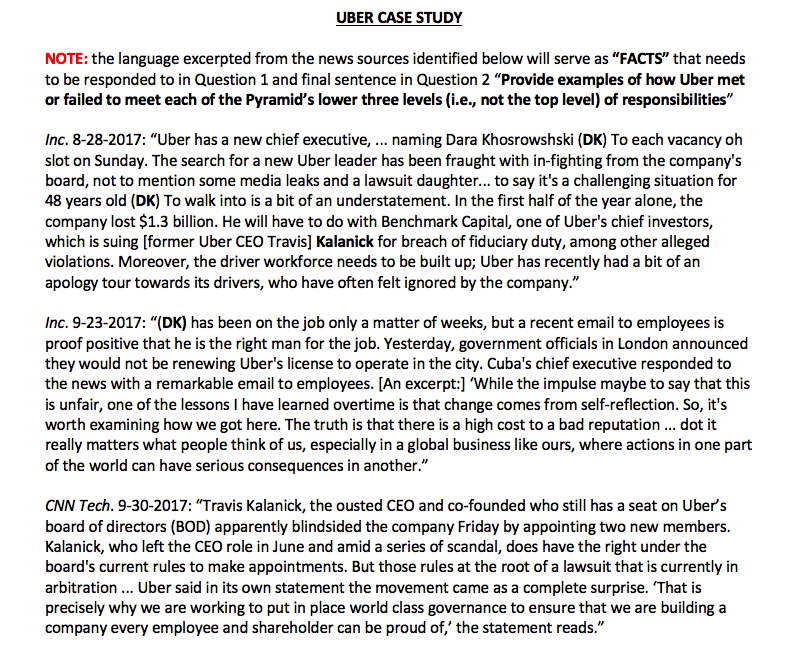

CMS ENERGY CASE MATERIALS PART 1 (early press description of initial issue) FORBES.COM Top Of The News Round Tripping On Energy Dan Ackman, 05.16.02, 9:11 AM ET Wednesday, CMS Energy admitted that it had booked $4.4 billion from so- called "round trip" transactions in 2000 and 2001 along with fellow energy traders Reliant Energy and Dynegy. Should energy-trading executives be prepared for round trips to prison--with a few Saturday night stay-overs in between? The answer is not yet, but the idea is not so far fetched. The U.S. Securities and Exchange Commission is widening an inquiry into phony revenue-generating practices, The Wall Street Journal reports. It is going beyond Dynegy Reliant and CMS Energy -- and perhaps beyond the energy-trading industry altogether, which is already reeling from scandal and the bankruptcy of Enron, once its leading light. The energy traders and their defenders on Wall Street have for a while quietly acknowledged that essentially all energy-trading revenue is phony--even when the sales are not round trip. They are phony not because the sales did not occur, but because nearly all the energy traders book their deals at their gross values. To give a crude example, gross value accounting means that if a trader makes a market in an energy derivative and matches an energy contract to buy energy for $1 million with an offsetting obligation to sell it for $1.01 million, he considers his revenue to be $1.01 million. A securities firm such as Goldman Sachs (making the same deal would book revenue of 0.01 million-- $10,000--that is, the spread between the buy price and the sell price. This kind of accounting is what allowed Enron, a company with roughly 24,000 employees, to be universally regaled as the nation's seventh-largest company when measured solely by revenue. Other companies in this revenue class, like IBM and General Electric, have closer to 300,000 employees. But the first thing one asks about a company is how big it is--that is, what its sales are. If you can use a simple accounting trick--and a legal trick to boot-- why not do it? In America, looking busy and productive is itself a status symbol. Some people at CMS Energy, Dynegy and Reliant wanted look even bigger, still busier. Thus the sham transactions. For these companies, though, even the legitimate transactions could be as distorting as a mirror in a funhouse. The Dearborn-Mich.-based CMS Energy, for its part, an integrated energy company with just 11,600 employees, recorded $9.6 billion in sales in 2001 - up a whopping 57% from 1999. The companies and their defenders on Wall Street will argue that there was no real deception because costs were also booked at gross values, hence the bottom line - profits -- were no different than they might have been. In its press release admitting the round-trip trades, CMS Energy takes this position: "The trades had no effect on the company's earnings, cash flow or balance sheet for 2001 or 2000," it says. In fact, CMS Energy was losing ground in those years when it came to profits. In 1999, it recorded a profit of $277 million, which fell to $36 million in 2000. Last year it had a loss of $545 million. Certainly, there were factors other than energy trading and sham trades at work. But the added volume didn't help. But in another sense the deception seems to have worked well, offering a motive for apparent nonsense. After CMS Energy's share price took a dive in early 2000, it took a steady rise from $15 a share to $27 in early 2001. This was despite its deteriorating profits. Even the massive losses of 2001 didn't lead to a complete collapse, though the share price had been above $40 in late 1998. A month ago, the shares were still trading above $21. Wednesday they closed at $17.23. That's not quite a round trip from two years ago, but it's close. PART 2 (Press Release of an interim resolution) CMS ENERGY ANNOUNCES AGREEMENT TO SETTLE DERIVATIVE LAWSUIT JACKSON, Mich., July 8, 2005-CMS Energy (NYSE: CMS) announced today that it has reached an agreement to settle a shareholder derivative lawsuit linked to round- trip energy trading. S. Kinnie Smith Jr., CMS Energy's vice chairman and general counsel, said the settlement, which remains subject to court approval, represents another milestone in the Company's ongoing efforts to resolve the legal issues stemming from a subsidiary's round-trip trading. "This agreement eliminates a major legal and business uncertainty for CMS Energy and its shareholders and moves us a step closer to writing the final chapter on an unfortunate period in the Company's history," Smith said. He noted the settlement agreement was approved by the Board of Directors' Special Litigation Committee and that the members of that committee joined the Board after the round-trip trading was discontinued. An individual shareholder filed the lawsuit, purportedly on behalf of the Company, in November 2003. The lawsuit claimed certain current and former CMS Energy officers and directors had breached their fiduciary duties in connection with round-trip trading and related internal controls. CMS Energy disclosed in May 2002 that certain employees of a Texas-based subsidiary had engaged in round-trip or wash" energy trades to raise the subsidiary's profile as an energy marketer with the goal of enhancing its ability to market its services. The Company restated its financial reports for 2000 and 2001 to eliminate all revenues and expenses from the round-trip trades, exited the wholesale energy trading business, closed the subsidiary's Texas office, and phased out most of its remaining operations. It reached a settlement on these matters with the U.S. Securities and Exchange Commission without paying any fine. Under the terms of the agreement to settle the shareholder derivative lawsuit: CMS Energy will receive $12 million under the Company's directors and officers liability insurance program. The Company will use $7 million of that to pay costs arising out of a securities class action lawsuit related to round-trip energy trading and internal controls. That lawsuit is pending in federal court in Michigan CMS Energy also may pay for related attorneys' fees and expenses arising out of the derivative proceeding from the remaining $5 million. The agreement also reflects CMS Energy's implementation of a number of corporate governance changes to foster greater transparency, update its employee compliance and ethics guidelines, and increase oversight by the independent members of the Board of Directors. As previously announced, CMS Energy has: Appointed a Chief Compliance Officer to ensure compliance with all applicable laws and regulations and ac as an interface for employees who have questions about business conduct Implemented a new Code of Conduct and Statement of Ethics, with related training, for all Company employees Established a clearer procedure for employees, shareholders or third parties to report anonymously concerns about behavior that may be unethical or illegal, including perceived accounting irregularities Retained one of the Big Four" independent accounting firms to handle the Company's internal audit functio Named an independent presiding director for executive sessions of the Board of Directors Split the roles of Chairman of the Board and Chief Executive Officer Robert Weiser, an attorney for the shareholder who brought the suit, commended CMS Energy for strengthening its corporate governance. "CMS Energy has made a substantial commitment to its shareholders. The policies adopted by the Company make it a national leader in the area of corporate governance. CMS Energy shareholders should be proud of the steps the Company's Board of Directors has taken," he said. The agreement to settle the shareholder derivative lawsuit includes no admission of liability by CMS Energy or any of the officers and directors named in the suit. The agreement has been submitted to a Jackson County, Michigan, circuit court for approval. The court already has approved the forms of shareholder notice and scheduled a hearing for final approval of the settlement for 3 p.m. on Aug. 26, 2005. Judge Edward J. Grant will conduct the hearing at the Jackson County Circuit Courthouse, 312 South Jackson Street, Jackson, Michigan 49201. The agreement and accompanying legal documents, including the forms of shareholder notice, are included in a Form 8-K that the Company is filing today with the U.S. Securities and Exchange Commission. The filing will be available at the Company's website at www.cmsenergy.com/invest, under SEC Filings." A shareholder notice announcing the proposed settlement also will be published in several major newspapers. CMS Energy is an integrated energy company, which has as its primary business operations an electric and natural gas utility, natural gas pipeline systems, and independent power generation. PART 3 (The legalese version of above settlement) STATE OF MICHIGAN IN THE CIRCUIT COURT FOR THE COUNTY OF JACKSON Case No. 03-06483-CK Hon. Edward J. Grant ANDREW KLOTZ, Derivatively on Behalf of Nominal Defendant CMS ENERGY CORPORATION, Plaintiff, v. WILLIAM U. PARFET, JOHN M. DEUTCH, JAMES J. DUDERSTADT, PERCY A. PIERRE, JOHN B. YASINSKY, KATHLEEN R. FLAHERTY, EARL D. HOLTON, KEN L. WAY, KENNETH WHIPPLE, WILLIAM T. MCCORMICK, JR. and ALAN M. WRIGHT, Defendants, And CMS ENERGY CORPORATION, Nominal Defendant. STIPULATION OF SETTLEMENT Plaintiff Andrew Klotz ("Plaintiff"), derivatively on behalf of nominal defendant CMS Energy Corporation ("CMS" or the "Company'); defendants William U. Parfet, John M. Deutch, James J. Duderstadt, Percy A. Pierre, John B. Yasinsky, Kathleen R. Flaherty, Earl D. Holton, Ken L. Way, Kenneth Whipple, William T. McCormick, Jr. and Alan M. Wright (collectively, Defendants"); CMS; and CMS's Special Litigation Committee (the "SLC") agree to settle this derivative action (the "Action") in accordance with the terms and conditions set forth in this stipulation of settlement (Stipulation"). I. BACKGROUND AND HISTORY OF THE ACTION By certified letter dated May 17, 2002 addressed to the Company, Plaintiff, a common shareholder of the Company, pursuant to Section 493a of the Michigan Business Corporation Act ("MBCA"), MCL 450.1493a, demanded that the Company's Board of Directors (the Board) take action to remedy alleged breaches of fiduciary duties by certain officers and directors of the Company based in large part on transactions which have come to be known as round-trip" energy trading (the "Shareholder Demand"). The Board formed the SLC and the disinterested directors on the Board appointed the SLC's members to investigate the allegations in the Shareholder Demand and to decide what action, if any, should be undertaken in response thereto. VI. PLAINTIFF'S ACTIONS HAVE SUBSTANTIALLY BENEFITED THE EFFECTIVENESS OF CMS'S CORPORATE GOVERNANCE REGIMEN 1. Following the submission of the Shareholder Demand and as part of the proposed settlement of the Action, the Company has implemented a continuing transition of the membership of its Board and the committees thereof, as well as substantial turnover of its senior executives, as follows: Since the Shareholder Demand was received, five of the eleven then-incumbent directors have left the Board, including the former Chairman/Chief Executive Officer ("CEO") and Chairmen of each of the Audit Committee and then-named Nominating Committee. Five new directors, each of whom meet all applicable legal and regulatory "independence requirements, have joined the Board during this period, as well as a new Vice Chairman/General Counsel. The two independent directors appointed in December 2002 to fill vacancies on the Board were subsequently elected by Company shareholders at the 2003 Annual Meeting, thereby confirming the Board's prior designation of each of them as an independent director" under the MBCA, an even more stringent standard than other legal and regulatory "independence requirements. The qualifications of these two new directors were reviewed with, and deemed acceptable to, Plaintiff's Settlement Counsel prior to their appointment. One of these two new directors has substantial financial expertise and now chairs the Audit Committee; the second such director, as well as a third director newly elected at the 2004 Annual Meeting, have substantial expertise in the energy/utility industry. The two shareholder-elected May 2005 additions to the Board are nationally recognized experts in accounting and corporate governance/legal areas. The prospect of adding a director with corporate governance/legal expertise was the basis of negotiations with Plaintiff's Settlement Counsel and corporate governance expert regarding appropriate Board composition. Further, as part of this transition, the Company will add at least one additional independent director to the Board at or before the Company's 2006 Annual Meeting if necessary to ensure that a majority of the Board's membership will consist of independent directors first elected since May 17, 2002. The composition of relevant committees of the Board has undergone an even more significant transition during this period. Three of the five May 2002 Audit Committee members, including its Chairman, have b since left the Board, and the remaining two members have left that committee. The May 2002 Chairman and two other members of the then-named Nominating Committee have since left the Board and the remaining three former members have left that committee; a majority of its current membership has joined the Board during this period, including the Chairman of the currently named Governance and Public Responsibility Committee. The Chairman and all but one of the May 2002 Organization and Compensation Committee members have also left that committee (currently named Compensation and Human Resources Committee) during this transition period. Of the seven named executive officers in the Company's April 22, 2002 Proxy Statement, all but one have since separated from the Company. Within three months of the Shareholder Demand, each of the Chairman/CEO, the Executive Vice President/Chief Financial Officer (CFO"), the Senior Vice President/General Counsel and the President/CEO of the Company's energy marketing, services and trading subsidiary had separated from the Company. The Chairman/CEO was replaced by a previously independent director, while the Executive Vice President/CFO and Senior Vice President/General Counsel were replaced by individuals previously employed outside of the Company. The only 2002 named executive officer who remains with the Company is David W. Joos, who had been elected effective October 2001 as President/Chief Operating Officer, following the separation of his predecessor in that office. In addition, the Senior Vice President/Chief Accounting Officer initially during this period had been relieved of his accounting and controller responsibilities and ultimately also separated. 2. As a result of the Shareholder Demand and the proposed settlement of the Action, the Company has created substantially enhanced Board, officer and employee compliance and governance oversight functions that include the following measures: a b The Company has created the position of Chief Compliance Officer that presently reports directly to the Audit Committee of the Board. The duties of the Chief Compliance Officer include, but are not limited to, overseeing and administering the Code of Conduct and Statement of Ethics, fostering a culture that integrates compliance and ethics into business processes and practices through awareness and training, and maintaining and monitoring a system for reporting and investigating potential compliance and ethics concerns. The Chief Compliance Officer will provide a formal report to the Audit Committee at least twice each year, and will report promptly to that committee (directly or through its Chairman) any allegations of compliance and ethics concerns relating to financial fraud. The Chief Compliance Officer has implemented a new Company-wide Code of Conduct and Statement of Ethics, with related training, for all Company employees. The Board, upon recommendation of its Governance and Public Responsibility Committee, adopted formal charters for each of its four standing committees, as well as Corporate Governance Principles ("CGP"), all reflecting developing best practices of board and corporate governance. Each of the committee charters, as well as the CGP, has been amended and restated at least once to reflect interim developments in such best practices. Among these interim changes are establishing a mandatory retirement age of 75 for directors, limitations on the number of other public company boards on which the Company's CEO (two others) and independent directors (five others) can serve, and better delineation and disclosure of the Company's CEO succession planning process. As a result of the implementation of these and related best practices, the Company has improved its Institutional Shareholder Services ("ISS") Corporate Governance Quotient relative ratings from an average score of approximately 15% of the two peer groups at the beginning of this period to the approximately 85% level represented in the ISS proxy recommendations (all favorable) issued in connection with the Company's 2005 Annual Meeting. d. e f 8 h i j The Company has split the roles of Chairman of the Board and CEO. The Board has named an independent Presiding Director who serves as chairman for the executive sessions of the Board, which now are a routine item on the agenda for each of the six regularly scheduled meetings of the Board. Each of the standing Board committees (currently the Audit Committee, Compensation and Human Resources Committee, Finance and Pension Committee, and Governance and Public Responsibility Committee) shall be composed exclusively of directors who meet or exceed all applicable legal and regulatory requirements for "independence of directors or committee members. The Company has agreed that all directors on the Board will satisfy applicable "independence" requirements other than: (i) the current CEO and any future CEO; and (ii) potentially one additional future management director, provided, however, that the current non-executive Chairman and the Vice Chairman/General Counsel shall continue to serve as directors until each of them reaches the Board's mandatory retirement age, are not nominated or elected to serve on the Board, or otherwise resign from the Board. The Company has increased "transparency" in the director nomination process, which includes improved communications with shareholders and enhanced disclosures to shareholders. The Board's Audit Committee and Governance and Public Responsibility Committee have set up processes whereby shareholders can communicate with Board members, which processes include a web-based system, Company email and toll-free numbers. The Chief Compliance Officer and Corporate Secretary oversee these processes. The Board has significantly enhanced the duties of its Audit Committee, which has included multiple amendments and restatements to the Audit Committee's Charter. These amendments include, but are not limited to, a substantially enhanced oversight role for the Audit Committee, and significant structural changes relating to the role of the full Audit Committee vis--vis the Company's internal audit function and its independent auditors. The Company's internal audit function is performed by an independent third party and will remain so until the Audit Committee determines that a predominately Company employee-staffed internal audit function is in the best interests of the Company's shareholders. The Audit Committee now includes executive sessions with each of the internal audit function, the independent auditor and financial management as a routine item on its agenda for each of its regularly scheduled meetings. The full Audit Committee now has regularly scheduled meetings at least four times a year to review annual and interim financial statements and disclosures, as well as related independent auditor attestations/certifications/reports. The Company has changed from (1) its prior practice of limiting affiliate trading in Company securities only during a limited "black-out period following the end of each quarter through the public release of earnings thereafter, to (ii) a new policy that only allows such trading during a much shorter "window perioda opening two days following the release of such quarterly earnings and closing at the end of that same month (typically this window period only lasts two-to-three weeks per quarter). The General Counsel, in consultation with the CFO and other relevant members of senior management, shall determine whether special circumstances dictate that affiliate trading should be foreclosed even during these quarterly window periods. The General Counsel or his or her designee(s) in the Legal Department must pre-clear in writing all affiliate trades during these window periods, with notice thereof to the CFO. k 1 m n 3. As a result of the Shareholder Demand and the proposed settlement of the Action, the Board has created stock ownership guidelines applicable to each of the directors and officers of the Company. The Company believes these guidelines further align the interests of the Board and management with those of shareholders. Independent directors and the Chairman of the Board are required to hold Company common stock equivalent in value to five times their annual cash retainer within five years of becoming a director or within five years of the 2004 initiation of the guidelines, whichever comes first. The officer guidelines require the CEO to hold Company common stock equivalent in value to five times his base salary, the Vice Presidents to hold Company common stock equivalent in value to their respective base salaries, and the intermediate officers (such as Executive Vice Presidents, Subsidiary Presidents and Senior Vice Presidents) to hold Company common stock equivalent in value to multiples of two or three times their respective base salaries, again within five years of the applicable date. 4. As a result of the Shareholder Demand and the proposed settlement of the Action, the Compensation and Human Resources Committee of the Board has substantially altered the Company's executive compensation practices in the following manner: (a) the Company has discontinued the use of stock options as part of its standard executive compensation package; (b) the Company has created new annual bonus performance criteria that currently focus on the Company's success in meeting challenging, ongoing Company earnings per share and free cash flow goals established by the Compensation and Human Resources Committee at the beginning of each year (future annual bonus goals may vary from these, but will be within the performance-based parameters approved by shareholders), and long-term awards (that currently take the form of performance-based restricted stock, which vests over a multi-year period) with performance criteria that currently focus on the Company's success, both on an absolute and a peer-comparison basis, in meeting challenging total shareholder return metrics (future long-term awards may take different forms and/or performance metrics, but will be within the parameters approved by shareholders); thereby making a significant portion of the executive's compensation "pay at risk;" (c) the Company has agreed not to provide its officers with any guaranteed bonuses; (d) the Company has agreed to end its historic practice of automatically providing employment agreements, with contractual rights to severance payments, for future officers; (e) the Company has increased transparency with respect to executive compensation practices, including, but not limited to, disclosing the types of annual and long-term performance criteria in the Company's filings with the United States Securities and Exchange Commission, including, without limitation, its Annual Meeting Proxy Statements and Forms 8-K. The Company agrees that the corporate governance/compliance and executive compensation measures included in paragraphs 2, 3 and 4 above will remain in effect for at least three years from the date of the Court's approval of the proposed settlement, or until such earlier time as there is a Change in Control of the Company (as defined in the Company's Policy on Change in Control Agreements and related agreements); provided, however, that any such measure can be altered or removed by the affirmative vote of a majority of the independent directors on the Board, upon a determination, in good faith and upon the advice of counsel, that such provision conflicts with or is substantially redundant with any law, regulation or rule (including listing requirements of the NYSE or other exchange or quotation system on which the Company's common stock is listed or traded), or conflicts with or is substantially redundant with any amendment to the Company's articles of incorporation approved by the Company's shareholders. Notwithstanding the foregoing, however, the parties anticipate that the Company, its Board and committees will continue to enhance these corporate governance/compliance and executive compensation measures during this three-year period and, thus, committee charters, the CGP and the referenced measures may continue to be updated to reflect developing best practices in those areas. UBER CASE STUDY NOTE: the language excerpted from the news sources identified below will serve as "FACTS that needs to be responded to in Question 1 and final sentence in Question 2 "Provide examples of how Uber met or failed to meet each of the Pyramid's lower three levels (i.e., not the top level) of responsibilities" Inc. 8-28-2017: "Uber has a new chief executive, ... naming Dara Khosrowshski (DK) To each vacancy oh slot on Sunday. The search for a new Uber leader has been fraught with in-fighting from the company's board, not to mention some media leaks and a lawsuit daughter... to say it's a challenging situation for 48 years old (DK) To walk into is a bit of an understatement. In the first half of the year alone, the company lost $1.3 billion. He will have to do with Benchmark Capital, one of Uber's chief investors, which is suing (former Uber CEO Travis] Kalanick for breach of fiduciary duty, among other alleged violations. Moreover, the driver workforce needs to be built up; Uber has recently had a bit of an apology tour towards its drivers, who have often felt ignored by the company." Inc. 9-23-2017: "(DK) has been on the job only a matter of weeks, but a recent email to employees is proof positive that he is the right man for the job. Yesterday, government officials in London announced they would not be renewing Uber's license to operate in the city. Cuba's chief executive responded to the news with a remarkable email to employees. [An excerpt:) 'While the impulse maybe to say that this is unfair, one of the lessons I have learned overtime is that change comes from self-reflection. So, it's worth examining how we got here. The truth is that there is a high cost to a bad reputation ... dot it really matters what people think of us, especially in a global business like ours, where actions in one part of the world can have serious consequences in another. CNN Tech. 9-30-2017: "Travis Kalanick, the ousted CEO and co-founded who still has a seat on Uber's board of directors (BOD) apparently blindsided the company Friday by appointing two new members. Kalanick, who left the CEO role in June and amid a series of scandal, does have the right under the board's current rules to make appointments. But those rules at the root of a lawsuit that is currently in arbitration ... Uber said in its own statement the movement came as a complete surprise. 'That is precisely why we are working to put in place world class governance to ensure that we are building a company every employee and shareholder can be proud of, the statement reads." FACTS: Note that the facts for both Question 1 are provided above in the UBER CASE STUDY. Use concepts from the CMS ENERGY CASE study as an example as well. But focus on the facts of the UBER CASE STUDY. Question 1: Carefully read and react to the UBER MINI CASE STUDY. Using terms and concepts like (shareholder, stakeholder primacy, stakeholder, power, legitimacy, corporate social responsibility, corporate governance, crisis management, accountability, checks & balances, control, short/long-term profits). A. Do the current and recent practices and decisions by Uber's Board of Directors and its two CEOs (the current CEO Dara Khosrowshahi and former CEO/Chair Travis Kalanick) reflect appropriate stakeholder management, preferably describing relevant stakeholder type and/or attributes reflected in the board of directors and two CEOs' respective actions, as well as Uber's type pf stakeholder interaction model and/or its stakeholder orientation more generally? B. Do Uber's corporate governance and crisis management efforts reflect applicable "best practices using corporate governance and crisis management concepts and terms in the CMS Energy Case Study? CMS ENERGY CASE MATERIALS PART 1 (early press description of initial issue) FORBES.COM Top Of The News Round Tripping On Energy Dan Ackman, 05.16.02, 9:11 AM ET Wednesday, CMS Energy admitted that it had booked $4.4 billion from so- called "round trip" transactions in 2000 and 2001 along with fellow energy traders Reliant Energy and Dynegy. Should energy-trading executives be prepared for round trips to prison--with a few Saturday night stay-overs in between? The answer is not yet, but the idea is not so far fetched. The U.S. Securities and Exchange Commission is widening an inquiry into phony revenue-generating practices, The Wall Street Journal reports. It is going beyond Dynegy Reliant and CMS Energy -- and perhaps beyond the energy-trading industry altogether, which is already reeling from scandal and the bankruptcy of Enron, once its leading light. The energy traders and their defenders on Wall Street have for a while quietly acknowledged that essentially all energy-trading revenue is phony--even when the sales are not round trip. They are phony not because the sales did not occur, but because nearly all the energy traders book their deals at their gross values. To give a crude example, gross value accounting means that if a trader makes a market in an energy derivative and matches an energy contract to buy energy for $1 million with an offsetting obligation to sell it for $1.01 million, he considers his revenue to be $1.01 million. A securities firm such as Goldman Sachs (making the same deal would book revenue of 0.01 million-- $10,000--that is, the spread between the buy price and the sell price. This kind of accounting is what allowed Enron, a company with roughly 24,000 employees, to be universally regaled as the nation's seventh-largest company when measured solely by revenue. Other companies in this revenue class, like IBM and General Electric, have closer to 300,000 employees. But the first thing one asks about a company is how big it is--that is, what its sales are. If you can use a simple accounting trick--and a legal trick to boot-- why not do it? In America, looking busy and productive is itself a status symbol. Some people at CMS Energy, Dynegy and Reliant wanted look even bigger, still busier. Thus the sham transactions. For these companies, though, even the legitimate transactions could be as distorting as a mirror in a funhouse. The Dearborn-Mich.-based CMS Energy, for its part, an integrated energy company with just 11,600 employees, recorded $9.6 billion in sales in 2001 - up a whopping 57% from 1999. The companies and their defenders on Wall Street will argue that there was no real deception because costs were also booked at gross values, hence the bottom line - profits -- were no different than they might have been. In its press release admitting the round-trip trades, CMS Energy takes this position: "The trades had no effect on the company's earnings, cash flow or balance sheet for 2001 or 2000," it says. In fact, CMS Energy was losing ground in those years when it came to profits. In 1999, it recorded a profit of $277 million, which fell to $36 million in 2000. Last year it had a loss of $545 million. Certainly, there were factors other than energy trading and sham trades at work. But the added volume didn't help. But in another sense the deception seems to have worked well, offering a motive for apparent nonsense. After CMS Energy's share price took a dive in early 2000, it took a steady rise from $15 a share to $27 in early 2001. This was despite its deteriorating profits. Even the massive losses of 2001 didn't lead to a complete collapse, though the share price had been above $40 in late 1998. A month ago, the shares were still trading above $21. Wednesday they closed at $17.23. That's not quite a round trip from two years ago, but it's close. PART 2 (Press Release of an interim resolution) CMS ENERGY ANNOUNCES AGREEMENT TO SETTLE DERIVATIVE LAWSUIT JACKSON, Mich., July 8, 2005-CMS Energy (NYSE: CMS) announced today that it has reached an agreement to settle a shareholder derivative lawsuit linked to round- trip energy trading. S. Kinnie Smith Jr., CMS Energy's vice chairman and general counsel, said the settlement, which remains subject to court approval, represents another milestone in the Company's ongoing efforts to resolve the legal issues stemming from a subsidiary's round-trip trading. "This agreement eliminates a major legal and business uncertainty for CMS Energy and its shareholders and moves us a step closer to writing the final chapter on an unfortunate period in the Company's history," Smith said. He noted the settlement agreement was approved by the Board of Directors' Special Litigation Committee and that the members of that committee joined the Board after the round-trip trading was discontinued. An individual shareholder filed the lawsuit, purportedly on behalf of the Company, in November 2003. The lawsuit claimed certain current and former CMS Energy officers and directors had breached their fiduciary duties in connection with round-trip trading and related internal controls. CMS Energy disclosed in May 2002 that certain employees of a Texas-based subsidiary had engaged in round-trip or wash" energy trades to raise the subsidiary's profile as an energy marketer with the goal of enhancing its ability to market its services. The Company restated its financial reports for 2000 and 2001 to eliminate all revenues and expenses from the round-trip trades, exited the wholesale energy trading business, closed the subsidiary's Texas office, and phased out most of its remaining operations. It reached a settlement on these matters with the U.S. Securities and Exchange Commission without paying any fine. Under the terms of the agreement to settle the shareholder derivative lawsuit: CMS Energy will receive $12 million under the Company's directors and officers liability insurance program. The Company will use $7 million of that to pay costs arising out of a securities class action lawsuit related to round-trip energy trading and internal controls. That lawsuit is pending in federal court in Michigan CMS Energy also may pay for related attorneys' fees and expenses arising out of the derivative proceeding from the remaining $5 million. The agreement also reflects CMS Energy's implementation of a number of corporate governance changes to foster greater transparency, update its employee compliance and ethics guidelines, and increase oversight by the independent members of the Board of Directors. As previously announced, CMS Energy has: Appointed a Chief Compliance Officer to ensure compliance with all applicable laws and regulations and ac as an interface for employees who have questions about business conduct Implemented a new Code of Conduct and Statement of Ethics, with related training, for all Company employees Established a clearer procedure for employees, shareholders or third parties to report anonymously concerns about behavior that may be unethical or illegal, including perceived accounting irregularities Retained one of the Big Four" independent accounting firms to handle the Company's internal audit functio Named an independent presiding director for executive sessions of the Board of Directors Split the roles of Chairman of the Board and Chief Executive Officer Robert Weiser, an attorney for the shareholder who brought the suit, commended CMS Energy for strengthening its corporate governance. "CMS Energy has made a substantial commitment to its shareholders. The policies adopted by the Company make it a national leader in the area of corporate governance. CMS Energy shareholders should be proud of the steps the Company's Board of Directors has taken," he said. The agreement to settle the shareholder derivative lawsuit includes no admission of liability by CMS Energy or any of the officers and directors named in the suit. The agreement has been submitted to a Jackson County, Michigan, circuit court for approval. The court already has approved the forms of shareholder notice and scheduled a hearing for final approval of the settlement for 3 p.m. on Aug. 26, 2005. Judge Edward J. Grant will conduct the hearing at the Jackson County Circuit Courthouse, 312 South Jackson Street, Jackson, Michigan 49201. The agreement and accompanying legal documents, including the forms of shareholder notice, are included in a Form 8-K that the Company is filing today with the U.S. Securities and Exchange Commission. The filing will be available at the Company's website at www.cmsenergy.com/invest, under SEC Filings." A shareholder notice announcing the proposed settlement also will be published in several major newspapers. CMS Energy is an integrated energy company, which has as its primary business operations an electric and natural gas utility, natural gas pipeline systems, and independent power generation. PART 3 (The legalese version of above settlement) STATE OF MICHIGAN IN THE CIRCUIT COURT FOR THE COUNTY OF JACKSON Case No. 03-06483-CK Hon. Edward J. Grant ANDREW KLOTZ, Derivatively on Behalf of Nominal Defendant CMS ENERGY CORPORATION, Plaintiff, v. WILLIAM U. PARFET, JOHN M. DEUTCH, JAMES J. DUDERSTADT, PERCY A. PIERRE, JOHN B. YASINSKY, KATHLEEN R. FLAHERTY, EARL D. HOLTON, KEN L. WAY, KENNETH WHIPPLE, WILLIAM T. MCCORMICK, JR. and ALAN M. WRIGHT, Defendants, And CMS ENERGY CORPORATION, Nominal Defendant. STIPULATION OF SETTLEMENT Plaintiff Andrew Klotz ("Plaintiff"), derivatively on behalf of nominal defendant CMS Energy Corporation ("CMS" or the "Company'); defendants William U. Parfet, John M. Deutch, James J. Duderstadt, Percy A. Pierre, John B. Yasinsky, Kathleen R. Flaherty, Earl D. Holton, Ken L. Way, Kenneth Whipple, William T. McCormick, Jr. and Alan M. Wright (collectively, Defendants"); CMS; and CMS's Special Litigation Committee (the "SLC") agree to settle this derivative action (the "Action") in accordance with the terms and conditions set forth in this stipulation of settlement (Stipulation"). I. BACKGROUND AND HISTORY OF THE ACTION By certified letter dated May 17, 2002 addressed to the Company, Plaintiff, a common shareholder of the Company, pursuant to Section 493a of the Michigan Business Corporation Act ("MBCA"), MCL 450.1493a, demanded that the Company's Board of Directors (the Board) take action to remedy alleged breaches of fiduciary duties by certain officers and directors of the Company based in large part on transactions which have come to be known as round-trip" energy trading (the "Shareholder Demand"). The Board formed the SLC and the disinterested directors on the Board appointed the SLC's members to investigate the allegations in the Shareholder Demand and to decide what action, if any, should be undertaken in response thereto. VI. PLAINTIFF'S ACTIONS HAVE SUBSTANTIALLY BENEFITED THE EFFECTIVENESS OF CMS'S CORPORATE GOVERNANCE REGIMEN 1. Following the submission of the Shareholder Demand and as part of the proposed settlement of the Action, the Company has implemented a continuing transition of the membership of its Board and the committees thereof, as well as substantial turnover of its senior executives, as follows: Since the Shareholder Demand was received, five of the eleven then-incumbent directors have left the Board, including the former Chairman/Chief Executive Officer ("CEO") and Chairmen of each of the Audit Committee and then-named Nominating Committee. Five new directors, each of whom meet all applicable legal and regulatory "independence requirements, have joined the Board during this period, as well as a new Vice Chairman/General Counsel. The two independent directors appointed in December 2002 to fill vacancies on the Board were subsequently elected by Company shareholders at the 2003 Annual Meeting, thereby confirming the Board's prior designation of each of them as an independent director" under the MBCA, an even more stringent standard than other legal and regulatory "independence requirements. The qualifications of these two new directors were reviewed with, and deemed acceptable to, Plaintiff's Settlement Counsel prior to their appointment. One of these two new directors has substantial financial expertise and now chairs the Audit Committee; the second such director, as well as a third director newly elected at the 2004 Annual Meeting, have substantial expertise in the energy/utility industry. The two shareholder-elected May 2005 additions to the Board are nationally recognized experts in accounting and corporate governance/legal areas. The prospect of adding a director with corporate governance/legal expertise was the basis of negotiations with Plaintiff's Settlement Counsel and corporate governance expert regarding appropriate Board composition. Further, as part of this transition, the Company will add at least one additional independent director to the Board at or before the Company's 2006 Annual Meeting if necessary to ensure that a majority of the Board's membership will consist of independent directors first elected since May 17, 2002. The composition of relevant committees of the Board has undergone an even more significant transition during this period. Three of the five May 2002 Audit Committee members, including its Chairman, have b since left the Board, and the remaining two members have left that committee. The May 2002 Chairman and two other members of the then-named Nominating Committee have since left the Board and the remaining three former members have left that committee; a majority of its current membership has joined the Board during this period, including the Chairman of the currently named Governance and Public Responsibility Committee. The Chairman and all but one of the May 2002 Organization and Compensation Committee members have also left that committee (currently named Compensation and Human Resources Committee) during this transition period. Of the seven named executive officers in the Company's April 22, 2002 Proxy Statement, all but one have since separated from the Company. Within three months of the Shareholder Demand, each of the Chairman/CEO, the Executive Vice President/Chief Financial Officer (CFO"), the Senior Vice President/General Counsel and the President/CEO of the Company's energy marketing, services and trading subsidiary had separated from the Company. The Chairman/CEO was replaced by a previously independent director, while the Executive Vice President/CFO and Senior Vice President/General Counsel were replaced by individuals previously employed outside of the Company. The only 2002 named executive officer who remains with the Company is David W. Joos, who had been elected effective October 2001 as President/Chief Operating Officer, following the separation of his predecessor in that office. In addition, the Senior Vice President/Chief Accounting Officer initially during this period had been relieved of his accounting and controller responsibilities and ultimately also separated. 2. As a result of the Shareholder Demand and the proposed settlement of the Action, the Company has created substantially enhanced Board, officer and employee compliance and governance oversight functions that include the following measures: a b The Company has created the position of Chief Compliance Officer that presently reports directly to the Audit Committee of the Board. The duties of the Chief Compliance Officer include, but are not limited to, overseeing and administering the Code of Conduct and Statement of Ethics, fostering a culture that integrates compliance and ethics into business processes and practices through awareness and training, and maintaining and monitoring a system for reporting and investigating potential compliance and ethics concerns. The Chief Compliance Officer will provide a formal report to the Audit Committee at least twice each year, and will report promptly to that committee (directly or through its Chairman) any allegations of compliance and ethics concerns relating to financial fraud. The Chief Compliance Officer has implemented a new Company-wide Code of Conduct and Statement of Ethics, with related training, for all Company employees. The Board, upon recommendation of its Governance and Public Responsibility Committee, adopted formal charters for each of its four standing committees, as well as Corporate Governance Principles ("CGP"), all reflecting developing best practices of board and corporate governance. Each of the committee charters, as well as the CGP, has been amended and restated at least once to reflect interim developments in such best practices. Among these interim changes are establishing a mandatory retirement age of 75 for directors, limitations on the number of other public company boards on which the Company's CEO (two others) and independent directors (five others) can serve, and better delineation and disclosure of the Company's CEO succession planning process. As a result of the implementation of these and related best practices, the Company has improved its Institutional Shareholder Services ("ISS") Corporate Governance Quotient relative ratings from an average score of approximately 15% of the two peer groups at the beginning of this period to the approximately 85% level represented in the ISS proxy recommendations (all favorable) issued in connection with the Company's 2005 Annual Meeting. d. e f 8 h i j The Company has split the roles of Chairman of the Board and CEO. The Board has named an independent Presiding Director who serves as chairman for the executive sessions of the Board, which now are a routine item on the agenda for each of the six regularly scheduled meetings of the Board. Each of the standing Board committees (currently the Audit Committee, Compensation and Human Resources Committee, Finance and Pension Committee, and Governance and Public Responsibility Committee) shall be composed exclusively of directors who meet or exceed all applicable legal and regulatory requirements for "independence of directors or committee members. The Company has agreed that all directors on the Board will satisfy applicable "independence" requirements other than: (i) the current CEO and any future CEO; and (ii) potentially one additional future management director, provided, however, that the current non-executive Chairman and the Vice Chairman/General Counsel shall continue to serve as directors until each of them reaches the Board's mandatory retirement age, are not nominated or elected to serve on the Board, or otherwise resign from the Board. The Company has increased "transparency" in the director nomination process, which includes improved communications with shareholders and enhanced disclosures to shareholders. The Board's Audit Committee and Governance and Public Responsibility Committee have set up processes whereby shareholders can communicate with Board members, which processes include a web-based system, Company email and toll-free numbers. The Chief Compliance Officer and Corporate Secretary oversee these processes. The Board has significantly enhanced the duties of its Audit Committee, which has included multiple amendments and restatements to the Audit Committee's Charter. These amendments include, but are not limited to, a substantially enhanced oversight role for the Audit Committee, and significant structural changes relating to the role of the full Audit Committee vis--vis the Company's internal audit function and its independent auditors. The Company's internal audit function is performed by an independent third party and will remain so until the Audit Committee determines that a predominately Company employee-staffed internal audit function is in the best interests of the Company's shareholders. The Audit Committee now includes executive sessions with each of the internal audit function, the independent auditor and financial management as a routine item on its agenda for each of its regularly scheduled meetings. The full Audit Committee now has regularly scheduled meetings at least four times a year to review annual and interim financial statements and disclosures, as well as related independent auditor attestations/certifications/reports. The Company has changed from (1) its prior practice of limiting affiliate trading in Company securities only during a limited "black-out period following the end of each quarter through the public release of earnings thereafter, to (ii) a new policy that only allows such trading during a much shorter "window perioda opening two days following the release of such quarterly earnings and closing at the end of that same month (typically this window period only lasts two-to-three weeks per quarter). The General Counsel, in consultation with the CFO and other relevant members of senior management, shall determine whether special circumstances dictate that affiliate trading should be foreclosed even during these quarterly window periods. The General Counsel or his or her designee(s) in the Legal Department must pre-clear in writing all affiliate trades during these window periods, with notice thereof to the CFO. k 1 m n 3. As a result of the Shareholder Demand and the proposed settlement of the Action, the Board has created stock ownership guidelines applicable to each of the directors and officers of the Company. The Company believes these guidelines further align the interests of the Board and management with those of shareholders. Independent directors and the Chairman of the Board are required to hold Company common stock equivalent in value to five times their annual cash retainer within five years of becoming a director or within five years of the 2004 initiation of the guidelines, whichever comes first. The officer guidelines require the CEO to hold Company common stock equivalent in value to five times his base salary, the Vice Presidents to hold Company common stock equivalent in value to their respective base salaries, and the intermediate officers (such as Executive Vice Presidents, Subsidiary Presidents and Senior Vice Presidents) to hold Company common stock equivalent in value to multiples of two or three times their respective base salaries, again within five years of the applicable date. 4. As a result of the Shareholder Demand and the proposed settlement of the Action, the Compensation and Human Resources Committee of the Board has substantially altered the Company's executive compensation practices in the following manner: (a) the Company has discontinued the use of stock options as part of its standard executive compensation package; (b) the Company has created new annual bonus performance criteria that currently focus on the Company's success in meeting challenging, ongoing Company earnings per share and free cash flow goals established by the Compensation and Human Resources Committee at the beginning of each year (future annual bonus goals may vary from these, but will be within the performance-based parameters approved by shareholders), and long-term awards (that currently take the form of performance-based restricted stock, which vests over a multi-year period) with performance criteria that currently focus on the Company's success, both on an absolute and a peer-comparison basis, in meeting challenging total shareholder return metrics (future long-term awards may take different forms and/or performance metrics, but will be within the parameters approved by shareholders); thereby making a significant portion of the executive's compensation "pay at risk;" (c) the Company has agreed not to provide its officers with any guaranteed bonuses; (d) the Company has agreed to end its historic practice of automatically providing employment agreements, with contractual rights to severance payments, for future officers; (e) the Company has increased transparency with respect to executive compensation practices, including, but not limited to, disclosing the types of annual and long-term performance criteria in the Company's filings with the United States Securities and Exchange Commission, including, without limitation, its Annual Meeting Proxy Statements and Forms 8-K. The Company agrees that the corporate governance/compliance and executive compensation measures included in paragraphs 2, 3 and 4 above will remain in effect for at least three years from the date of the Court's approval of the proposed settlement, or until such earlier time as there is a Change in Control of the Company (as defined in the Company's Policy on Change in Control Agreements and related agreements); provided, however, that any such measure can be altered or removed by the affirmative vote of a majority of the independent directors on the Board, upon a determination, in good faith and upon the advice of counsel, that such provision conflicts with or is substantially redundant with any law, regulation or rule (including listing requirements of the NYSE or other exchange or quotation system on which the Company's common stock is listed or traded), or conflicts with or is substantially redundant with any amendment to the Company's articles of incorporation approved by the Company's shareholders. Notwithstanding the foregoing, however, the parties anticipate that the Company, its Board and committees will continue to enhance these corporate governance/compliance and executive compensation measures during this three-year period and, thus, committee charters, the CGP and the referenced measures may continue to be updated to reflect developing best practices in those areas. UBER CASE STUDY NOTE: the language excerpted from the news sources identified below will serve as "FACTS that needs to be responded to in Question 1 and final sentence in Question 2 "Provide examples of how Uber met or failed to meet each of the Pyramid's lower three levels (i.e., not the top level) of responsibilities" Inc. 8-28-2017: "Uber has a new chief executive, ... naming Dara Khosrowshski (DK) To each vacancy oh slot on Sunday. The search for a new Uber leader has been fraught with in-fighting from the company's board, not to mention some media leaks and a lawsuit daughter... to say it's a challenging situation for 48 years old (DK) To walk into is a bit of an understatement. In the first half of the year alone, the company lost $1.3 billion. He will have to do with Benchmark Capital, one of Uber's chief investors, which is suing (former Uber CEO Travis] Kalanick for breach of fiduciary duty, among other alleged violations. Moreover, the driver workforce needs to be built up; Uber has recently had a bit of an apology tour towards its drivers, who have often felt ignored by the company." Inc. 9-23-2017: "(DK) has been on the job only a matter of weeks, but a recent email to employees is proof positive that he is the right man for the job. Yesterday, government officials in London announced they would not be renewing Uber's license to operate in the city. Cuba's chief executive responded to the news with a remarkable email to employees. [An excerpt:) 'While the impulse maybe to say that this is unfair, one of the lessons I have learned overtime is that change comes from self-reflection. So, it's worth examining how we got here. The truth is that there is a high cost to a bad reputation ... dot it really matters what people think of us, especially in a global business like ours, where actions in one part of the world can have serious consequences in another. CNN Tech. 9-30-2017: "Travis Kalanick, the ousted CEO and co-founded who still has a seat on Uber's board of directors (BOD) apparently blindsided the company Friday by appointing two new members. Kalanick, who left the CEO role in June and amid a series of scandal, does have the right under the board's current rules to make appointments. But those rules at the root of a lawsuit that is currently in arbitration ... Uber said in its own statement the movement came as a complete surprise. 'That is precisely why we are working to put in place world class governance to ensure that we are building a company every employee and shareholder can be proud of, the statement reads." FACTS: Note that the facts for both Question 1 are provided above in the UBER CASE STUDY. Use concepts from the CMS ENERGY CASE study as an example as well. But focus on the facts of the UBER CASE STUDY. Question 1: Carefully read and react to the UBER MINI CASE STUDY. Using terms and concepts like (shareholder, stakeholder primacy, stakeholder, power, legitimacy, corporate social responsibility, corporate governance, crisis management, accountability, checks & balances, control, short/long-term profits). A. Do the current and recent practices and decisions by Uber's Board of Directors and its two CEOs (the current CEO Dara Khosrowshahi and former CEO/Chair Travis Kalanick) reflect appropriate stakeholder management, preferably describing relevant stakeholder type and/or attributes reflected in the board of directors and two CEOs' respective actions, as well as Uber's type pf stakeholder interaction model and/or its stakeholder orientation more generally? B. Do Uber's corporate governance and crisis management efforts reflect applicable "best practices using corporate governance and crisis management concepts and terms in the CMS Energy Case Study