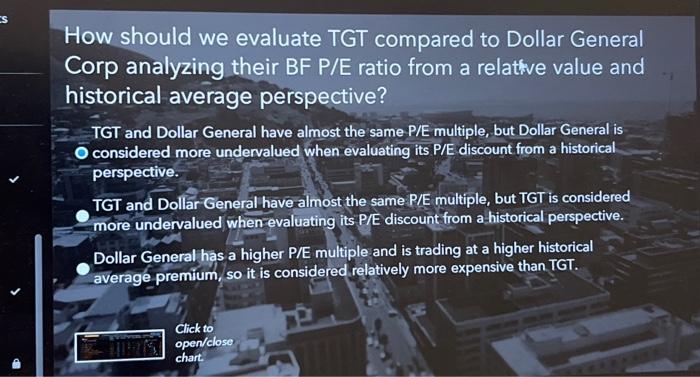

Question: How should we evaluate TGT compared to Dollar General Corp analyzing their BF P / E ratio from a relative value and historical average perspective?

How should we evaluate TGT compared to Dollar General Corp analyzing their BF PE ratio from a relative value and historical average perspective?

TGT and Dollar General have almost the same PE multiol but Dollar Genera isconsidered more undervalued when evaluating its. P E discoun from a histoical perspective.

Dollar General has a hoher pis oultiple and theo ing at a higher historical

TGT and Dollar General have almost the same RAE multiple, but TGT is considered more undervalued when evaluatingits p discount from a historical perspective

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock