Question: how to answer this problems On June 1, 2021, VIXEN Company received $1,077,200 plus accrued interest for 12% bonds with face amount of P1,000,000. The

how to answer this problems

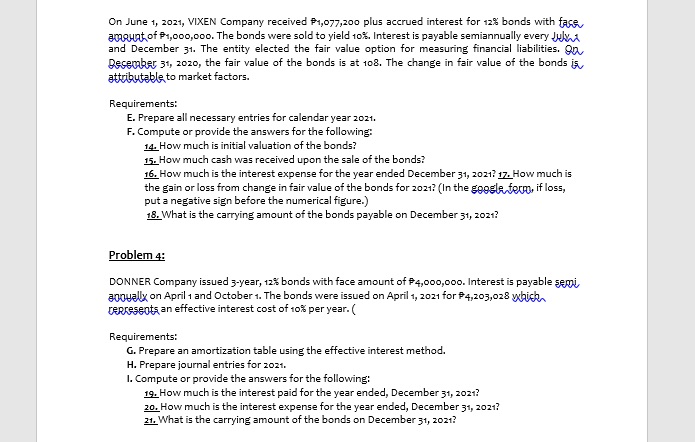

On June 1, 2021, VIXEN Company received $1,077,200 plus accrued interest for 12% bonds with face amount of P1,000,000. The bonds were sold to yield 10%. Interest is payable semiannually every JA and December 31. The entity elected the fair value option for measuring financial liabilities. 90 December 31, 2020, the fair value of the bonds is at 108. The change in fair value of the bonds is. attributable to market factors. Requirements: E. Prepare all necessary entries for calendar year 2021. F. Compute or provide the answers for the following: 14. How much is initial valuation of the bonds? 15. How much cash was received upon the sale of the bonds? 16. How much is the interest expense for the year ended December 31, 20217 17. How much is the gain or loss from change in fair value of the bonds for 2021? (In the google form, if loss, put a negative sign before the numerical figure.) 16. What is the carrying amount of the bonds payable on December 31, 2021? Problem 4: DONNER Company issued 3-year, 12% bonds with face amount of $4,000,000. Interest is payable semi aggyally on April 1 and October 1. The bonds were issued on April 1, 2021 for $4,203,028 which represents an effective interest cost of 10% per year. ( Requirements: G. Prepare an amortization table using the effective interest method. H. Prepare journal entries for 2021. I. Compute or provide the answers for the following: 19. How much is the interest paid for the year ended, December 31, 2021? 20. How much is the interest expense for the year ended, December 31, 2021? 21. What is the carrying amount of the bonds on December 31, 2021

On June 1, 2021, VIXEN Company received $1,077,200 plus accrued interest for 12% bonds with face amount of P1,000,000. The bonds were sold to yield 10%. Interest is payable semiannually every JA and December 31. The entity elected the fair value option for measuring financial liabilities. 90 December 31, 2020, the fair value of the bonds is at 108. The change in fair value of the bonds is. attributable to market factors. Requirements: E. Prepare all necessary entries for calendar year 2021. F. Compute or provide the answers for the following: 14. How much is initial valuation of the bonds? 15. How much cash was received upon the sale of the bonds? 16. How much is the interest expense for the year ended December 31, 20217 17. How much is the gain or loss from change in fair value of the bonds for 2021? (In the google form, if loss, put a negative sign before the numerical figure.) 16. What is the carrying amount of the bonds payable on December 31, 2021? Problem 4: DONNER Company issued 3-year, 12% bonds with face amount of $4,000,000. Interest is payable semi aggyally on April 1 and October 1. The bonds were issued on April 1, 2021 for $4,203,028 which represents an effective interest cost of 10% per year. ( Requirements: G. Prepare an amortization table using the effective interest method. H. Prepare journal entries for 2021. I. Compute or provide the answers for the following: 19. How much is the interest paid for the year ended, December 31, 2021? 20. How much is the interest expense for the year ended, December 31, 2021? 21. What is the carrying amount of the bonds on December 31, 2021

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock