Question: How To? Binomial tree: random interest rates I Consider the two-step binomial tree in Chapter 8 Question 1. However, now suppose that if the stock

How To?

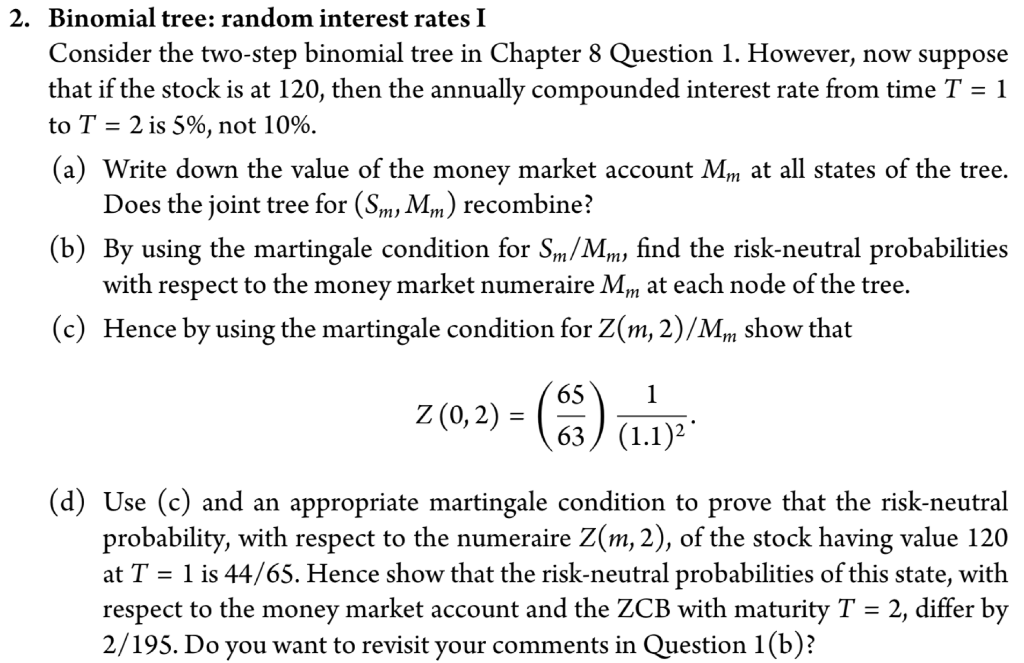

Binomial tree: random interest rates I Consider the two-step binomial tree in Chapter 8 Question 1. However, now suppose that if the stock is at 120 , then the annually compounded interest rate from time T=1 to T=2 is 5%, not 10%. (a) Write down the value of the money market account Mm at all states of the tree. Does the joint tree for (Sm,Mm) recombine? (b) By using the martingale condition for Sm/Mm, find the risk-neutral probabilities with respect to the money market numeraire Mm at each node of the tree. (c) Hence by using the martingale condition for Z(m,2)/Mm show that Z(0,2)=(6365)(1.1)21 (d) Use (c) and an appropriate martingale condition to prove that the risk-neutral probability, with respect to the numeraire Z(m,2), of the stock having value 120 at T=1 is 44/65. Hence show that the risk-neutral probabilities of this state, with respect to the money market account and the ZCB with maturity T=2, differ by 2/195. Do you want to revisit your comments in Question 1(b)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts