Question: How to compute this problem? I have read and understand the above instructions for this test. I have not received assistance from anyone else in

How to compute this problem?

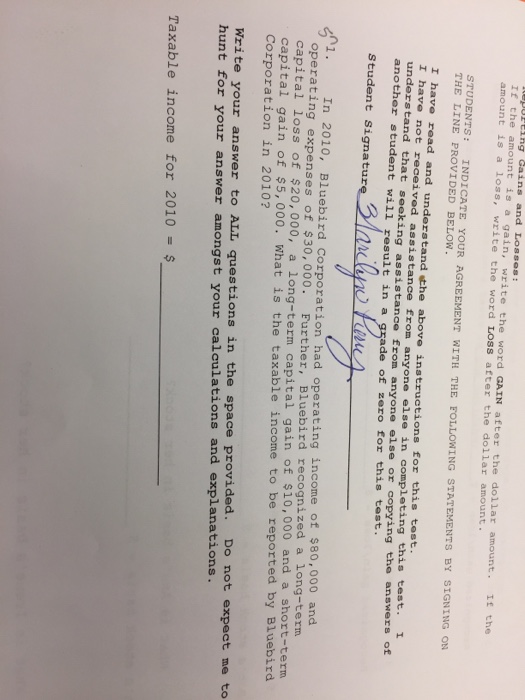

How to compute this problem? I have read and understand the above instructions for this test. I have not received assistance from anyone else in completing this test. I understand that seeking assistance from anyone else or copying the answers of another student will result in a grade of zero for this test. Student Signature 2010, Bluebird Corporation had operating income of $80,000 and operating expenses of $30,000. Further, Bluebird recognized a long-term capital loss of $20,000, a long-term capital gain of $10,000 and a short-term capital gain of $5,000. What is the taxable income to be reported by Bluebird Corporation in 2010? Write your answer to ALL questions in the space provided. Do not expect me hunt for your answer amongst your calculations and explanations.Taxable income for 2010 = $

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts