Question: How to construct a typical zero investment arbitrage portfolio as a hedge fund manager if you have the following assets: Asset p which has

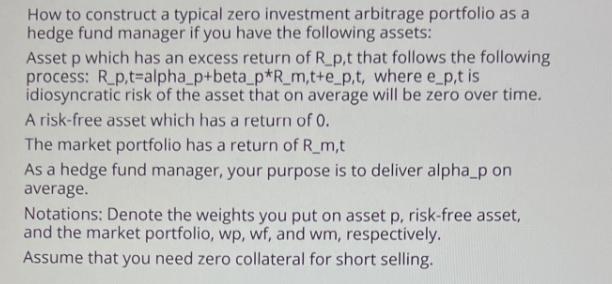

How to construct a typical zero investment arbitrage portfolio as a hedge fund manager if you have the following assets: Asset p which has an excess return of R_p,t that follows the following process: R_p,t-alpha_p+beta_p*R_m,t+e_p,t, where e_p,t is idiosyncratic risk of the asset that on average will be zero over time. A risk-free asset which has a return of 0. The market portfolio has a return of R_m,t As a hedge fund manager, your purpose is to deliver alpha_p on average. Notations: Denote the weights you put on asset p, risk-free asset, and the market portfolio, wp, wf, and wm, respectively. Assume that you need zero collateral for short selling.

Step by Step Solution

3.46 Rating (159 Votes )

There are 3 Steps involved in it

Lets start by setting up the equation for the expected return of the portfolio ERp wpRptalphapbetapRmtept wf0 wmRmt Now we can use this equation to solve for the optimal weights First we need to set t... View full answer

Get step-by-step solutions from verified subject matter experts